Sterling jumps broadly today as traders pare back bet on an imminent rate cut by BoE next week. Record improvement in quarterly business optimism is seen as a trigger for the sharp change in expectations. Canadian Dollar attempts to rally after CPI met expectations. But there is no range breakout yet ahead of BoC. Swiss Franc and Yen are the weakest ones as markets seemed to be comfortable with China’s handling of the coronavirus. But the optimism is not much reflected in stocks.

Technically, GBP/USD’s break of 1.3318 suggests that pull back from 1.3284 has completed. Further rise would be seen back to this resistance first. Break will target 1.3514 high. EUR/GBP’s break of 0.8454 suggests that corrective rebound from 0.8276 has completed. Deeper fall should be seen to retest this low. 144.52 in GBP/JPY will be an immediate focus. Break will bring further rebound back to retest 147.95 high. Also, USD/CAD would finally break out of 1.3029/13104 range after BoC.

In Europe, currently, FTSE is down -0.26%. DAX is down -0.01%. CAC is down -0.07%. German 10-year yield is down -0.0078 at -0.253. Earlier in Asia, Nikkei rose 0.70%. Hong Kong HSI rose 1.27%. China Shanghai SSE rose 0.28%. Singapore Strait Times rose 0.21%. Japan 10-year JGB yield rose 0.0038 to -0.002, continuing to fluctuate around 0% handle.

Canada CPI unchanged at 2.2%, matched expectations

Canada CPI was unchanged at 2.2% yoy in December, matched expectations. CPI common accelerated to 2.0% yoy, up from 1.9% yoy, beat expectation of 1.9% yoy. CPI median slowed to 2.2% yoy, down from 2.3% yoy, missed expectation of 2.4% yoy. CPI trimmed slowed to 2.1% yoy, down from 2.2% yoy, missed expectation of 2.2% yoy.

UK business optimism at highest since 2014, largest positive swing on record

According to CBI survey, UK business optimism jumped sharply to 23% in the three months to January, up from -4% in October. That’s the strongest level since April 2014. the 67% quarterly swing was also the largest on record since 1958.

Anna Leach, CBI Deputy Chief Economist, said: “With business optimism improving at its fastest pace since 2014 and some of the squeeze on investment plans lifting, it’s clear manufacturers are entering the new year with a spring in their step. Firms are now planning to invest more in plants and machinery, which will ultimately help increase capacity and output.

“However, this boost to sentiment belies poor trading conditions over the past quarter, with output and orders still declining. If we are to build on this rebound in optimism among UK manufacturers, it is crucial for the UK and EU to establish a trade deal that supports growth in this sector.”

UK to introduce digital tax in April, US threatens retaliation with auto tariffs

UK Chancellor of the Exchequer Sajid Javid insisted that UK will go ahead with the induction of digital tax in April. He said, at panel discussion at the Davos forum, “It is a proportionate tax, and a tax that is deliberately designed as a temporary tax. It will fall away when there is an international agreement.”

At the same discussion, US Treasury Secretary Steven Mnuchin warned “We think the digital tax is discriminatory in nature… if people want to just arbitrarily put taxes on our digital companies we will consider arbitrarily putting taxes on car companies”. “We’re going to have some private conversations about that… and I’m sure the President and Boris will be speaking on it as well”.

Mnuchin: No deadline to phase 2 trade talks with China

US Treasury Secretary Steven Mnuchin said there is “no deadline” to phase 2 trade negotiation with China. “The first issue that we’re very focused on in the next 30 days is implementing phase 1, then we’ll start on phase 2. “If we get that done before the election, great, if it takes longer, that’s fine,” he said.

Mnuchin also added, “we could easily have phase two A, two B, two C, it doesn’t need to be a big bang, and we’ll take tariffs off along the way, so there is a big incentive for the Chinese to continue to negotiate and conclude various additional parts of the agreement.”

Trump to announce very big middle class tax cut over the next 90 days

US President Donald Trump told Fox Business that the administration is planning a “very big” middle-class tax cut. He said, “we are going to be doing a middle-class tax cut, a very big one. We’ll be doing that. We’ll be announcing that over the next 90 days.”

On trade deals, “the China deal is amazing, we’ll be starting phase two very soon. The tariffs were left on Chinese goods because its good to negotiate for phase two.”

At the same time, “the European Union is tougher to deal with than anybody. They’ve taken advantage of our country for many years,” said Trump. “Ultimately it will be very easy because if we can’t make a deal, we’ll have to put 25 percent tariffs on their cars.”

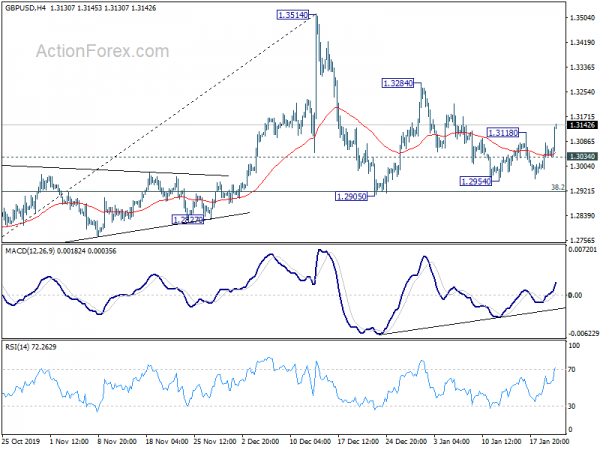

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2998; (P) 1.3041; (R1) 1.3085; More…

GBP/USD’s break of 1.3118 suggests that pull back from 1.3284 has completed. Intraday bias is back on the upside for 1.3284 resistance first. Break will pave the way to retest 1.3514 high. On the downside, below 1.3034 minor support will turn bias tot he downside for retesting 38.2% retracement of 1.1958 to 1.3514 at 1.2920.

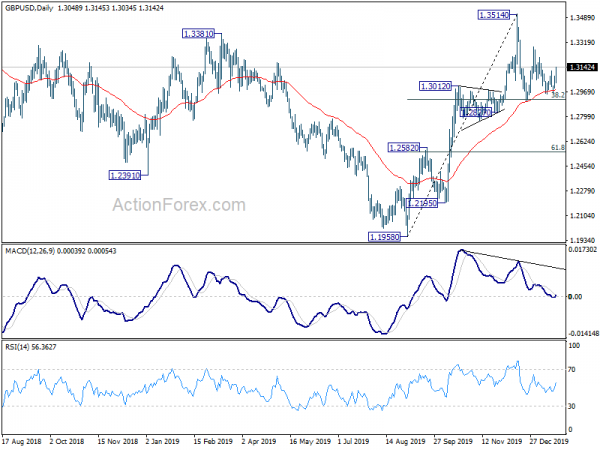

In the bigger picture, rise from 1.1958 medium term bottom is expected to extend higher to retest 1.4376 key resistance. Reactions from there would decide whether it’s in consolidation from 1.1946 (2016 low). Or, firm break of 1.4376 will indicate long term bullish reversal. In any case, for now, outlook will stay bullish as long as 1.2582 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Consumer Confidence Jan | -1.80% | -1.90% | ||

| 09:30 | GBP | Public Sector Net Borrowing (GBP) Dec | 4.0B | 4.5B | 4.9B | 4.2B |

| 11:00 | GBP | CBI Industrial Order Expectations Jan | -22 | -25 | -28 | |

| 13:30 | CAD | Wholesale Sales M/M Nov | -1.20% | -0.30% | -1.10% | |

| 13:30 | CAD | New Housing Price Index M/M Dec | 0.20% | 0.00% | -0.10% | |

| 13:30 | CAD | CPI M/M Dec | 0.00% | 0.00% | -0.10% | |

| 13:30 | CAD | CPI Y/Y Dec | 2.20% | 2.20% | 2.20% | |

| 13:30 | CAD | CPI Common Y/Y Dec | 2.00% | 1.90% | 1.90% | |

| 13:30 | CAD | CPI Median Y/Y Dec | 2.20% | 2.40% | 2.40% | 2.30% |

| 13:30 | CAD | CPI Trimmed Y/Y Dec | 2.10% | 2.20% | 2.20% | |

| 14:00 | USD | Housing Price Index M/M Nov | 0.20% | 0.20% | 0.20% | 0.40% |

| 15:00 | USD | Existing Home Sales M/M Dec | 5.42M | 5.35M | ||

| 15:00 | CAD | BoC Interest Rate Decision | 1.75% | 1.75% |