Yen is under broad based selling pressure today as sentiments somewhat improved with expectations of more stimulus from China to counter the impact of Wuhan coronavirus outbreak. Additionally, Japanese Prime Minister Shinzo Abe is under increasing political pressure on handling the spread of the coronavirus in the country. Sterling is following as second weakest for today, shrugging off stronger than expected inflation data. On the other hand, Canadian and Dollar are both lifted by respective inflation data.

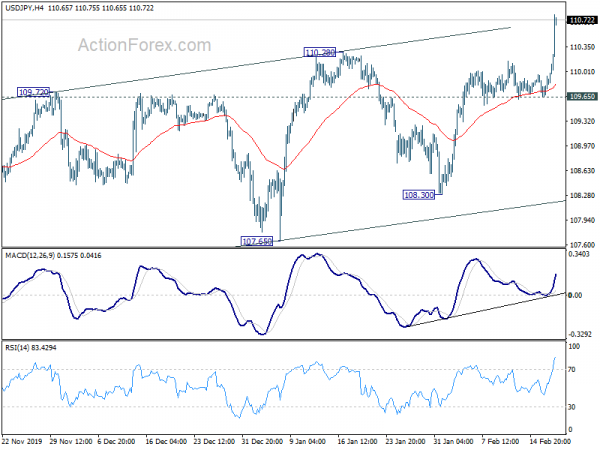

Technically, USD/JPY’s break of 110.28 resistance confirms resumption of whole rise form 104.45. Long term channel resistance at 111.21 is next target. EUR/GBP lost much downside momentum ahead of 0.8726 low. Break of 0.8348 will delay down trend resumption and bring near term rebound towards 0.8537 resistance first. USD/CAD is extending near term correction from 1.3329. But downside should be contained well above 1.3104 support to bring rebound.

In Europe, currently, FTSE is up 0.83%. DAX is up 0.56%. CAC is up 0.70%. German 10-year yield is down -0.0002 at -0.404. Earlier in Asia, Nikkei rose 0.89%. Hong Kong HSI rose 0.46%. China Shanghai SSE dropped -0.32%. Singapore Strait Times rose 0.53%. Japan 10-year JGB yield rose 0.0045 to -0.046.

PBoC: Impact of Wuhan coronavirus limited in terms of time and scope

China’s central bank PBOC tried to tone down the impact of the Wuhan coronavirus outbreak, and said today that the impact on the economy will be “short-lived” and “limited in terms of time and scope”. Nevertheless, it will still work to promote consumption and investment to boost domestic demand.

There were also talks of more stimulus by the government, including cash infusions and bailouts for the struggling airline industry.

US PPI accelerated to 2.1%, core PPI to 1.7%

US PPI rose 0.5% mom, 2.1% yoy in January, well above expectation of 0.2% mom, 1.4% yoy. PPI core rose 0.5% mom, 1.7% yoy, also well above expectation of 0.2% mom, 1.2% yoy.

Building permits rose 9.2% mom to 1.551m annualized rate, above expectation of 1.450m. Housing starts dropped -3.6% mom to 1.567m, above expectation of 1.390m.

Canada CPI rose to 2.4%, beat expectations

Canada CPI accelerated to 2.4% yoy in January, up from 2.2% yoy, beat expectation of 2.2% yoy. CPI common slowed to 1.8% yoy, down from 2.0% yoy, missed expectation of 2.0% yoy. CPI median was unchanged at 2.2% yoy, matched expectations. CPI trimmed was unchanged at 2.1% yoy, missed expectation of 2.2% yoy.

UK CPI accelerated to 1.8%, core CPI up to 1.6%

UK CPI accelerated to 1.8% yoy in January, up from 1.3% yoy, beat expectation of 1.4% yoy. CPI Core also accelerated to 1.6% yoy, up from 1.4% yoy, beat expectation of 1.4% yoy. RPI accelerated to 2.7% yoy, up from 2.2% yoy, beat expectation of 2.4% yoy.

PPI input came in at 0.9% mom, 2.1% yoy versus expectation of -0.4% mom, 3.5% yoy. PPI output was at 0.3% mom, 1.1% yoy, versus expectation of -0.1% mom, 1.2% yoy. PPI output core was at 0.1% mom, 0.7% yoy versus expectation of 0.1% mom, 0.6% yoy.

DIHK: Germany to see little real growth this year

Germany’s DIHK Chambers of Industry and Commerce said that the country’s economy would growth 0.7% in 2020, slightly higher than 0.6% in 2019. However, it also pointed out that around 0.5% of growth is due to “statistical effects” such as the overhang from the previous year and four additional working days this year. Hence, CEO Martin Wansleben said “that is why we currently see little real growth.”

He added: “It is worrying: A whole host of data, particularly from industry, suggest that structural challenges, such as e-mobility, digitization, the energy turnaround and further the shortage of skilled workers, are adding to the current economic downturn. Some regions are particularly affected.”

RBNZ Orr: Pleasing how resilient New Zealand economy has been

RBNZ Governor Adrian Orr told the Finance and Expenditure Committee today that it’s “pleasing how resilient the New Zealand economy has been”, during a “period of weakening global growth and heightened global uncertainty”. He added that monetary policy is “in a good position”, with inflation at the “mid-point of our inflation target”. Employment is also “at, or slightly above” maximum sustainable employment.

Orr also said, RBNZ is “well advanced on understanding how we would meet our monetary policy mandate should we approach zero interest rates.” The central bank will publish work on these alternative monetary policy approaches in the coming weeks, “even if we don’t expect to be using them”.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 109.71; (P) 109.83; (R1) 110.00; More..

USD/JPY rises to as high as 110.80 so far and strong break of 110.28 resistance confirms resumption of whole rally from 104.45. Intraday bias is back on the upside for channel resistance (now at 111.21). Sustained break there will carry larger bullish implication and target 112.40 resistance next. For now, near term outlook will remain bullish as long as 109.65 support holds, in case of retreat.

In the bigger picture, there is no change in the bearish outlook yet in spite of the rebound from 104.45. The pair is staying in long term falling channel that started at 118.65 (Dec. 2016). Rise from 104.45 is seen as a correction and the down trend could still extend through 104.45 low. However, sustained break of the channel resistance will be an important sign of bullish reversal and target 114.54 resistance for confirmation.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Leading Index M/M Jan | 0.10% | 0.10% | 0.00% | |

| 23:50 | JPY | Trade Balance (JPY) Jan | -0.22T | -0.10T | -0.11T | |

| 23:50 | JPY | Machinery Orders M/M Dec | -12.50% | -9.00% | 18.00% | |

| 00:30 | AUD | Wage Price Index Q/Q Q4 | 0.50% | 0.50% | 0.50% | |

| 09:00 | EUR | Eurozone Current Account (EUR) Dec | 32.6B | 34.5B | 33.9B | 32.4B |

| 09:30 | GBP | DCLG House Price Index Y/Y Dec | 2.20% | 2.30% | 2.20% | 1.70% |

| 09:30 | GBP | CPI M/M Jan | -0.30% | -0.50% | 0.00% | |

| 09:30 | GBP | CPI Y/Y Jan | 1.80% | 1.40% | 1.30% | |

| 09:30 | GBP | CPI Core Y/Y Jan | 1.60% | 1.40% | 1.40% | |

| 09:30 | GBP | RPI M/M Jan | -0.40% | -0.70% | 0.30% | |

| 09:30 | GBP | RPI Y/Y Jan | 2.70% | 2.40% | 2.20% | |

| 09:30 | GBP | PPI Input M/M Jan | 0.90% | -0.40% | 0.10% | 0.90% |

| 09:30 | GBP | PPI Input Y/Y Jan | 2.10% | 3.50% | -0.10% | 0.90% |

| 09:30 | GBP | PPI Output M/M Jan | 0.30% | -0.10% | 0.00% | |

| 09:30 | GBP | PPI Output Y/Y Jan | 1.10% | 1.20% | 0.90% | |

| 09:30 | GBP | PPI Output Core M/M Jan | 0.10% | 0.10% | -0.10% | |

| 09:30 | GBP | PPI Output Core Y/Y Jan | 0.70% | 0.60% | 0.90% | |

| 13:30 | USD | Building Permits Jan | 1.551M | 1.450M | 1.420M | |

| 13:30 | USD | Housing Starts Jan | 1.567M | 1.390M | 1.608M | 1.626M |

| 13:30 | USD | PPI M/M Jan | 0.50% | 0.20% | 0.10% | |

| 13:30 | USD | PPI Y/Y Jan | 2.10% | 1.40% | 1.30% | |

| 13:30 | USD | PPI Core M/M Jan | 0.50% | 0.20% | 0.10% | |

| 13:30 | USD | PPI Core Y/Y Jan | 1.70% | 1.20% | 1.10% | |

| 13:30 | CAD | CPI M/M Jan | 0.30% | 0.30% | 0.00% | |

| 13:30 | CAD | CPI Y/Y Jan | 2.40% | 2.20% | 2.20% | |

| 13:30 | CAD | CPI Common Y/Y Jan | 1.80% | 2.00% | 2.00% | |

| 13:30 | CAD | CPI Median Y/Y Jan | 2.20% | 2.20% | 2.20% | |

| 13:30 | CAD | CPI Trimmed Y/Y Jan | 2.10% | 2.20% | 2.10% | |

| 19:00 | USD | FOMC Minutes |