Global stock market could be considered in crash mode as worries over China’s coronavirus continues to intensify. Confirmed infections in China jumped to 2835, according to latest information from state media. Death toll continues to stand at 81. WHO Director-General Tedros Adhanom Ghebreyesus is heading to Beijing to offer help as there is no sign of a slowdown in the outbreak. The coronavirus is also spreading quickly other countries, including US, Canada, Taiwan, Australia, Franc, Thailand and many others.

Stocks are in deep selloff with DOW future, currently down more than -430 pts. In Europe, FTSE is down -2.13%. DAX is down -2.26%. CAC is down -2.25%. German 10-year yield is down -0.040 at -0.373. Earlier in Asia, Nikkei dropped -2.03%. 10-year JGB yield dropped -0.0283 to -0.048. China, Hong Kong and Singapore were on holidays.

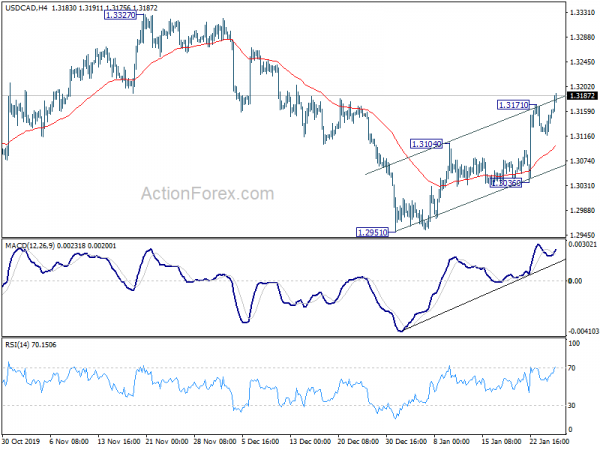

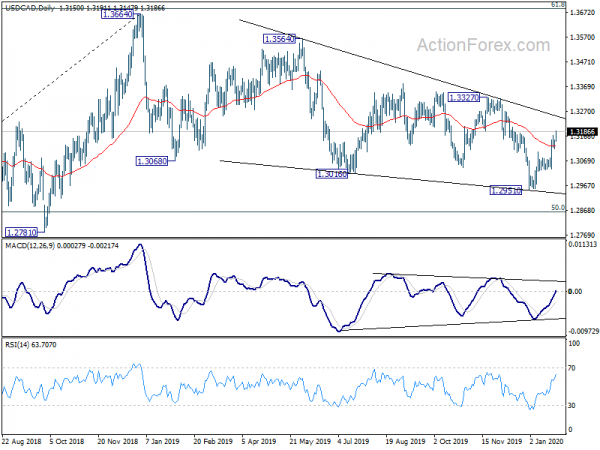

In the currency markets, commodity currencies are the worst performing as led by Australian Dollar. Yen and Swiss Franc are the strongest on risk aversion naturally. Dollar is following as the third strongest for now. technically, USD/CAD’s break of 1.3171 temporary top indicates resumption of rebound from 1.2951. We’re favoring the case that medium term consolidation from 1.3664 has completed at 1.2951. USD/CAD should take on 1.3327 resistance to confirm. EUR/AUD is pressing 1.6294 resistance and break will resume the rise from 1.5962 and reaffirm medium term bullishness too.

German ifo dropped to 95.9, manufacturing improved markedly, services fell noticeably

Germany ifo Business Climate dropped to 95.9 in January, down from 96.3, missed expectation of 97.0. Current Assessment Index rose to 99.1, up from 98.8, but missed expectation of 99.4. Expectations Index dropped to 92.9, down form 93.9, missed expectation of 95.0.

Ifo President Clemens Fuest said the decline in the headline index was “due to companies’ more pessimistic outlook for the coming months”. The German economy is starting the year “in a cautious mood”.

Manufacturing “improved markedly”, up from -5.0 to -1.6, and is showing “signs of recovery”. But services indictor “fell noticeably” from 21.3 to 18.7, “due to companies’ considerably more restrained expectations”. Trade rose from 0.0 to 2.2 while construction dropped from 17.9 to 14.0.

EU Barnier warns of cliff edge Brexit by year end

EU chief Brexit negotiator Michel Barnier warned today that there is still risk of a cliff edge Brexit at the end of 2020. He said, negotiation with the UK on trade “is not usual because at the end of this year, the UK is leaving the single market, it is it’s choice, it is leaving the customs union”. “If we have no agreement, it will not be business as usual and the status quo, we have to face the risk of a cliff edge, in particular for trade.”

Irish Prime Minister Leo Varadkar said the EU has an upper hand in the trade talks because of its size. He told BBC, “the European Union is a union of 27 member states. The UK is only one country. And we have a population and a market of 450 million people”. He also acknowledged that “it will be difficult” to complete the deal by year end.

USD/CAD Mid-Day Outlook

Daily Pivots: (S1) 1.3127; (P) 1.3140; (R1) 1.3161; More….

USD/CAD’s rally resumed after brief consolidation and intraday bias is back on the upside for 1.3327 resistance. We’re favoring the case that corrective pattern from 1.3664 has completed as a triangle at 1.2951. Break of 1.3327 should confirm this bullish view and pave the way for a retest on 1.3664 high. In any case, near term outlook will remain bullish as long as 1.3104 resistance turned support holds, in case of retreat.

In the bigger picture, rise from 1.2061 (2017 low) could have completed at 1.3664, after failing 61.8% retracement of 1.4689 (2016 high) to 1.2061 at 1.3685. However, structure of price actions from 1.3664 argues that it’s probably just a corrective move. Hence, while further fall cannot be ruled out, downside should be contained by 50% retracement of 1.2061 to 1.3664 at 1.2863.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 09:00 | EUR | Germany IFO – Business Climate Jan | 95.9 | 97 | 96.3 | |

| 09:00 | EUR | Germany IFO – Expectations Jan | 92.9 | 95 | 93.8 | 93.9 |

| 09:00 | EUR | Germany IFO – Current Assessment Jan | 99.1 | 99.4 | 98.8 | |

| 09:30 | GBP | BBA Mortgage Approvals Dec | 46.8K | 44.0K | 43.7K | 40.1K |

| 15:00 | USD | New Home Sales M/M Dec | 730K | 719K | ||

| 15:00 | USD | New Home Sales Change M/M Dec | 0.80% | 1.30% |