Risk aversion continues in Asian session today, following the worst 2-day percentage drop in DOW in two years. Nevertheless, panic is no spreading to other markets so far. Gold is staying in consolidation below 7-year high of 1689, currently hovering around 1645. In the currency markets, Australian is currently the weakest one for today, followed by Yen. Dollar is the strongest, followed by Canadian and then New Zealand Dollars.

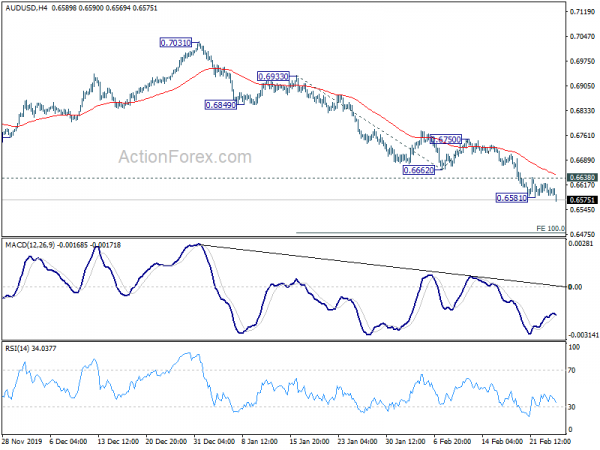

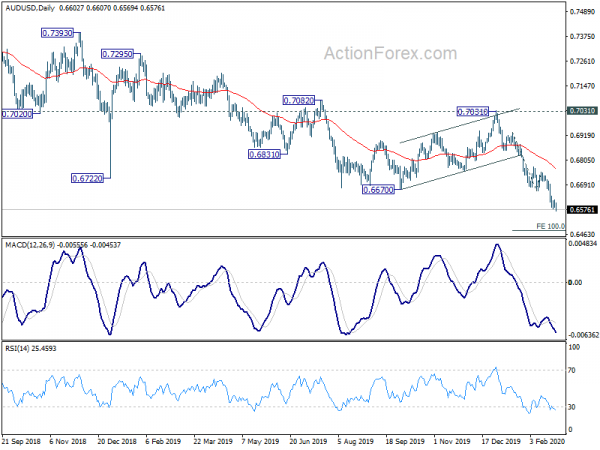

Technically, AUD/USD’s break of 0.6581 suggests that brief consolidation has completed and larger down trend has resumed. EUR/AUD also regains upside momentum and should target 1.6593 resistance next. USD/JPY’s break of 110.28 support argues that near term trend might be resuming. Focus is back on 108.30 structural support next. USD/CHF will be a pair to watch, with focus on 0.9741 support. Break will suggest completion of rebound from 0.9613 and bring deeper fall to retest this low. That might also drag USD/JPY lower.

In Asia, Nikkei closed down -0.79%. Hong Kong HSI is down -0.85%. China Shanghai SSE is down -0.74%. Singapore Strait Times is down -0.98%. 10-year JGB yield is up 0.0079 at -0.094. Overnight, DOW dropped -879.44 pts or -3.15%. S&P 500 dropped -3.03%. NASDAQ dropped -2.77%. 10-year yield dropped -0.047 to 1.330, new record low.

World not ready for Wuhan coronavirus pandemic, as cases in South Korea and Italy continue to surge

A team of 25 global health experts returned from China’s Wuhan, the epicenter of the coronavirus outbreak. Team leader Bruce Aylward warned in a press conference that the Wuhan coronavirus is a “rapidly escalating epidemic in different places that we’ve got to tackle superfast to prevent a pandemic.” However, “big conclusion for the world is – it’s simply not ready,”

According to data from China’s National Health Commission, situation seems to be easing with slowing increase in new cases and deaths. On February 25, there were 406 new confirmed cases, bringing the total accumulated number to 78064. Death tolls rose 52 to 2715. Separately announced, the northwestern regions of Inner Mongolia and Xinjiang and the southwestern province of Sichuan have downgraded their emergency response level. Gansu, Yunnan, Guangdong, Shanxi, Guizhou and Anhui downgrade emergency level earlier this week.

Situations in other countries worsen, however. South Korea reported 169 news cases today, bringing the total to 1146,with 11 deaths. There are 323 cases in Italy, with 11 deaths. Japan’s cases rise steadily to 159, with 1 death. Iran has reported a total of 95 cases, with 16 deaths.

Fed Clarida: To soon to speculate the spillover effects of China’s coronavirus outbreak

Fed Vice Chair Richard Clarida reiterated overnight that monetary policy is “in a good place”. “As long as incoming information about the economy remains broadly consistent with this outlook, the current stance of monetary policy likely will remain appropriate.”

Also, the economy is “in a good place” too. FOMC will “proceed on a meeting-by-meeting basis and will be monitoring the effects of our recent policy actions along with other information bearing on the outlook as we assess the appropriate path of the target range for the federal funds rate.”

He warned that the Wuhan coronavirus is likely to have a “noticeable impact” on China’s economy and “the disruption there could spill over to the rest of the global economy.”. However, it’s “still too soon” to speculate the size or persistence of the spillover effects, or “whether they will lead to a material change in the outlook.” Should that outlook change, he said, “we will respond accordingly.”

Dallas Fed President Robert Kaplan said it’s “too soon to make a judgment” about how the coronavirus outbreak might relate to monetary policy. “We are still in the heat of this and there’s just a lot of uncertainty”, he added. “In the next three or four weeks some of the uncertainty is going to get cleared up, either for better or worse”.

On the data front

UK BRC shop price index dropped -0.6% yoy in January. Australia construction work done dropped -3.0% in Q4 versus expectation of -1.0%. Later in the day, US will release new home sales and crude oil inventories.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6584; (P) 0.6604; (R1) 0.6620; More….

AUD/USD’s down trend resumes after brief consolidation, taking out 0.6581 temporary and hits as low as 0.6569 so far. Intraday bias is back on the downside. Next near term target is 100% projection of 0.6933 to 0.6662 from 0.6750 at 0.6479. On the upside, above 0.6638 minor resistance will turn intraday bias neutral and bring consolidations again, before staging another decline.

In the bigger picture, AUD/USD’s decline from 0.8135 (2018 high) is still in progress. It’s part of the larger down trend from 1.1079 (2011 high). Rejection by 55 week EMA affirms medium term bearishness. Next target is 0.6008 (2008 low). Outlook will stay bearish as long as 0.7031 resistance holds, even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:01 | GBP | BRC Shop Price Index Y/Y Jan | -0.60% | -0.30% | ||

| 00:30 | AUD | Construction Work Done Q4 | -3.00% | -1.00% | -0.40% | 0.40% |

| 15:00 | USD | New Home Sales Jan | 710K | 694K | ||

| 15:30 | USD | Crude Oil Inventories | 2.3M | 0.4M |