Dollar turns slightly weaker in early US session as core PCE inflation data stayed well below Fed’s target. Nevertheless, as risk aversion remains in the markets, commodity currencies continue to be the weakest ones. Sterling continues to rise on post BoE rebound but there is no clear range breakout yet. Strength in Swiss Franc appears to be lifting Euro slightly higher too. But overall, traders would likely stay cautious before weekly close, awaiting development regarding China’s coronavirus in the coming weekend.

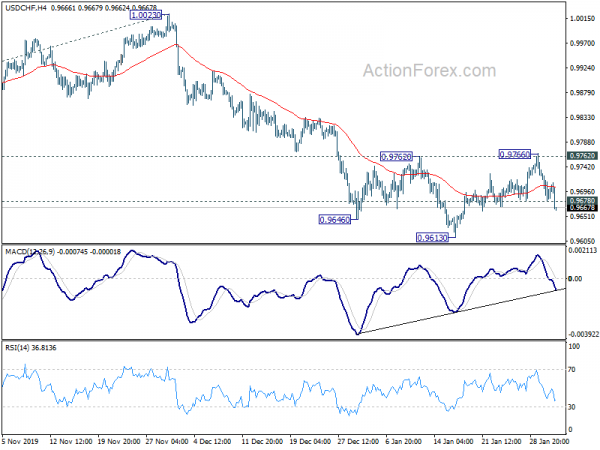

Technically, USD/CHF’s break of 0.9678 minor support suggests that rebound from 0.9613 has completed after rejection by 0.9762 resistance. Intraday bias is back on the downside for retesting 0.9613 low. EUR/CHF also weakens mildly but stays well above 1.0665 temporary low. EUR/GBP is now eyeing 0.8386 temporary low and break will bring retest of 0.8276 support.

In Europe, FTSE is down -0.64%. DAX is down -0.40%. CAC is down -0.39%. German 10-year yield is down -0.012 at -0.417. Earlier in Asia, Nikkei rose 0.99%. Hong Kong HSI dropped -0.52%. Singapore Strait Times dropped -0.53%. 10-year JGB yield dropped -0.0088 to -0.063.

US PCE rose to 1.6%, core PCE rose to 1.6%

US personal income rose 0.2% in December, below expectation of 0.3%. Personal spending rose 0.3%, matched expectations. Headline PCE accelerated to 1.6% yoy, up from 1.4% yoy, missed expectation of 1.7% yoy. Core PCE rose to 1.6% yoy, matched expectations.

Canada GDP grew 0.1% in November, matched expectations

Canada GDP grew 0.1% mom in November, matched expectations. On three-month rolling average bases, GDP grew 0.1%, down from 0.2% in the three month to October. Goods-producing industries edged up 0.1% after posting declines in September and October, while services-producing industries also edged up 0.1%.

RPMI rose 2.8% mom, IPPI rose 0.1% mom in December.

UK Johnson: Brexit is a moment of real national renewal and change

UK is finally due to leave the EU today and the relationship will enter into a transition period. UK Prime Minister Boris Johnson is expected to say Brexit is “the moment when the dawn breaks and the curtain goes up on a new act”. And, “it is a moment of real national renewal and change.”

European Commission President Ursula von der Leyen said “we want to have the best possible relationship with the United Kingdom but it will never replicate the benefits of membership.” European Council President Charles Michel warned, “the more the UK will diverge from the EU standards, the less the access to the single market they will have.”

Released from UK, Gfk consumer confidence improved to -9 in January, matched expectations. Mortgage approvals rose 1k to 67k in December, above expectation of 66k. M4 money supply rose 0.1% mom, below expectation of 0.6% mom.

Eurozone GDP grew 0.1% in Q4, CPI rose to 1.4% in Jan

Eurozone GDP grew 0.1% qoq in Q4, below expectation of 0.2% qoq. Annually, GDP grew 1.0% yoy. EU28 GDP grew 0.1% qoq, 1.4% yoy. France GDP dropped -0.1% qoq in Q4, much worse than expectation of 0.3% qoq expansion. Italy GDP contracted -0.3% qoq in Q4, below expectation of 0.0% qoq.

Eurozone CPI accelerated to 1.4% yoy in January, up from 1.3% yoy, matched expectations. CPI core slowed to 1.1% yoy, down from 1.3% yoy, missed expectation of 1.2% yoy.

Germany retail sales dropped -3.3% mom in December, worse than expectation of -0.5% mom. Swiss retail sales rose 0.1% yoy in December.

Japan industrial production contracted most since 2013 in Q4, despite Dec rebound

Japan industrial production grew 1.3% mom in December, beat expectation of 0.7% mom. However, in the three months of October-December, factory output has indeed contracted -4.0%. That was the worst decline since data began in 2013. The Trade Ministry also said “the pace of rebound (in Dec) was not big… we will closely monitor whether factory output will recover in coming months.” It also kept the assessment of production as weakening.

Retail sales dropped -2.6% yoy in December, down for a third straight month, and missed expectation of -1.8% yoy. Unemployment rate was unchanged at 2.2%, better than expectation of 2.3%. Housing starts dropped -7.9% yoy, versus expectation of -11.5% yoy. Tokyo CPI core slowed to 0.7% yoy in January, down from 0.8% yoy, missed expectation of 0.8% yoy.

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9671; (P) 0.9705; (R1) 0.9729; More…

USD/CHF’s break of 0.9678 minor support suggests that corrective rebound from 0.9614 has completed at 0.9766. Intraday bias is turned back to the downside for retesting 0.9613 low. Break will resume larger fall form 1.0237 to 100% projection from 1.0237 to 0.9659 from 1.0023 at 0.9445. In any case, outlook will remain bearish as long as 0.9766 resistance holds, in case of recovery.

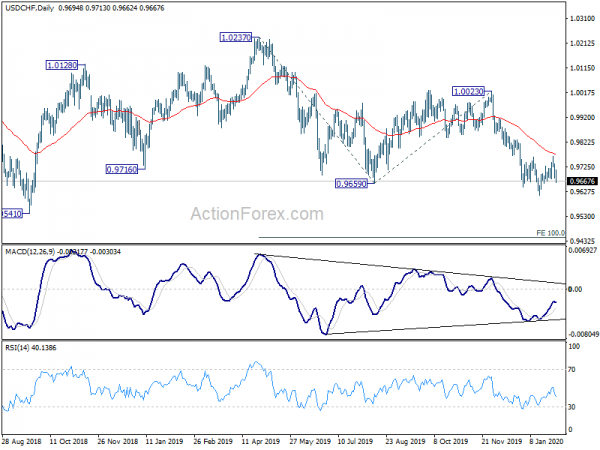

In the bigger picture, medium term outlook remains neutral as USD/CHF is staying sideway trading started from 1.0342 (2016 high). Fall from 1.0237 is a leg inside the pattern and could target 0.9186 (2018 low). In case of another rise, break of 1.0237 is needed to indicate up trend resumption. Otherwise, more sideway trading would be seen with risk of another fall.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Core Y/Y Jan | 0.70% | 0.80% | 0.80% | |

| 23:30 | JPY | Unemployment Rate Dec | 2.20% | 2.30% | 2.20% | |

| 23:50 | JPY | Industrial Production M/M Dec P | 1.30% | 0.70% | -1.00% | |

| 23:50 | JPY | Retail Trade Y/Y Dec | -2.60% | -1.80% | -2.10% | |

| 00:01 | GBP | GfK Consumer Confidence Jan | -9 | -9 | -11 | |

| 00:30 | AUD | Private Sector Credit M/M Dec | 0.20% | 0.20% | 0.10% | 0.20% |

| 00:30 | AUD | PPI Q/Q Q4 | 0.30% | 0.30% | 0.40% | |

| 00:30 | AUD | PPI Y/Y Q4 | 1.40% | 1.40% | 1.60% | |

| 02:00 | CNY | Manufacturing PMI Jan | 50 | 50.1 | 50.2 | |

| 02:00 | CNY | Non-Manufacturing PMI Jan | 54.1 | 53.5 | 53.5 | |

| 05:00 | JPY | Housing Starts Y/Y Dec | -7.90% | -11.50% | -12.70% | |

| 06:30 | EUR | France GDP Q/Q Q4 P | -0.10% | 0.30% | 0.30% | |

| 07:00 | EUR | Germany Retail Sales M/M Dec | -3.30% | -0.50% | 2.10% | 1.60% |

| 07:30 | CHF | Real Retail Sales Y/Y Dec | 0.10% | 0.40% | 0.00% | 0.50% |

| 09:00 | EUR | Italy GDP Q/Q Q4 P | -0.30% | 0.00% | 0.10% | |

| 09:30 | GBP | Mortgage Approvals Dec | 67K | 66K | 65K | 66K |

| 09:30 | GBP | M4 Money Supply M/M Dec | 0.10% | 0.60% | 0.80% | |

| 10:00 | EUR | Eurozone GDP Q/Q Q4 P | 0.10% | 0.20% | 0.20% | |

| 10:00 | EUR | Eurozone CPI Y/Y Jan P | 1.40% | 1.40% | 1.30% | |

| 10:00 | EUR | Eurozone CPI – Core Y/Y Jan P | 1.10% | 1.20% | 1.30% | |

| 13:30 | CAD | GDP M/M Nov | 0.10% | 0.10% | -0.10% | |

| 13:30 | CAD | Raw Material Price Index Dec | 2.80% | 0.70% | 1.50% | 1.40% |

| 13:30 | CAD | Industrial Product Price M/M Dec | 0.10% | 0.00% | 0.10% | -0.10% |

| 13:30 | USD | Personal Income M/M Dec | 0.20% | 0.30% | 0.50% | 0.40% |

| 13:30 | USD | Personal Spending Dec | 0.30% | 0.30% | 0.40% | |

| 13:30 | USD | PCE Price Index M/M Dec | 0.30% | 0.10% | 0.20% | 0.10% |

| 13:30 | USD | PCE Price Index Y/Y Dec | 1.60% | 1.70% | 1.50% | 1.40% |

| 13:30 | USD | Core PCE Price Index M/M Dec | 0.20% | 0.20% | 0.10% | |

| 13:30 | USD | Core PCE Price Index Y/Y Dec | 1.60% | 1.60% | 1.60% | 1.50% |

| 13:30 | USD | Employment Cost Index Q4 | 0.70% | 0.70% | 0.70% | |

| 14:45 | USD | Chicago PMI Jan | 48.7 | 48.9 | ||

| 15:00 | USD | Michigan Consumer Sentiment Jan F | 99.3 | 99.1 |