Sentiments continue to be relatively stable in Asian session today. Hong Kong stocks are back from holiday and tumble sharply. But Nikkei and Singapore Strait times are having mild recovery. Gold is back below 1570 level and WTI crude oil is back at 54. In the currency markets, Australian Dollar is limited slightly by CPI data. Yen and Dollar are also currently firm. New Zealand Dollar, on the other hand, is the weakest, followed by Swiss Franc. Ongoing development of the coronavirus outbreak in China will remain the most important factor to watch. Fed’s rate decision could take a back seat.

Technically, Swiss Franc could be a currency to watch today. USD/CHF is extending the recovery from 0.9613 but outlook stays bearish as long as 0.9762 resistance holds. Similarly, EUR/CHF is in the recovery from 1.0665 but outlook also stays bearish as long as 1.0788 resistance holds. However, decisive break of these two levels will indicate short term topping in the Franc in general and bring deeper pull back.

In Asia, Nikkei closed up 0.71%. Hong Kong HSI is down -2.68%. Singapore Strait Times is up 0.09%. Japan 10-year yield is up 0.0020 at -0.035. Overnight, DOW rose 0.66%. S&P 500 rose 1.01%. NASDAQ rose 1.43%. 10-year yield rose 0.036 to 1.641.

China coronavirus cases jump to 5974, surpassed SARS

China’s National Health Commission reported today that, as of end of Tuesday, the number of confirmed coronavirus cases in China surged to 5974, up from 4515 a day ago. The number also surpassed the 5327 cases in of SARS in the country 17 years ago. Death toll rose from 106 to 132. Globally, number of confirmed case now stands at 6058.

BoJ: Only halfway out of Japanification, downside risks still significant

In the Summary of Opinions of BoJ’s January 20/21 meeting, it’s noted that there has been “no further increase in the possibility that the momentum toward achieving the price stability target will be lost.”. Therefore, it’s “appropriate” to keep monetary policy unchanged. Nevertheless, the possibility of inflation losing momentum continues to “warrant attention”. It’s “appropriate” to tilt toward monetary accommodation.

Also, Japan is just “only halfway toward moving out of the so-called Japanification” of secular stagnation where low growth, low inflation, and low interest rates last for a long period. Risk of deflation continues to “warrant attention”. Downside risks to economic activity and prices are “still significant”. It’s necessary to be prepared for possible economic downturn as one of the risk scenarios.

Australia CPI rose 0.7% qoq, 1.8% yoy, drought pushed food prices higher

Australia CPI rose 0.7% qoq, 1.8% yoy in Q4, up from 0.5% qoq, 1.7% yoy, beat expectation of 0.6% qoq, 1.7% yoy. RBA trimmed mean CPI rose 0.4% qoq, 1.6% yoy, unchanged from prior quarter. RBA weighted median CPI rose 0.4% qoq, 1.3% yoy, also unchanged from Q3. The set of data affirmed the chance for RBA to stand pat in February, and delay the widely expected rate cut.

ABS Chief Economist, Bruce Hockman said: “Drought conditions are impacting prices for a range of food products. Food prices increased 1.3 per cent this quarter with price rises for beef and veal (+2.9 per cent), pork (+4.7 per cent), milk (+1.7 per cent) and cheese (+2.4 per cent). Both the impact from the drought and lower seasonal supply contributed to price rises for fruit (+6.8 per cent) this quarter.”

“Annual inflation remains subdued partly due to some price falls for housing related expenses. Through the year to the December 2019 quarter, price falls were recorded for utilities (-1.0 per cent) and new dwelling purchase by owner-occupiers (-0.1 per cent), while rent price rises remained modest (+0.2 per cent),” said Hockman.

Fed to keep rate unchanged at 1.50-1.75%, some previews

FOMC rate decision is a major focus today. Fed is widely expected to keep interest rate unchanged at 1.50-1.75%. The accompanying statement will, at most, contain only minor changes from December’s. There will be no update on economic projections and median dot plot at the meeting. Fed Chair Jerome Powell would reiterate that monetary policy is at the right place. Overall, the decision and press conference is more likely a non-event than not.

Currently, fed fund futures are indeed pricing in 87.3% chance of no change for today, and 12.7% chance of a hike to 1.75-2.00%. For June meeting, markets are pricing in 74.1% chance of federal funds rate being at 1.50-1.7% or above.

Here are some suggested previews:

- FOMC Preview: Will Powell Open The Door To A Summer Rate Cut?

- FOMC to Stay Put this Week

- January Flashlight for FOMC Blackout Period

Also featured

Germany will release Gfk consumer sentiment. Swiss will release ZEW expectations. Eurozone will release M3 money supply. From US, goods trade balance and pending home sales will also be released.

AUD/USD Daily Report

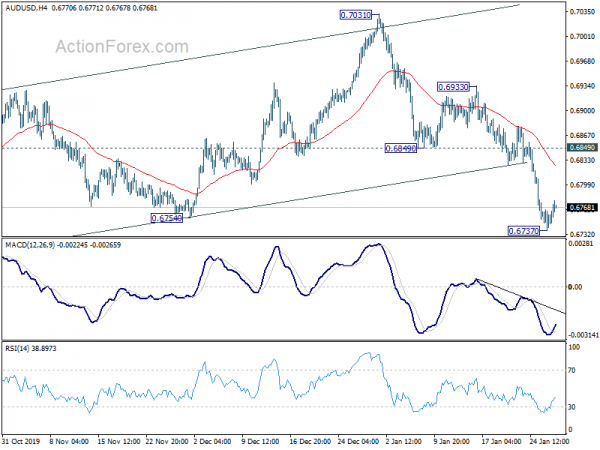

Daily Pivots: (S1) 0.6745; (P) 0.6755; (R1) 0.6773; More…

A temporary low is formed at 0.6737 in AUD/USD and intraday bias is turned neutral first. Some consolidations would be seen but upside should be limited by 0.6849 support turned resistance to bring another decline. Corrective rebound from 0.6670 has completed with three waves up to 0.7031. Break of 0.6737 will pave the way to retest 0.6670 low. However, firm break of 0.6849 will dampen our bearish view and turn focus back to 0.7031 instead.

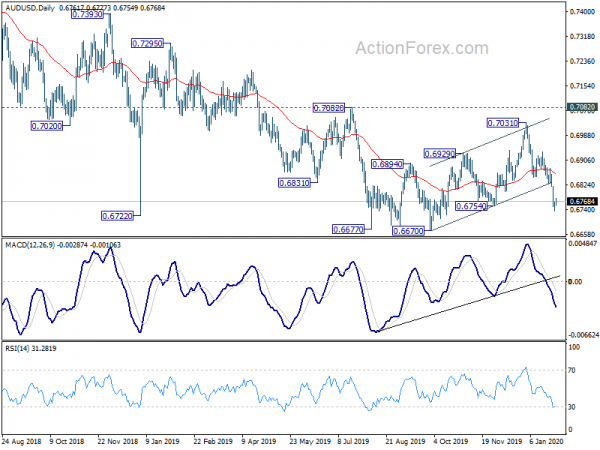

In the bigger picture, with 0.7082 resistance intact, there is no clear confirmation of trend reversal yet. That is, down trend from 0.8135 (2018 high) is still expect to continue to 0.6008 (2008 low). However, decisive break of 0.7082 will confirm medium term bottoming and bring stronger rally back to 55 month EMA (now at 0.7484).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Leading Index M/M Dec | 0.10% | -0.10% | 0.00% | |

| 23:50 | JPY | BoJ Summary of Opinions | ||||

| 0:01 | GBP | BRC Shop Price Index Y/Y Dec | -0.30% | -0.40% | ||

| 0:30 | AUD | CPI Q/Q Q4 | 0.70% | 0.60% | 0.50% | |

| 0:30 | AUD | CPI Y/Y Q4 | 1.80% | 1.70% | 1.70% | |

| 0:30 | AUD | RBA Trimmed Mean CPI Q/Q Q4 | 0.40% | 0.40% | 0.40% | |

| 0:30 | AUD | RBA Trimmed Mean CPI Y/Y Q4 | 1.60% | 1.50% | 1.60% | |

| 5:00 | JPY | Consumer Confidence Index Jan | 39.1 | 40.8 | 39.1 | |

| 7:00 | EUR | Germany Gfk Consumer Confidence Feb | 9.8 | 9.6 | ||

| 9:00 | CHF | ZEW Survey Expectations Jan | 12.5 | |||

| 9:00 | EUR | Eurozone M3 Money Supply Y/Y Dec | 5.50% | 5.60% | ||

| 13:30 | USD | Wholesale Inventories Dec P | 0.10% | -0.10% | ||

| 13:30 | USD | Goods Trade Balance (USD) Dec | -64.5B | -63.2B | ||

| 15:00 | USD | Pending Home Sales M/M Dec | 0.30% | 1.20% | ||

| 15:30 | USD | Crude Oil Inventories | 0.7M | -0.4M | ||

| 19:00 | USD | FOMC Rate Decision | 1.75% | 1.75% | ||

| 19:30 | USD | FOMC Press Conference |