Sterling is sold off sharply after slowdown in inflation reading dents hope of a near term BoE hike. The violent move in the Pound makes it the weakest currency today, overtaking Dollar and Kiwi. The greenback tumbles broadly after another failure of Trump care and stays generally weak as traders pare back expectations of another Fed hike this year. Kiwi was sold off sharply earlier as CPI miss suggests that RBNZ was right not to turn hawkish. Meanwhile, Australian Dollar remains the strongest one today as RBA minutes raised hope of a hawkish turn in the central bank. Trading in other currencies are mixed. In other markets, Gold again rides on Dollar weakness and is back pressing 1240. WTI crude oil also firms up mildly and is back above 46.

Dollar sold off on another Trumpcare failure

Dollar is under much selling pressure on the news of the collapse of health care bill of US President Donald Trump and Republicans to replace ObamaCare. Senate Majority Leader Mitch Connell accepted defeat after a total of four Senate Republicans openly announced opposition to the bill, that leaves it two vote short of advancing. McConnell said in a statement that "regretfully, it is now apparent that the effort to repeal and immediately replace the failure of Obamacare will not be successful". Senate Democratic leader Chuck Schumer urged the Republicans to "start from scratch and work with Democrats" on a bill to fix problems with Obamacare. And, he criticized that "this second failure of Trumpcare is proof positive that the core of this bill is unworkable."

According to a Reuters poll of over 100 economists, the consensus is that Fed will hike federal funds rates by 25 to 1.25-1.50% by the end of the year. Meanwhile, two-thirds of the respondents expected Fed to announce the plan to unwind the USD 4T balance sheet in September. Fed fund futures are pricing in only 8.4% chance of a Fed hike in September.

Released from US, import price index dropped -0.2% mom in June.

UK CPI miss lifted pressure on BoE to hike

Sterling drops broadly as inflation data comes in much lower than expected. Headline CPI in UK slowed to 2.6% yoy in June, down from 2.9% yoy and missed expectation of 2.9% yoy. Core CPI slowed to 3.4% yoy, down from 2.6% yoy and missed expectation of 2.6% yoy. RPI also slowed to 3.5% yoy, down from 3.7% yoy and missed expectation of 3.6% yoy. The data should have eased much pressure for BoE to hike interest rate in near term. Back in June, the MPC decided to keep bank rate unchanged at 0.25% with 5-3 vote. Kristin Forbes has left the committee already and has returned to MIT’s Sloan School of Management. And it’s unlikely that other MPC members will rush to vote for a hike in August.

Also from UK, PPI input slowed to 9.9% yoy, PPI output slowed to 3.3% yoy, PPI output core rose to 2.9% yoy. House price index rose 4.7% yoy in May.

While the markets are pricing in full chance of 25bps hike by May 2018, a Reuters poll suggests that rates will not be raised until 2019. Meanwhile, there is on average a 1/3 chance of a rate hike this year. Only two of the 80 economists surveyed expected a hike in August. And four others expected a hike by the end of December.

German ZEW dropped by outlook remains positive

German ZEW economic sentiment dropped to 17.5 in July, down from 18.6 and missed expectation of 18.0. Current situation gauge dropped to 86.4, down from 88.0 and missed expectation of 88.0. Eurozone ZEW economic sentiment dropped to 35.6, down fro 37.7 and missed expectation of 37.2. ZEW president Achim Wambach noted in the statement the "overall assessment of the economic development it Germany Remains unchanged compared to the previous month. And, "the outlook for the German economic growth in the coming six months continues to be positive. This is now also reflected in the survey results for the eurozone."

RBA minutes: 3.5% could be the appropriate neutral rate

RBA minutes for the July meeting suggested that policymakers acknowledged the economic growth and the improvement in the labor market recently. The members also discussed the appropriate neutral rate which they believed should be at 3.5%, well above the current cash rate of 1.5%. This heightened market expectations of a potential rate hike in the near-term. As such, Aussie jumped to a 2-year high after the release of the minutes. More in Speculations Of RBA Rate Hike Heightened, As Members Discussed Neutral Rate.

Kiwi plummets as CPI affirmed RBNZ’s neutral stance

New Zealand Dollar tumbles sharply after weaker than expected inflation data. Over the quarter, CPI rose 0.0% qoq, down from prior quarter’s 1.0% qoq and missed expectation of 0.2% qoq. Annually, CPI slowed to 1.7% yoy, down from 2.2% yoy and missed expectation of 1.9% yoy. The reading now clearly support RBNZ’s neutral stance. There were some questions and disappointment as RBNZ didn’t turn hawkish after CPI shoot to 2.2% yoy back in Q1. But now it’s obvious that the central bank has made the correct decision.

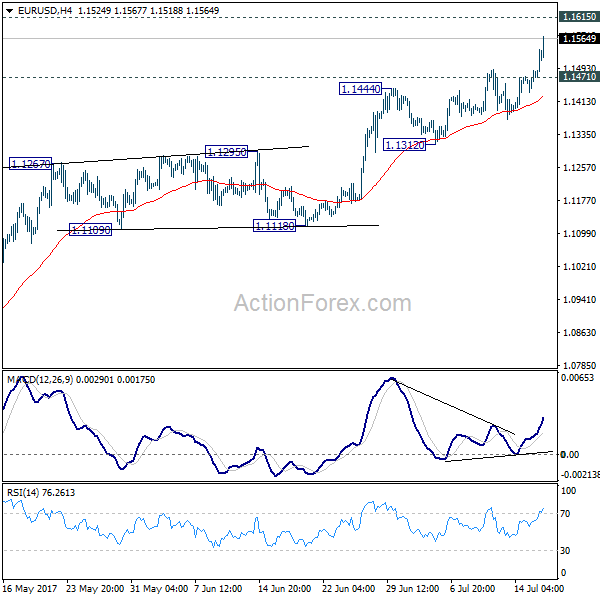

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1446; (P) 1.1466 (R1) 1.1498; More…..

EUR/USD’s rally continues today and reaches as high as 1.1567 so far. Intraday bias remains on the upside for 1.1615 key resistance. Decisive break there will pave the way to 1.2 handle next. On the downside, below 1.1471 minor support will turn intraday bias neutral and bring consolidations. But downside of retreat should be contained above 1.1312 support and bring rise resumption.

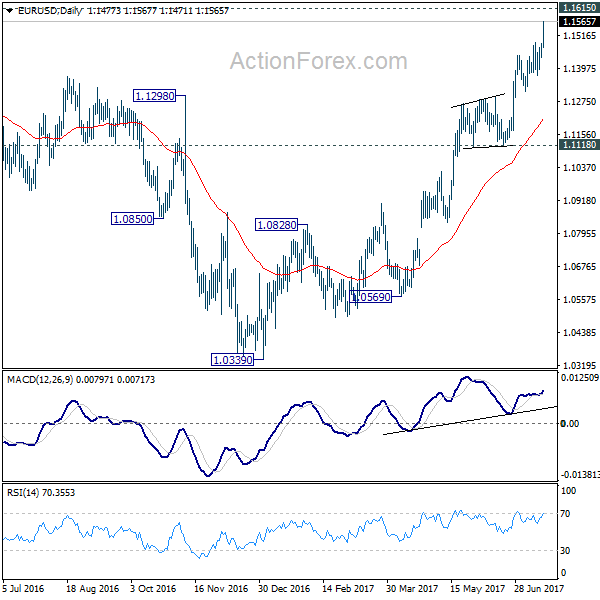

In the bigger picture, the firm break of 1.1298 resistance further affirm medium term reversal. That is, an important bottom was formed at 1.0339 on bullish convergence condition in weekly MACD. Further rise would be seen to 55 month EMA (now at 1.1756). Sustained break there will pave the way to 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 next. This will now remain the favored case as long as 1.1118 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | CPI Q/Q Q2 | 0.00% | 0.20% | 1.00% | |

| 22:45 | NZD | CPI Y/Y Q2 | 1.70% | 1.90% | 2.20% | |

| 01:30 | AUD | RBA Minutes July | ||||

| 03:00 | NZD | Non Resident Bond Holdings Jun | 61.50% | 61.40% | ||

| 08:30 | GBP | CPI M/M Jun | 0.00% | 0.20% | 0.30% | |

| 08:30 | GBP | CPI Y/Y Jun | 2.60% | 2.90% | 2.90% | |

| 08:30 | GBP | Core CPI Y/Y Jun | 2.40% | 2.60% | 2.60% | |

| 08:30 | GBP | RPI M/M Jun | 0.20% | 0.40% | 0.40% | |

| 08:30 | GBP | RPI Y/Y Jun | 3.50% | 3.60% | 3.70% | |

| 08:30 | GBP | PPI Input M/M Jun | -0.40% | -0.90% | -1.30% | -0.70% |

| 08:30 | GBP | PPI Input Y/Y Jun | 9.90% | 9.30% | 11.60% | 12.10% |

| 08:30 | GBP | PPI Output M/M Jun | 0.00% | 0.10% | 0.10% | |

| 08:30 | GBP | PPI Output Y/Y Jun | 3.30% | 3.40% | 3.60% | |

| 08:30 | GBP | PPI Output Core M/M Jun | 0.20% | 0.10% | 0.10% | |

| 08:30 | GBP | PPI Output Core Y/Y Jun | 2.90% | 2.80% | 2.80% | |

| 08:30 | GBP | House Price Index Y/Y May | 4.70% | 3.00% | 5.60% | 5.30% |

| 09:00 | EUR | German ZEW (Economic Sentiment) Jul | 17.5 | 18 | 18.6 | |

| 09:00 | EUR | German ZEW (Current Situation) Jul | 86.4 | 88 | 88 | |

| 09:00 | EUR | Eurozone ZEW (Economic Sentiment) Jul | 35.6 | 37.2 | 37.7 | |

| 12:30 | USD | Import Price Index M/M Jun | -0.20% | -0.20% | -0.30% | -0.10% |

| 14:00 | USD | NAHB Housing Market Index Jul | 67 | 67 | ||

| 20:00 | USD | Net Long-term TIC Flows May | 20.3B | 1.8B |