Australian Dollar recovers broadly today after RBA stands pat. More importantly, the central bank gives no hint of an imminent rate cut in the accompanying statement. It actually sounds quite comfortable with the current policy. Markets are relatively mixed elsewhere. Sterling turned mixed after yesterday’s selloff . Yen also turned mixed as risk markets stabilized, awaiting next development regarding China’s coronavirus.

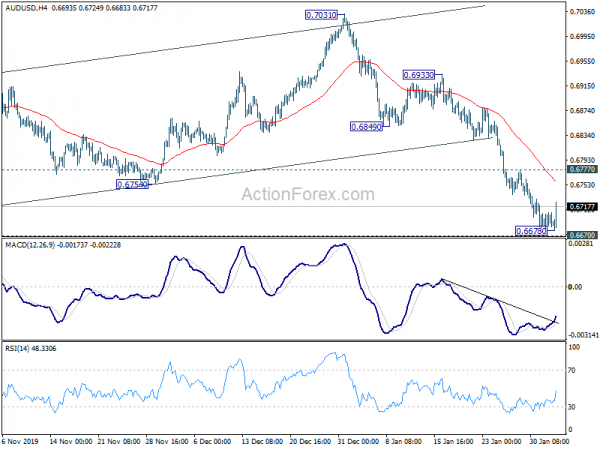

Technically, AUD/USD should have formed a temporary low ahead of 0.6670 key support. Some consolidations likely but selloff should resume sooner rather than later as long as 0.6777 resistance holds. EUR/AUD also formed a temporary top at 1.6593 and turns into consolidations. Downside of retreat should be contained above 1.6294 resistance turned support to bring rise resumption.

In Asia, currently, Nikkei is up 0.44%. Hong Kong HSI is up 1.14%. China Shanghai SSE is up 0.21%. Singapore Strait Times is up 1.28%. Japan 10-year JGB yield is up 0.0041 at -0.052. Overnight, DOW rose 0.51%. S&P 500 rose 0.73%. NASDAQ rose 1.34%. 10-year yield closed flat at 1.520.

RBA keeps cash rate at 0.75%, no indication of rate cut

RBA left cash rate unchanged at 0.75% as widely expected. Australian Dollar recovers as there is no clear sign of imminent rate cut. The central just said “due to both global and domestic factors, it is reasonable to expect that an extended period of low interest rates will be required.” The board “remains prepared to ease monetary policy further if needed”.

RBA expects the economy have a “step up” and grow around 2.75% in 2020 and 3.00% in 2021. Bushfires and coronavirus will “temporarily weigh on domestic growth”. But overall outlook is “supported by the low level of interest rates, recent tax refunds, ongoing spending on infrastructure, a brighter outlook for the resources sector and, later this year, an expected recovery in residential construction.”

Unemployment rate is expected to “remain around” 5.1% for some time, before “gradually declining” to a little below 5% in 2021. Wage growth is “subdued” and is expected to “remain” at current rate for some time. Inflation remains “low and stable”. CPI is expected to be around 2% in the near term and “fluctuate around that rate over the next couple of years”.

China’s coronavirus cases top 20k, death toll reaches 425

From China’s National Health Commission, as of February 3, number of confirmed coronavirus cases rose to 20438 in China, up 3235 from a day ago. Death toll rose 64 to 425. Serious cases rose 492 to 2788. Suspected cases rose 5072 to 23214. Number of people tracked rose 31432 to 221015.

An op-ed published today in state-backed Securities Times tried to tone down the impact of the coronavirus to the markets. It said, “such events are usually only a short-term interruption … and do not have a lasting economic impact.” Another article, in the China Securities Journal said “the impact of the current epidemic … is necessarily short-term. After release of pessimism, the stock market is expected to gradually stabilise.”

Fed Bostic: Coronavirus hasn’t change outlook or rate path yet

Atlanta Fed President Raphael Bostic warned that if China’s coronavirus becomes a “world issue, with ripples through many countries and many economies, then that’s different type of event than as I understand it to be today”. But for now, given our past recent experience with these sorts of things, I don’t think it should; it hasn’t changed my outlook or my expectation about our rates path.”

On monetary policy, Bostic said Fed’s three rate cuts last year are “working their way through the economy”. Policymakers “just have to wait and see”. There was “a lot of stimulus” for where the economy was. That should “make it more resilient to these sorts of things.”

Bundesbank Weidmann, policy objection should be understandable, forward-looking and realistic

Bundesbank President Jens Weidmann said ECB should formulate the monetary policy objective in a way that is “understandable, forward-looking and realistic”. At the same time “we should counteract any impressions and claims that we can fine-tune inflation to the decimal place — we can’t do that!”

He explained, “a realistic and forward-looking definition of our goal allows monetary policy to wait if there are good reasons, in order not to react hectically to every change in incoming data. It allows the incorporation of the longer-term risks to price stability.”

Currently, ECB’s price stability means inflation is “below but close to 2%.” Weidmann is against the argument that raising the inflation target would give policymakers more room. He said “the gain in the capacity to act could be smaller than hoped. A strong increase in the goal could raise risks that inflation expectations become deanchored,” he said, adding that “higher inflation comes with costs for people.”

On the data front

New Zealand building permits rose 9.9% mom in December. Japan monetary base rose 2.9% yoy in January. UK contruction PMI, Eurozone PPI will be featured in Euroepan session. US will release factory orders later in the day.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6682; (P) 0.6694; (R1) 0.6705; More…

A temporary low is formed at 0.6678 in AUD/USD, just ahead of 0.6670 key support. Intraday bias is turned neutral for some consolidations. But upside of recovery should be limited by 0.6777 resistance to bring fall resumption. On the downside, decisive break of 0.6670 low will confirm resumption of larger down trend. Next target will be 0.6008 key support. Nevertheless, firm break of 0.6777 will indicate short term bottoming and extend the consolidation pattern form 0.6670 with another near term rise.

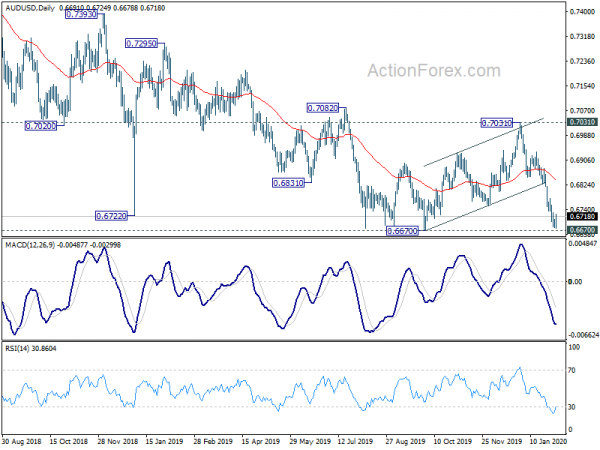

In the bigger picture, AUD/USD’s decline from 0.8135 (2018 high) is still in progress. It’s part of the larger down trend from 1.1079 (2011 high). Next target is 0.6008 (2008 low). This will remain the favor case as long as 0.7031 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Building Permits M/M Dec | 9.90% | -8.50% | -8.40% | |

| 23:50 | JPY | Monetary Base Y/Y Jan | 2.90% | 3.10% | 3.20% | |

| 3:30 | AUD | RBA Interest Rate Decision | 0.75% | 0.75% | 0.75% | |

| 9:30 | GBP | Construction PMI Jan | 44.9 | 44.4 | ||

| 10:00 | EUR | Eurozone PPI M/M Dec | 0.00% | 0.20% | ||

| 10:00 | EUR | Eurozone PPI Y/Y Dec | -0.70% | -1.40% | ||

| 15:00 | USD | Factory Orders M/M Dec | 0.70% | -0.70% |