Asian markets trade mildly lower as China’s coronavirus continues to spread. But losses in major indices are so far limited. In the currency markets, commodity currencies are trading to recovery some of last week’s losses, together with Sterling. Yen and Dollar turn weaker despite mild risk aversion. But major pairs and crosses are confined within Friday’s range in general. There is no change in the greenback’s near term bullishness so far.

Technically, bias stays on the downside for EUR/USD as long as 1.0985 minor resistance holds. Same for GBP/USD as long as 1.2959 minor resistance holds. USD/CAD should still take on 1.3327 resistance as long as 1.3262 minor support holds. Though, break of these levels will suggest that Dollar has topped out at least temporarily and is in pull back.

In Asia, currently, Nikkei is down -0.49%. Hong Kong HSI is down -0.62%. China Shanghai SSE is up 0.09%. Singapore Strait Times is down -0.68%. 10-year JGB yield is down -0.0181 at -0.054.

Beijing in closed community management as China’s coronavirus death tolls hit 908

From China’s National Health Commission, confirmed cases of coronavirus in the country jumped to 40171 as of February 9. Death toll reached 908 while suspected cases rose to 23589. No of people tracked rose to 399487, just shy of 400k. For the time being, 80 cities have been locked down under “closed off management” measures, while capital Beijing is also now in “closed community management”, under which vehicles and personnel from outside a community will not be allowed to enter.

The World Health Organization is leading a team of international experts to Beijing to help investigate China’s coronavirus epidemic. Director-General Tedros Adhanom Ghebreyesus also warned in his tweets that “In an evolving public health emergency, all countries must step up efforts to prepare for #2019nCoV’s possible arrival and do their utmost to contain it should it arrive. This means lab capacity for rapid diagnosis, contact tracing and other tools in the public health arsenal.”

Separately, Adam Kucharski, an associate professor of the London School of Hygiene & Tropical Medicine, warned that “Assuming current trends continue, we’re still projecting a mid-to-late-February peak” of virus cases in Wuhan. “There’s a lot of uncertainty, so I’m cautious about picking out a single value for the peak, but it’s possible based on current data we might see a peak prevalence over 5%.” That is, the coronavirus could infect up to 500k people in Wuhan alone before peaking.

Japan Abe: Coronavirus has a major impact of tourism, economy and our society

According to Kyodo news, Japan Prime Minister Shinzo Abe said over the weekend, “the new coronavirus is having a major impact on tourism, the economy and our society as a whole. The government will do its utmost to address the impact.” He asked “ministers to compile measures to use reserves and implement them as soon as possible.”

Abe emphasized the necessity to ensure that Japanese residents have access to medical checkups and masks. But no further details about the measures were given.

Released from Japan today, bank lending rose 1.9% yoy in January, matched expectations. Current account surplus narrowed slightly to JPY 1.71T in December, above expectation of JPY 1.68T.

Fed Powell’s testimony to highlight the week

Fed chair Jerome Powell’s testimony will be a main event for the week. There were some increased speculation of Fed cut this year after outbreak of China’s coronavirus. But such expectations receded mildly last week. Powell’s view on the impact of the coronavirus could set the tone for market pricing. US will also release CPI, retail sales, and industrial production, which could be market moving.

Elsewhere, UK CDP and production, Eurozone GDP and production will be watched closely. RBNZ will meet this week and will likely keep OCT unchanged at 1.00%.

- Monday: China CPI, PPI; Japan bank lending, current account, eco watcher sentiment; Swiss unemployment rate, CPI; Eurozone Sentix investor confidence; Canada housing starts and building permits.

- Tuesday: Australia NAB business confidence; UK BRC retail sales monitor, GDP, productions, trade balance; Fed chair Powell’s testimony.

- Wednesday: RBNZ rate decision; Japan machine tools orders; Eurozone industrial production; Fed chair Powell’s testimony.

- Thursday: Japan PPI; Australia inflation expectations; Germany CPI final; UK RICS house price balance; US CPI, jobless claims.

- Friday: New Zealand BusinessNZ manufacturing index; Japan tertiary industry index; Germany CPI; Swiss PPI; Eurozone GDP, employment; US retail sales, import prices, industrial production, business inventories U of Michigan consumer sentiment.

USD/CAD Daily Outlook

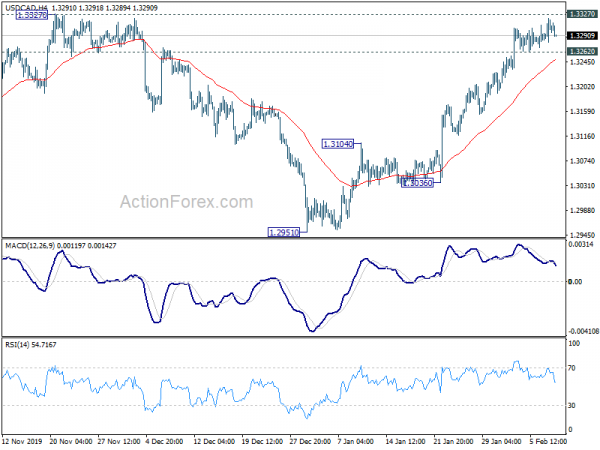

Daily Pivots: (S1) 1.3285; (P) 1.3302; (R1) 1.3325; More….

USD/CAD is losing some upside momentum as seen in 4 hour MACD. But intraday bias stays on the upside with 1.3262 minor support intact. As noted before, corrective pattern from 1.3664 should have completed as a triangle at 1.2951. Sustained break of 1.3327 resistance should confirm this bullish case and pave the way for retest of 1.3664 high. On the downside, below 1.3262 minor support will turn intraday bias neutral for consolidation first, before staging another rally.

In the bigger picture, price actions from 1.3664 (2018 high) is seen as a corrective move that has probably completed. Rise from 1.2061 (2017 low) might be ready to resume. Decisive break of 61.8% retracement of 1.4689 (2016 high) to 1.2061 at 1.3685 will pave the way to retest 1.4689 high.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Bank Lending Y/Y Jan | 1.90% | 1.90% | 1.80% | |

| 23:50 | JPY | Current Account (JPY) Dec | 1.71T | 1.68T | 1.79T | |

| 1:30 | CNY | CPI Y/Y Jan | 5.40% | 4.90% | 4.50% | |

| 1:30 | CNY | PPI Y/Y Jan | 0.10% | 0.10% | -0.50% | |

| 5:00 | JPY | Eco Watchers Survey: Current Jan | 41.9 | 40.5 | 39.8 | |

| 6:45 | CHF | Unemployment Rate M/M Jan | 2.30% | 2.30% | ||

| 7:30 | CHF | CPI M/M Jan | -0.20% | 0.00% | ||

| 7:30 | CHF | CPI Y/Y Jan | 0.20% | 0.20% | ||

| 9:00 | EUR | Italy Industrial Output M/M Dec | 0.10% | |||

| 13:15 | CAD | Housing Starts Y/Y Jan | 210.0K | 197K | ||

| 13:30 | CAD | Building Permits M/M Dec | 3.50% | -2.40% |