Australian Dollar remains the strongest one for the week while markets are back in risk on mode. Fears over China’s coronavirus seem to have subsided, with S&P 500 and NASDAQ new record highs. 10-year yield also staged a strong rebound, taking Dollar broadly higher too. On the other hand, Yen and Swiss Franc suffered heavy selling this week, with European majors also dragged down.

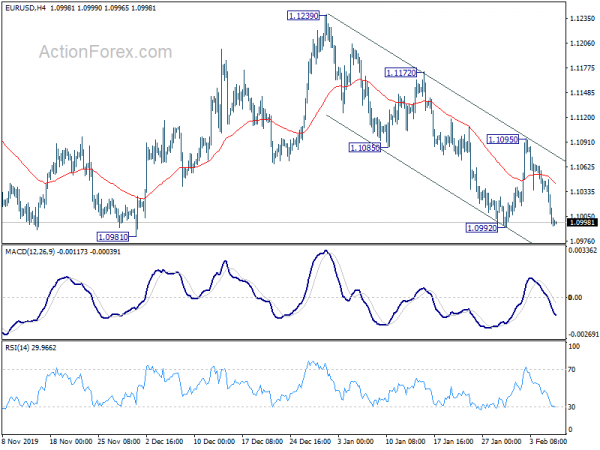

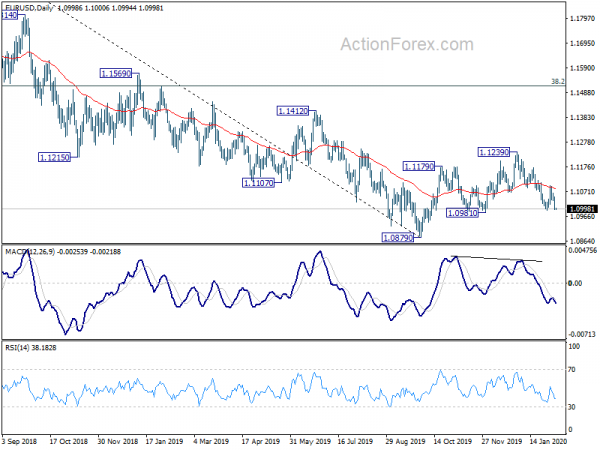

Technically, 0.6777 minor resistance in AUD/USD is a level to watch to see whether Dollar or Aussie would win the race. As long as 0.6777 holds, near term outlook stays bearish and break of 0.6670 low will resume medium term down trend. Nevertheless, firm break of 0.6777 will indicate short term bottoming and bring sustainable rebound. 1.0992 support in EUR/USD is another level to watch today. Break will reaffirm the case that corrective rise from 1.0879 has completed with three waves up from 1.1239. Retest of 1.0879 low should be seen next.

In Asia, currently, Nikkei is up 2.07%. Hong Kong HSI is up 1.89%. China Shanghai SSE is up 0.77%. Singapore Strait Times is up 0.33%. Japan 10-year JGB yield is up 0.0202 at -0.012. Overnight, DOW rose 1.68%. S&P 500 rose 1.13%. NASDAQ rose 0.43%. 10-year yield rose 0.046 to 1.649.

Fed Daly: No material change to US economy due to coronavirus

San Francisco Fed President Mary Daly told CNBC that monetary policy is now in a “really good position”. Uncertainties like US-China trade tensions receded while hard Brexit was avoided. The three rate cuts last year “puts the US economy in a good place to weather these storms” like China’s coronavirus.

She added that China’s coronavirus “bears further watching and of course we are keeping a close eye, but right now I am not looking for this to do anything material to our economy.” She expected China to has a “couple of quarters perhaps of weaker growth but then bounce back once this has been resolved and then that to have a temporary impact on the US economy and go away once things have been resolved”.

China coronavirus deaths hit 563, Yuan recovers with hesitation

According to China’s National Health Commission, on February 5, number of confirmed coronavirus cases in China rose 3694 to 28018. Death tolls rose 73 to 563. Serious cases rose 640 to 3859. Suspected cases rose 5328 to 24702. Number of people tracked rose 30659 to 282813. Outside of China, over 25 countries reported confirmed cases, with 35 in Japan, 28 in Singapore, 25 in Thailand and 11 in Taiwan.

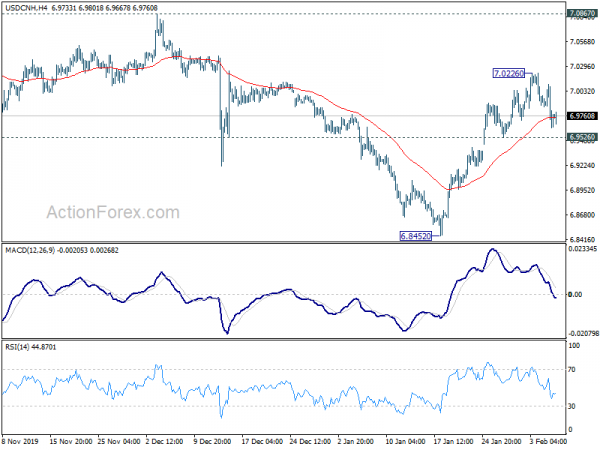

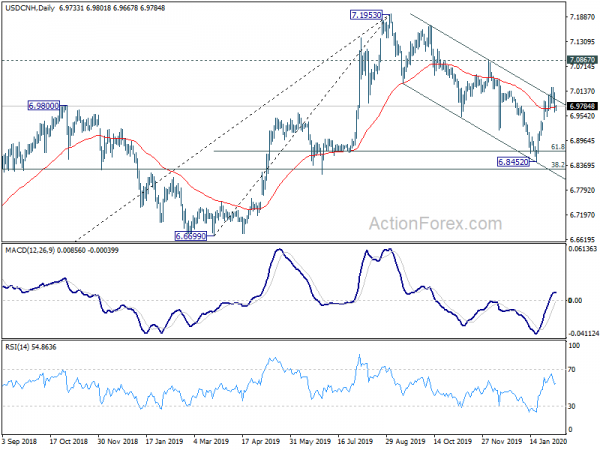

The fears in the financial markets subsided rather quickly this week, including Yuan’s exchange rate. USD/CNH formed a temporary top at 7.0226 and retreated notably. Nevertheless, the pull back is so far relatively shallow and is contained above 6.9526 minor support. Further rise remains mildly in favor. Sustained break of near term channel resistance will indicate bullish reversal for 7.0867 resistance. However, break of 6.9526 will indicate completion of rebound from 6.8452 and keep the decline from 7.1953 intact. The next move will depend on the breakthrough in the coronavirus outbreak, in either way.

Australia retail sales dropped -0.5%, trade surplus narrowed to AUD 5.22B

Australia retail sales dropped -0.5% mom in December, worse than expectation of -0.2% mom. Though, that was not enough to offset November’s strong 1.0% mom rise. The following states and territories fell in seasonally adjusted terms in December 2019: New South Wales (-1.2%), Queensland (-0.5%), South Australia (-1.3%), the Northern Territory (-0.4%), and the Australian Capital Territory (-0.1%). Victoria (0.0%) and Western Australia (0.0%) were relatively unchanged, while Tasmania (1.1%) rose.

In seasonally adjusted terms, exports of goods and services rose AUD 557m to AUD 41.29B. Import of goods and services rose AUD 853m to AUD 36.07B. Trade surplus narrowed slightly to AUD 5.22B, smaller than expectation of AUD 5.60B.

Australia NAB business confidence unchanged at -1, more RBA support still needed

Australia NAB Business Confidence was unchanged at -1 in Q4. Current Business Conditions, improved from 2 to 4. However, Business Conditions for the next three months dropped from 10 to 9, for the next 12 months dropped from 20 to 16.

Alan Oster, NAB Group Chief Economist: “The survey broadly fits with our overall read of the economy. A weak private sector – particularly in the consumer space and only modest inflation pressure. There also appears some risk around the outlook for the labour market and business investment. We think more policy support is needed and that this is still likely to occur in 2020, but for now the RBA appears in wait and see mode with labour market conditions still faring well”.

Looking ahead

ECB bulletin and EU’s economic foreacasts will be the main focuses today. Germany will also release factory orders. Later in the day, US will release Challenger job cuts, jobless claims and non-farm productivity.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.0979; (P) 1.1014; (R1) 1.1033; More…

Focus stays on 1.0992 support in EUR/USD. Decisive break there will resume the whole decline from 1.1239. Also, that would add to the case that corrective rebound from 1.0879 has completed at 1.1239. In this case, deeper decline would be seen back to retest 1.0879 low. On the upside, break of 1.1095 will turn bias to the upside for 1.1172 resistance instead.

In the bigger picture, rebound from 1.0879 is seen as a corrective move at this point. In case of another rise, upside should be limited by 38.2% retracement of 1.2555 to 1.0879 at 1.1519. And, down trend from 1.2555 (2018 high) would resume at a later stage. However, sustained break of 1.1519 will dampen this bearish view and bring stronger rise to 61.8% retracement at 1.1915 next.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | NAB Business Confidence Q4 | -1 | -2 | -1 | |

| 00:30 | AUD | Retail Sales M/M Dec | -0.50% | -0.20% | 0.90% | 1.00% |

| 00:30 | AUD | Trade Balance (AUD) Dec | 5.22B | 5.60B | 5.80B | 5.52B |

| 07:00 | EUR | Germany Factory Orders M/M Dec | 0.60% | -1.30% | ||

| 09:00 | EUR | ECB Economic Bulletin | ||||

| 10:00 | EUR | European Commission Economic Forecasts | ||||

| 12:30 | USD | Challenger Job Cuts Y/Y Jan | -25.20% | |||

| 13:30 | USD | Initial Jobless Claims (Jan 31) | 210K | 216K | ||

| 13:30 | USD | Nonfarm Productivity Q4 P | 1.40% | -0.20% | ||

| 13:30 | USD | Unit Labor Costs Q4 P | 0.90% | 2.50% | ||

| 15:30 | USD | Natural Gas Storage | -201B |