The financial markets lack a general theme today. DOW opens flat and is set to extend recent range trading. European indices are trading mixed at the time of writing with FTSE and CAC in red. The strong rebound in Nikkei earlier today had no follow through in other markets. Gold is struggling in tight range between 1210/5 while WTI crude oil is bounded between 44/45. In the currency markets, Sterling dips notably as markets are disappointed by the lack of hints on monetary policy from BoE deputy. New Zealand Dollar remains the weakest for today, followed by Swiss Franc and Yen. Technical development in Sterling will be closely watched in the US session. Key levels are 1.2849 in GBP/USD, 0.8879 in EUR/GBP and 146.03 in GBP/JPY.

BoE Broadbent gave no hints on monetary policy

BoE Deputy Governor Ben Broadbent warned of risks of trade after Brexit. He noted that "a significant curtailment of trade with Europe would force the U.K. to shift away from producing the things it’s been relatively good at, and therefore tends to export to the EU, and towards the things it currently imports and is relatively less good at." In particular, he cited the example of moving away from services exports that could hurt income and raise costs of food and machinery. While Broadbent didn’t touch on monetary policies directly, his cautious tone argues that the is unlikely to vote for a rate hike in the next MPC meeting in August.

Released from UK, BRC retail sales monitor rose 1.2% yoy in June.

Australia firm on business conditions, Kiwi tumbles

Australia NAB business confidence rose 1 point to 9 in June. Business conditions gauge improved 4 points to 15. Most industrial performed well with strongest gains in wholesale, construction and manufacturing. On the other hand, mining was the worst performer due to falling commodity prices. The business conditions index is indicate back at pre-financial crisis level.

But confidence lagged behind and recorded slower rise in recent months. NAB noted that "we continue to be pleasantly surprised by just how upbeat the business sector is, given the context of a fairly beleaguered household sector that has been weighed down by limited wages growth and record levels of debt". However, it also warned that long term outlook could easily "underperform the RBA’s upbeat expectations as important growth drivers (LNG exports, commodity prices and housing construction) begin to fade". Also from Australia, home loans rose 1.0% in May.

New Zealand dollar tumbles today as government data showed retail spending on credit and debit cards was unchanged in June. Some economists pointed out that’s an import miss as there was expectations of a boost from the British and Irish Lions’ rugby tour.

Elsewhere, Japan M2 rose 3.9% yoy in June, machine tools orders rose 31.1% in June. Canada housing starts rose to 213k in June. .

GBP/USD Mid-Day Outlook

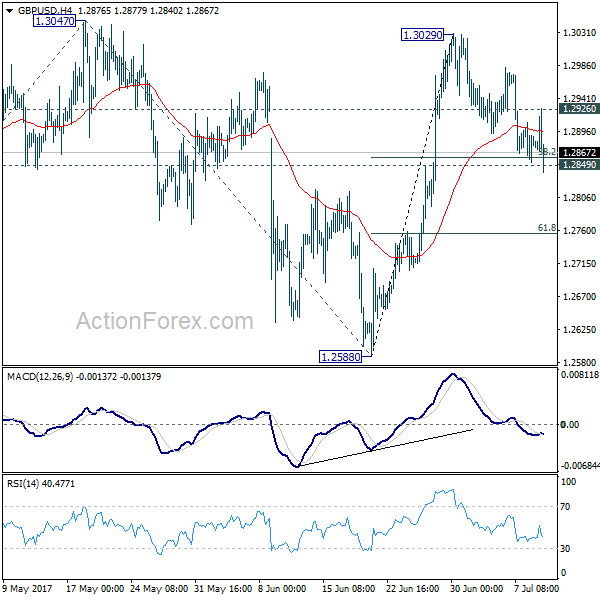

Daily Pivots: (S1) 1.2853; (P) 1.2881; (R1) 1.2907; More…

GBP/USD’s corrective pull back from 1.3029 extends lower today and hits 1.2840. But it quickly recovers after hitting 1.2849 support. Intraday bias remains neutral first. We’d still expect downside to be contained by 1.2849 support to bring rise resumption. Above 1.2926 minor resistance should turn bias back to the upside for 1.3047 resistance. Break will target 61.8% projection of 1.2108 to 1.3047 from 1.2588 at 1.3168 next. However, sustained break of 1.2849 will dampen our near term bullish view and turn focus back to 1.2588 support.

In the bigger picture, overall, price actions from 1.1946 medium term low are seen as a corrective pattern that is still in progress. While further upside is now in favor, overall outlook remains bearish as long as 1.3444 key resistance holds. Larger down trend from 1.7190 is expected to resume later after the correction completes. And break of 1.2588 will indicate that such down trend is resuming.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Retail Sales Monitor Y/Y Jun | 1.20% | 0.50% | -0.40% | |

| 23:50 | JPY | Japan Money Stock M2+CD Y/Y Jun | 3.90% | 3.90% | 3.90% | 3.80% |

| 1:30 | AUD | NAB Business Confidence Jun | 9 | 7 | 8 | |

| 1:30 | AUD | Home Loans May | 1.00% | 1.50% | -1.90% | |

| 6:00 | JPY | Machine Tool Orders Y/Y Jun P | 31.10% | 24.50% | ||

| 12:15 | CAD | Housing Starts Jun | 213K | 200K | 195K |