The forex markets are pretty steady today with Japan on holiday. Upbeat economic data from China didn’t trigger much reactions. Traders are having their mind on the upcoming central bank events in the week, most notably ECB rate decision and press conference. In addition, there will be quite a number of key economic data to watch including UK CPI, Australia employment and Canada CPI. As for today Eurozone CPI final for June will be released. Canada will release international securities transactions while US will release Empire State manufacturing index. Also, some attention will be on EU and UK as the second round of Brexit negotiations starts.

China GDP grew 6.9% in Q2.

Released from China, GDP expanded 6.9% yoy in Q2, same pace as the prior quarter but above consensus of 6.8%. Economic activities in June continued to improve. Industrial production growth accelerated to 7.6% yoy in June, beating consensus of and May’s 6.5%. Retail sales expanded 11% yoy in June, up from 10.7% a month ago. The market had anticipated mild deceleration to 10.6%. Fixed asset investment in urban areas grew 8.6% yoy in the first half of the year, same pace as in the first five months of the year. The government acknowledged that the country’s economy continued to improve. It appears that the country’s growth is on track to meet the government target of "around 6.5%".

In his first address at the National Financial Work Conference, which is held once every five years, over the weekend, Chinese President Xi Jinping affirmed that the PBOC would play a stronger role in defending against risks, calling for more work on safeguarding the financial system and modernizing its regulatory framework. Interestingly, the word "risk" appeared 31 times in the meeting note, followed by "regulation", which appeared 28 times, signaling that implementation of "regulations" to prevent financial system "risks" is the key direction of the government’s policy.

More in China Watch – 2017 Growth Target On Track, Xi Commands To Prevent Risks And Tighten Regulations

Brexit negotiation round 2

The second round of Brexit negotiation starts today in Brussels. UK Brexit Secretary David Davis said ahead of the week long meeting that "we made a good start last month, and this week we’ll be getting into the real substance." He noted that "protecting the rights of all our citizens is the priority for me going into this round and I’m clear that it’s something we must make real progress on." There will be working groups focusing on three areas, including citizen’s rights, the divorce bill and other loose ends. Another group will focus on the border of Ireland. Three more weeks of talks will be held till early October. By that time, EU chief negotiator Michel Barnier would hope to show "significant" progress to EU leaders to approve moving the negotiations to trade agreements.

Central bank activities to be main focuses ahead

There are some important central bank events ahead in the week. Of most attention is the ECB meeting on Thursday. President Mario Draghi would likely add more hawkish flavor in the meeting statement. Yet, it remains a 50-50 chance over whether the policymakers would decide to drop the forward guidance on QE (e.g.: the ECB is ready to extend size and/or duration of the current bond purchases of 60B euro/ month). Ahead of it, the central bank would release the quarterly Bank Lending Survey on Tuesday.

RBA minutes would be released on Tuesday. Recall that the market dumped Aussie instantly after the July meeting as the central bank failed to deliver a more hawkish monetary policy stance. However, the weakness was short-lived and Aussie jumped last week on strong iron ore prices. The upbeat Chinese dataflow should also give Aussie a boost as China is the world’s biggest consumer of iron ore and the largest importer of Australia’s iron ores.

BOJ would be meeting on Thursday (Japan time). There are talks that BoJ could once again upgrade growth forecasts. That’s a sensible expectation based on recent upbeat economic assessments. Nonetheless, BoJ would also be lowering inflation forecasts again as recent readings remained sluggish. Recent surge in global bond yields triggered BoJ to offer to buy an unlimited amount of JGBs, earlier in July. That’s a move under the Yield Curve Control framework to hold long term interest rate near zero. BoJ might provide some comments on the operations too.

In addition to central activities, there are some key economic data to watch. New Zealand CPI; Australia employment; UK CPI; German ZEW, Canada CPI and retail sales will also be closely watched.

Here are some highlights for the week ahead:

- Tuesday: New Zealand CPI; RBA minutes; UK CPI, PPI, house price index; German ZEW; US import prices, NAHB housing index

- Wednesday: Canada manufacturing shipments; US housing starts and building permits

- Thursday: Japan trade balance, BoJ; Australia employment; Swiss trade balance; German PPI; Eurozone current account, ECB; US jobless claims, Philly Fed survey, leading indicators

- Friday: UK public sector borrowing; Canada CPI, retail sales

USD/JPY Daily Outlook

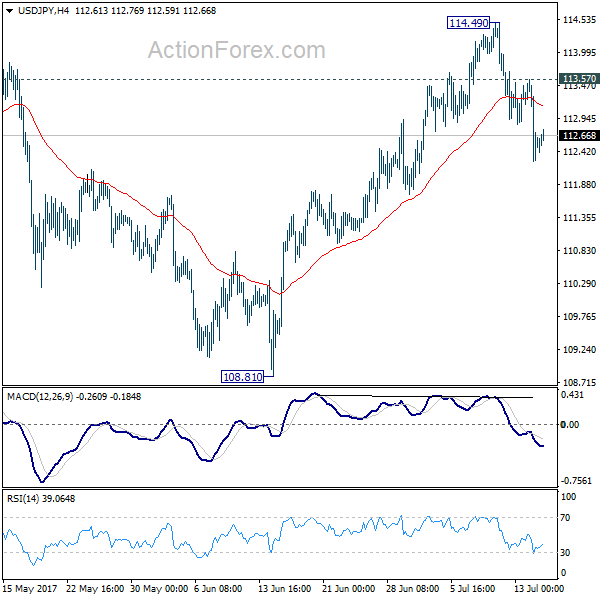

Daily Pivots: (S1) 111.98; (P) 112.78; (R1) 113.30; More…

Intraday bias in USD//JPY remains on the downside for 55 day EMA (now at 112.03). The rejection from 114.36 resistance suggests that whole correction from 118.65 is possibly still in progress. Sustained break of 55 day EMA will pave the way to 108.12 and below. On the upside, above 113.57 minor resistance will turn focus back to 114.49 resistance instead.

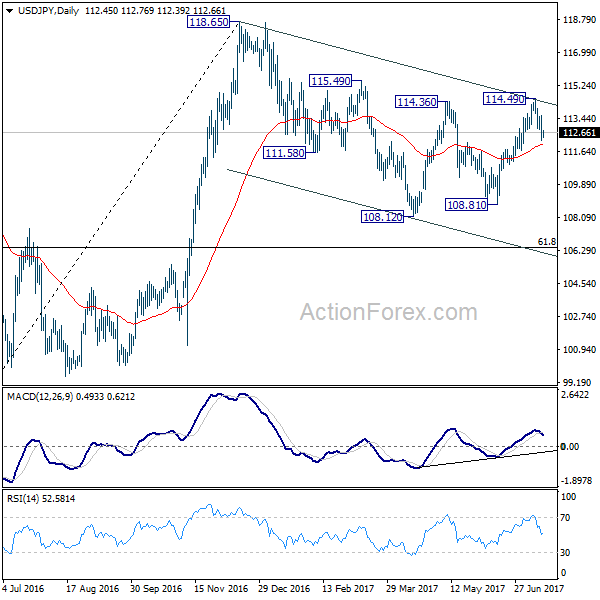

In the bigger picture, the corrective structure of the fall from 118.65 suggests that rise from 98.97 is not completed yet. Break of 118.65 will target a test on 125.85 high. At this point, it’s uncertain whether rise from 98.97 is resuming the long term up trend from 75.56, or it’s a leg in the consolidation from 125.85. Hence, we’ll be cautious on topping as it approaches 125.85. If fall from 118.65 extends lower, down side should be contained by 61.8% retracement of 98.97 to 118.65 at 106.48 and bring rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | Rightmove House Prices M/M Jul | 0.10% | -0.40% | ||

| 2:00 | CNY | Retail Sales Y/Y Jun | 11.00% | 10.60% | 10.70% | |

| 2:00 | CNY | Fixed Assets Ex Rural YTD Y/Y Jun | 8.60% | 8.50% | 8.60% | |

| 2:00 | CNY | Industrial Production Y/Y Jun | 7.60% | 6.50% | 6.50% | |

| 2:00 | CNY | GDP Y/Y Q2 | 6.90% | 6.80% | 6.90% | |

| 9:00 | EUR | Eurozone CPI M/M Jun | 0.00% | -0.10% | ||

| 9:00 | EUR | Eurozone CPI Y/Y Jun F | 1.30% | 1.40% | ||

| 9:00 | EUR | Eurozone CPI – Core Y/Y Jun F | 1.10% | 1.10% | ||

| 12:30 | CAD | International Securities Transactions (CAD) May | 9.78B | 10.60B | ||

| 12:30 | USD | Empire State Manufacturing Jul | 15 | 19.8 |