Global coronavirus outbreak remain the main theme but markets are having kind of different reactions. US stocks extended this week’s steep decline overnight, down selling pressure seemed to have eased a bit. Nikkei is leading Asian markets low but Chinese stocks are relatively resilient. In the currency markets, commodity currencies remain weakest without a doubt while Yen is the strongest. A point to note is that Euro seems to be gaining some upside momentum quietly even though it’s uncertainty for how long that could sustain.

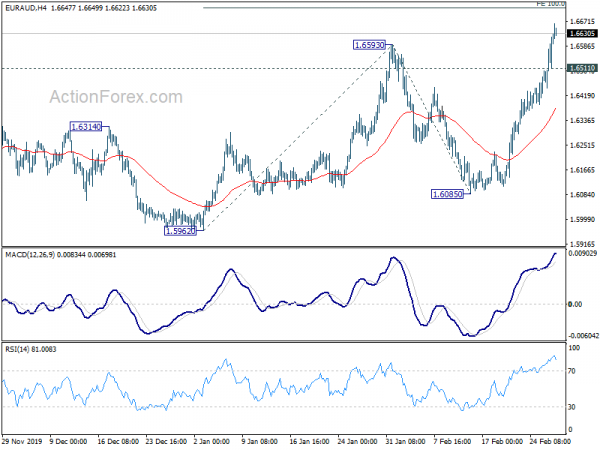

Technically, EUR/AUD finally took out 1.6593 resistance to resume whole rise fro 1.5962. Retest of 1.6786 high should be seen next. USD/CAD broke 1.3329 resistance to resume rally from 1.2951. It should now head to retest 1.3664 key resistance. EUR/GBP resumes the rebound form 0.8282 after breaking 0.8415 temporary top. Such rise is seen as the third leg of the consolidation pattern from 0.8276, and should target 0.8537/8595 resistance zone.

In Asia, currently, Nikkei is trading down -1.79%. Hong Kong HSI is down -0.57%. China Shanghai SSE is up 0.51%. Singapore Strait Times is down -0.72%. Japan 10-year JGB yield is down -0.0128 at -0.106. Overnight, DOW dropped -0.46%. S&P 500 dropped -0.38%. NASDAQ rose 0.17%. 10-year yield dropped -0.020 to 1.310, after hitting new record low at 1.302.

Coronavirus cases in South Korea and Italy continue to surge

In China, the National Health Commission reported 433 new confirmed coronavirus cases on February 26, bringing to accumulated total to 78497. Death toll rose 29 to 2641.

South Korea, the worst outbreaks outside of mainland China, reported another 334 cases, bringing the total to 1595. Italy and Iran are having the worst developments next to South Korea. Italy reported a total of 447 confirmed cases so far, with 12 deaths. Iran had 139 cases with 19 deaths. South American reported the first confirmed case in Brazil, a 61-year old man who recently visited Italy.

Situation in the US is so far contained, with 15 cases only. President Donald Trump appointed Vice President Mike Pence to lead and coordinate response to the coronavirus. For now, Trump said “it’s not the right time” to extend travel restrictions to other affected countries like Italy and South Korea.

Australia private capital expenditure dropped -2.8% in Q4

Australia private capital expenditure dropped -2.8% in Q4, much worse than expectation of 0.5% increase. In seasonally adjust terms, building and structures dropped -5.9%. Mining dropped -2.7%. Equipment, plant and machinery rose 0.8% Manufacturing dropped -10.1%. Other selected industries fell -1.9%

The set of data is rather disappointing as weak economic outlook appeared to have dampen investments again. Both monetary and fiscal stimulus are need for the economy. Q2 will be important for Australia as markets are expecting an RBA rate cut and increased government spending in May’s budget.

New Zealand ANZ business confidence plunged to -19.4, coronavirus taking a heavy toll

New Zealand ANZ Business Confidence dropped sharply from -13.2 to -19.4 in February. Confidence is worst in Agriculture at -63.6, and best in construction at 0. Activity Outlook index dropped from 17.2 to 12.0. Agriculture also scored the worst outlook at -30.3, with construction best at 21.9.

ANZ noted, “it is clear that the human and economic damage being wrought by the devastating COVID-19 outbreak in China, and now in other countries, is taking a heavy toll on sentiment and confidence in the primary sector and manufacturers already”.

New Zealand exports to China surged in January, coronavirus impact to be seen

New Zealand trade deficit came in at NZD -340m in January, better than expectation of NZD -530m. Goods exports rose 8.8% yoy to NZD 4.7B. Goods imports dropped -4.0% yoy to NZD 5.1B. In particular, exports to China jumped 31% yoy to NZD 3.1B.

“China is New Zealand’s top trading partner and exports have grown strongly over the past three years, continuing into the first month of 2020,” international statistics manager Darren Allan said. “China is an especially important market for our top three exports, accounting for more than a quarter of dairy, about half of all meat, and almost two-thirds of wood exports in January. We will see any initial economic impact of coronavirus in February trade figures. This may reflect a change in demand because of the extended Chinese New Year holiday and quarantine imposed in some areas in China.”

Looking ahead

Eurozone M3 and confidence indicators will be the main feature in European session. Later in the day, US will release Q4 GDP revision, durable goods orders, pending home sales and jobless claims.

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.6502; (P) 1.6565; (R1) 1.6684; More…

EUR/AUD surges to as high as 1.6663 as rise from 1.5962 resumed. Intraday bias stays on the upside for 100% projection of 1.5962 to 1.6593 from 1.6085 at 1.6716, and then 1.6785 high. On the downside, below 1.6511 minor support will turn intraday bias neutral and bring consolidations first.

In the bigger picture, EUR/AUD is still bounded in established range of 1.5905/6786. Continuos support from 55 week EMA (now at 1.6122) is seen as an indication of medium term bullishness. For now, larger up trend from 1.1602 (2012 low) is still in favor to continue as long as 1.5962 support holds. Break of 1.6786 will target 61.8% retracement of 2.1127 (2008 high) to 1.1602 at 1.7488.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance (NZD) Jan | -340M | -530M | 547M | 384M |

| 00:00 | NZD | ANZ Business Confidence Feb | -19.4 | -13.2 | ||

| 00:30 | AUD | Private Capital Expenditure Q4 | -2.80% | 0.50% | -0.20% | -0.40% |

| 09:00 | EUR | Eurozone M3 Money Supply Y/Y Jan | 5.50% | 5.00% | ||

| 09:00 | EUR | Private Loans Y/Y Jan | 3.70% | 3.70% | ||

| 10:00 | EUR | Eurozone Business Climate Feb | -0.24 | -0.23 | ||

| 10:00 | EUR | Eurozone Economic Sentiment Feb | 101.5 | 102.8 | ||

| 10:00 | EUR | Eurozone Industrial Confidence Feb | -7.8 | -7.3 | ||

| 10:00 | EUR | Eurozone Services Sentiment Feb | 10.8 | 11 | ||

| 10:00 | EUR | Eurozone Consumer Confidence Feb F | -6.6 | -6.6 | ||

| 13:30 | CAD | Current Account (CAD) Q4 | -9.00B | -9.86B | ||

| 13:30 | USD | Initial Jobless Claims (Feb 21) | 211K | 210K | ||

| 13:30 | USD | GDP Annualized Q4 P | 2.10% | 2.10% | ||

| 13:30 | USD | GDP Price Index Q4 P | 1.70% | 1.50% | ||

| 13:30 | USD | Durable Goods Orders Jan | -1.50% | 2.40% | ||

| 13:30 | USD | Durable Goods Orders ex Transportation Jan | 0.20% | -0.10% | ||

| 15:00 | USD | Pending Home Sales M/M Jan | 2.00% | -4.90% | ||

| 15:30 | USD | Natural Gas Storage | -158B | -151B |