Risk sentiments stabilize some what today as markets are digesting the impact of China’s coronavirus outbreak. But there is no clear sign of a turn around in the markets yet. Commodity currencies are just consolidating at low levels. Yen is also staying in tight range close to this week’s high. Dollar is currently one of the strongest as slight inversion between 1-yr and 5-yr yield is not triggering much concerns yet.

Technically, Sterling’s selloff is worth a note. GBP/USD is now heading back to 1.2920 fibonacci level and 1.2905 support. Break there will extend the whole correction from 1.3514 and put 1.2582 resistance turned support into focus. EUR/GBP’s recovery is also picking up momentum. Break of 0.8487 minor resistance will extend the corrective pattern from 0.8276 low, possibly with a break of 0.8595 resistance.

In other markets, DOW futures is currently up 120 pts. FTSE is up 0.49%. DAX is up 0.48%. CAC is up 0.47%. German 10-year yield is up 0.014 at -0.369. Earlier in Asia, Nikkei dropped -0.55%. Singapore Strait Times dropped -1.81%. Japan 10-year JGB yield rose 0.0112 to -0.036.

US durable goods orders rose 2.4%, but ex-transport orders dropped -0.1%

US durable goods orders rose 2.4% to USD 245.5B in December, way above expectation of 1.2%. However, ex-transport orders dropped -0.1%, missed expectation of 0.4%. Ex-defense orders dropped -2.5%.

S&P Case-Shiller 20 cities house price rose 2.6% yoy in November, above expectation of 2.4% yoy.

WHO and China discussed alternatives to evacuation due to coronavirus

WHO spokesman Christian Lindmeier said in Geneva that Director-General Tedros Adhanom Ghebreyesus met Chinese President Xi Jinping in Beijing. Both have discussed ways to protect people in areas affected by the coronavirus. Also, they talked about “possible alternatives” to evacuations by other countries.

Lindmeier added that the Emergency Committee is being “kept in the loop” on the coronavirus outbreak. At this point, WHO hasn’t seen onward human-to-human spread of the virus outside China. He said it’s “good news but of course this could change”.

China’s Xi was quoted by state media, saying: “The virus is a devil and we cannot let the devil hide,” state television quoted Xi as saying. China will strengthen international cooperation and welcomes the WHO participation in virus prevention … We believe that the WHO and international community will give a calm, objective and rational assessment of the virus and China is confident of winning the battle against the virus.”

German BDI: Simply impossible to complete a EU-UK trade deal by year end

Joachim Lang, Managing Director of Germany’s BDI industry group said today, “the uncertainty surrounding the withdrawal may be over, but there is no reason to be relieved.” “The risk of a hard Brexit, meaning a disorderly British exit from the EU at the end of the year, is not off the table.”

Lang warned that is is “simply impossible” to complete the task of trade negotiations between EU and UK by the end of the year. He complained that “it is a serious mistake for the British government to categorically rule out an extension of the transition period.”

He also explained that only a basic free trade agreement could be achieved by year end. And, . “We would be miles away from a modern free trade agreement such as the one with Canada, for example.” He also urged a strong EU position and “the EU cannot leave any doubt: those who will diverge from EU rules will not get the best access to the world’s largest internal market. We expect the EU to act in a united and strong way.”

Australia NAB business confidence dropped to -2, lowest since mid-2013

Australia NAB Business Confidence dropped to -2 in December, down from 0, hitting the lowest level since mid-2013. Business Conditions rose 1pt to 3. Trading condition dropped from 6 to 5. Profitability condition dropped from 3 to 1. Employment condition was unchanged at 4.

Alan Oster, NAB Group Chief Economist: “At present there appears to be a relatively large divergence between confidence and conditions, and we will continue to watch the survey to see how this resolves. Though, if confidence and forward orders remain weak, it is likely that the early part of 2020 could see further deterioration in the growth momentum (especially in private sector demand). We think that more policy stimulus will be needed to boost the economy over 2020”.

GBP/USD Mid-Day Outlook

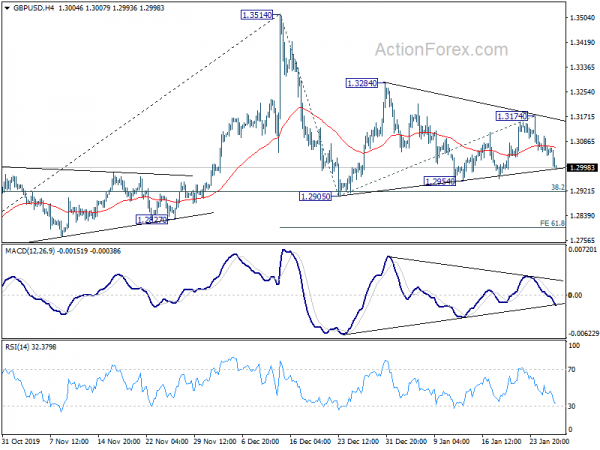

Daily Pivots: (S1) 1.3030; (P) 1.3067; (R1) 1.3094; More…

Intraday bias in GBP/USD remains on the downside for 1.2905 support. Break there will resume whole correction from 1.3514. Next downside target will be 61.8% projection of 1.3514 to 1.2905 from 1.3174 at 1.2798. On the upside, break of 1.3174 resistance will turn bias to the upside for 1.3284 resistance instead.

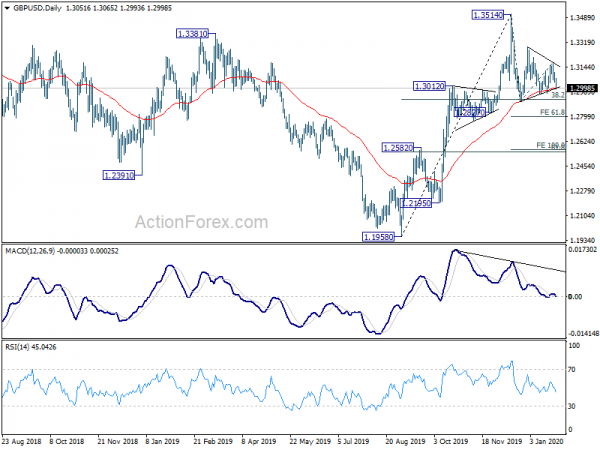

In the bigger picture, rise from 1.1958 medium term bottom is expected to extend higher to retest 1.4376 key resistance. Reactions from there would decide whether it’s in consolidation from 1.1946 (2016 low). Or, firm break of 1.4376 will indicate long term bullish reversal. In any case, for now, outlook will stay bullish as long as 1.2582 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Index Y/Y Dec | 2.10% | 2.10% | 2.10% | |

| 00:30 | AUD | NAB Business Conditions Dec | 3 | 4 | ||

| 00:30 | AUD | NAB Business Confidence Dec | -2 | 0 | ||

| 07:00 | CHF | Trade Balance (CHF) Dec | 1.96B | 3.34B | 3.92B | 3.95B |

| 11:00 | GBP | CBI Realized Sales Jan | 5 | 0 | ||

| 13:30 | USD | Durable Goods Orders Dec | 2.40% | 1.20% | -2.10% | |

| 13:30 | USD | Durable Goods Orders ex-Transport Dec | -0.10% | 0.40% | -0.10% | |

| 14:00 | USD | S&P/CS Composite-20 Home Price Y/Y Nov | 2.60% | 2.40% | 2.20% | |

| 15:00 | USD | Consumer Confidence | 128.2 | 126.5 |