The financial markets are generally steady today. Fed’s emergency -50bps rate cut provided no apparent boost to investor confidence. Instead, US stocks ended sharply lower again as traders are worried about worsening global outbreak of Wuhan coronavirus. Asian markets are mixed too. Major forex pairs and crosses are bounded inside yesterday’s range for now. Australian Dollar is currently the strongest one for the week, followed by Euro. Sterling is the weakest, followed by Dollar.

Technically, there is no particular change in outlook. EUR/USD edged higher but still struggles to break through 1.1239 key resistance. Decisive break there will indicate medium term bottoming at 1.0777 and turn outlook bullish. Nevertheless, break of 1.1038 will retain near term bearishness and turn bias to the downside. 0.6433 might be a short term bottom in AUD/USD. But for now, we’d expect strong resistance from 0.6662 support turned resistance to limit upside to bring fall resumption.

In Asia, Nikkei closed up 0.08%. Hong Kong HSI is down -0.26%. China Shanghai SSE is up 0.32%. Singapore Strait Times is up 0.08%. Japan 10-year JGB yield is down -0.0276 at -0.139. Overnight, DOW dropped -785.91 pts, or -2.94%. S&P 500 dropped -2.81%. NASDAQ dropped -2.99%. 10-year yield dropped to new record low at 0.908, before closing at 1.010, down -0.078.

Fed cut -50bps in surprised move to counter coronavirus risks

Fed surprised the markets by -50bps cut in federal funds rate to 1.00-1.25% overnight. That came with an emergency announcement, just two weeks ahead of the scheduled FOMC meeting. The move was not entirely surprising, given Chair Jerome Powell’s statement last Friday and Goldman Sachs’ report that followed. Yet, it reveals the severity of the impacts the Wuhan coronavirus could bring to the US economy.

Additionally, the move reveals the lack of tools the Fed, as well as global central banks, can manipulate in face of the largest headwind since the global financial crisis in 2007/08. We expect more rate cuts to be adopted later this year. Depending on the development of the pandemic, as well as US’ economic data.

Suggested readings on FOMC:

- Fed’s Emergency Cut Reveals the Lack of Tools to Deal with Corona-Crisis

- Fed Monitor: We Expect Easing of a Further 50bp During the Spring

- Fed Takes Extraordinary Action in Response to Coronavirus Fears

- Fed Cuts Rates 50 bps—Further Easing Likely in Store

- FOMC Makes Intra-Meeting 50 Basis Point Cut on COVID-19 Concerns

- Fed Powell: Risks to US outlook have changed materially because of coronavirus outbreak

South Korea, Italy and Iran remain most serious coronavirus center outside China

Global coronavirus cases surged to 93191 at the time of writing, with 3203 deaths. 119 new cases were reported in China with 38 new deaths, totaling 80270 cases and 2981 deaths. South Korea (5328 cases, 32 deaths), Italy (2502 cases with 79 deaths) and Iran (2336 cases, 77 deaths) remain the most serious center outside China. There is no slowdown in other countries with 293 cases in Japan, 212 in France, 203 in Germany and 165 in Spain. USA (128) surpassed Singapore (110).

WHO said globally, fatality rate is at around 3.4%, much more serious than seasonal flu which kills far fewer than 1% of those infected. Director-General Tedros Adhanom Ghebreyesus said COVID-19 spreads less efficiently than flu, transmission does not appear to be driven by people who are not sick, it causes more severe illness than flu, there are not yet any vaccines or therapeutics, and it can be contained”.

Australia GDP grew 0.5% in Q4, remains below long run average

Australia GDP grew 0.5% qoq in Q4, above expectation of 0.4% qoq, but slowed from Q3’s 0.6% qoq. Through the year, the economy grew 2.2%. Household consumption and inventories are the main contributor to growth, followed by imports and government consumptions. Public capital formation and exports provided no contributed while private capital formation was a drag. Chief Economist for the ABS, Bruce Hockman, said: “The economy has continued to grow and picked up through the year, however the rate of growth remains below the long run average.”

China Caixin PMI services dropped to 26.5, necessary to pay attention to divergence of business sentiment

China Caixin PMI Services dropped to 26.5 in February, down from 51.8, well below expectation of 48.0. Markit said the sharply decline in activity was due to travel restrictions and company closures. There were record falls in total new work and export sales. Outstanding work rose substantially. PMI Composite dropped from 51.9 to 27.5.

Zhengsheng Zhong, Chairman and Chief Economist at CEBM Group said: “The coronavirus epidemic has obviously impacted China’s economy. It is necessary to pay attention to the divergence of business sentiment between the manufacturing and the service sectors. While recent supportive policies for manufacturing, small businesses and industries heavily affected by the epidemic have had a more obvious effect on the manufacturing sector, it is more difficult for service companies to make up their cash flow losses.”

Looking ahead

BoC rate decision is the major focus today. Fed surprised the markets with -50bps cut after G7 conference call. BoC is now expected to follow and lower interest rate by -50bps to 1.25%.

Swiss will release CPI in European session. Eurozone PMI services final and retail sales will be featured. UK will also publish PMI services final. Later in the day, Canada will also release labor productivity while US will release ISM non-manufacturing. Fed will publish Fed’s Beige Book report.

USD/JPY Daily Outlook

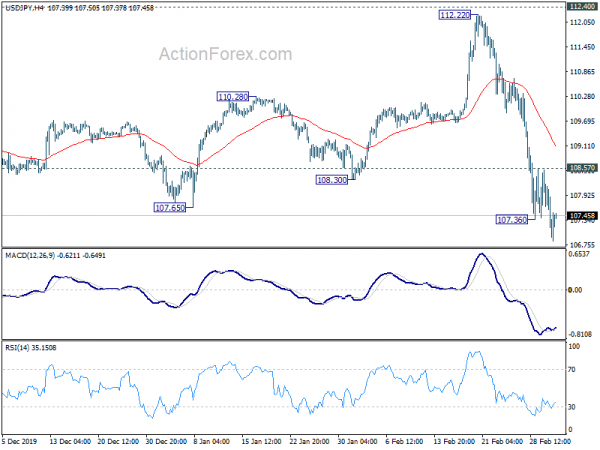

Daily Pivots: (S1) 106.52; (P) 107.53; (R1) 108.11; More..

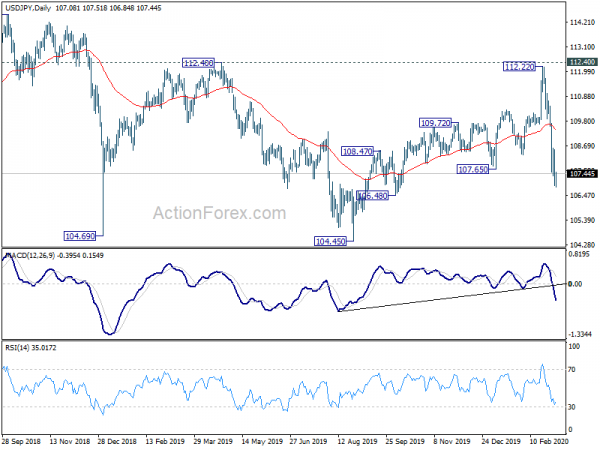

USD/JPY’s fall resumed after brief consolidation and hits as low as 106.48 so far. Intraday bias is back on the downside. As noted before, whole rise form 104.45 has completed after rejection by 112.40 resistance. Fall from 112.22 should target a test on 104.45 low. On the upside, above 108.57 minor resistance will turn bias neutral and bring consolidations, before staging another fall.

In the bigger picture, current steep decline and rejection by 112.40 resistance mixes up the medium term outlook again. Sustained break of 108.30 support will argue that larger fall from 118.65 (Dec 2016) hasn’t completed. Further fall could be seen through 104.45 low. Nevertheless, break of 112.40 resistance will revive the case of bullish reversal and target 114.54 key resistance for confirmation.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Construction Index Feb | 42.7 | 41.3 | ||

| 21:45 | NZD | Building Permits M/M Jan | -2.00% | 9.90% | 9.80% | |

| 00:00 | NZD | ANZ Commodity Price Feb | -2.10% | -0.90% | ||

| 00:30 | AUD | GDP Q/Q Q4 | 0.50% | 0.40% | 0.40% | 0.60% |

| 01:45 | CNY | Caixin Services PMI Feb | 26.5 | 48 | 51.8 | |

| 07:00 | EUR | Germany Retail Sales M/M Jan | 0.90% | -3.30% | ||

| 07:30 | CHF | CPI M/M Feb | 0.30% | -0.20% | ||

| 07:30 | CHF | CPI Y/Y Feb | 0.00% | 0.20% | ||

| 08:45 | EUR | Italy Services PMI Feb | 51.5 | 51.4 | ||

| 08:50 | EUR | France Services PMI Feb F | 52.6 | 52.6 | ||

| 08:55 | EUR | Germany Services PMI Feb F | 53.3 | 53.3 | ||

| 09:00 | EUR | Eurozone Services PMI Feb F | 52.8 | 52.8 | ||

| 09:30 | GBP | Services PMI Feb F | 53.3 | 53.3 | ||

| 10:00 | EUR | Eurozone Retail Sales M/M Jan | 0.60% | -1.60% | ||

| 13:15 | USD | ADP Employment Change Feb | 191K | 291K | ||

| 13:30 | CAD | Labor Productivity Q/Q Q4 | 0.20% | 0.20% | ||

| 14:45 | USD | Services PMI Feb F | 49.4 | 49.4 | ||

| 15:00 | USD | ISM Non-Manufacturing PMI Feb | 55.5 | 55.5 | ||

| 15:00 | CAD | BoC Interest Rate Decision | 1.25% | 1.75% | ||

| 15:30 | USD | Crude Oil Inventories | 2.8M | 0.5M | ||

| 16:15 | CAD | BoC Press Conference | ||||

| 19:00 | USD | Fed’s Beige Book |