Risk aversion dominates the Asian markets today on concerns of coronavirus outbreak in China. Hong Kong HSI leads the way down, additionally pressured by Moody’s downgrade. In the currency markets, commodity currencies are broadly lower, with Australian Dollar suffering biggest selloff. Yen and Swiss Franc are the strongest for now. Focus will turn to UK job data, which could trigger another round of selloff in Sterling.

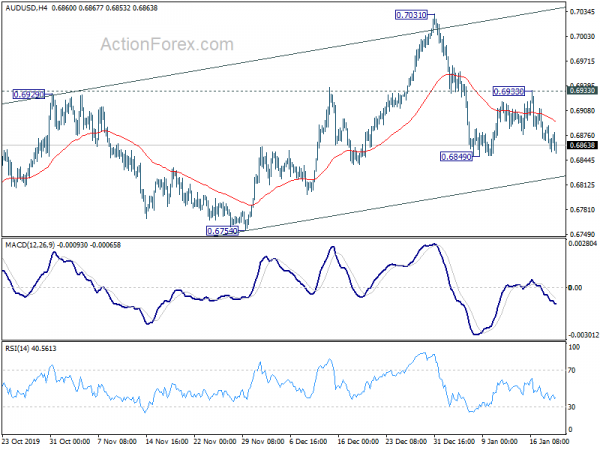

Technically, 0.6849 support in AUD/USD is in focus. Break will resume whole fall from 0.7031 and add to the case of near term bearish reversal. USD/JY is also eying 109.79 minor support. Break there will confirm short term topping and bring deeper corrective pull back. Gold’s break of 1563.11 resistance suggests that pull back from 1611.37 is over at 1535.91. Further rebound would be seen to retest 1611.37 high.

In Asia, currently, Nikkei is down -0.88%. Hong Kong HSI is down -2.29%. China Shanghai SSE is down-1.04%. Singapore Strait Times is down -1.18%. Japan 10-year JGB yield is down -0.0138 at -0.005, turned negative.

Asian stocks tumble on concern of coronavirus outbreak in China

Asian stocks tumble broadly today on concern of an outbreak of a coronavirus in China, as well as other countries in the region. China’s National Health Commission already confirmed that the virus which causes a type of pneumonia, can pass from person-to-person. That couldn’t come at the worst time as massive number of people are expected to travel within China before Lunar New Year.

According to a report by London Imperial College’s MRC Centre for Global Infectious Disease Analysis, it’s estimated that there were already over 1700 cases in Wuhan city by January 12. Such estimate was not commented by the Chinese authorities yet. But there were already cases reported by Thailand, Japan and South Korea, involving people from from Wuhan or who recently visited the city.

The virus is believed to be in the same family of Severe Acute Respiratory Syndrome (SARS), which killed nearly 800 people during an outbreak in 2003, starting in China and spread to Hong Kong. The World Health Organization (WHO) said yesterday that the primary source of the outbreak appeared to be an animal and some “limited human-to-human transmission” occurred between close contacts. WHO also called for an emergence committee on Wednesday to assess the situation.

Moody’s downgrades Hong Kong to Aa3 on weak government

Moody’s cut Hong Kong’s credit rating by one notch to Aa3 yesterday. The ratings agency also changed the outlook to “stable” from “negative.” In a statement, Moody’s said “the absence of tangible plans to address either the political or economic and social concerns of the Hong Kong population that have come to the fore in the past nine months may reflect weaker inherent institutional capacity than Moody’s had previously assessed.”

Protests in Hong Kong has now lasted for more than seven months. The first demand was met with the China extradition bill withdrawn after months of protests. Yet, there was no clear measures to address the rest of the “five demands” of the protesters. In particular, the government continuously refused to set up a commission of enquiry on policy brutality and corruption. In the meantime, there is increasing call for an independent and international inquiry into the Hong Kong police.

In response to Moody’s downgrade, the HKSAR government said: “Although Hong Kong has faced the most severe social unrest since its return to the Motherland in the past seven months or so, the HKSAR Government, with the staunch support of the Central Government, has firmly upheld the ‘one country, two systems’ principle and handled the situation in accordance with the law to curb violence on its own to restore social order as soon as possible”.

BoJ stands pat, raises growth forecasts, lower inflation projections

BoJ left monetary policy unchanged as widely expected. Under the yield curve control framework, short-term policy interest rate is held at -0.1%. Annual pace of monetary base expansion is held at around JPY 80T, to keep 10-year JGB yields at around zero percent. Harada Yutaka and Kataoka Goushi dissented again in 7-2 vote.

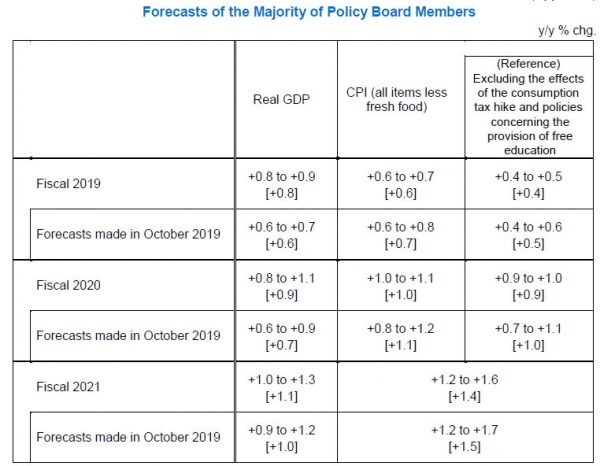

In the new economic projections, fiscal 2020 growth forecast was raised from 0.7% to 0.9%. CPI core forecast (ex-sales tax hike) was lowered from 1.0% to 0.9%. For fiscal 2021, growth forecast was raised from 1.0% to 1.1%. CPI core forecast was lowered form 1.5% to 1.4%. BoJ added that risks to economic activity and prices are both “skewed to the downside”. Momentum toward achieving 2% inflation target is “maintained by is not yet sufficiently firm”.

BoJ statement, outlook for economic activity and prices.

IMF downgrades growth forecast, sentiments boosted not yet visible in data

In the update to World Economic Outlook, IMF lowered 2020 global growth forecast by -0.l% to 3.3%, and 2021 by -0.2% to 3.4%. Still, they represent pickup form 2019’s 2.9% growth. IMF also noted that the downward revision “primarily reflects negative surprises to economic activity in a few emerging market economies, notably India”.

Meanwhile, market sentiment has been “boosted by “tentative signs that manufacturing activity and global trade are bottoming out, a broad-based shift toward accommodative monetary policy, intermittent favorable news on US-China trade negotiations, and diminished fears of a no-deal Brexit”. However, “few signs of turning points are yet visible in global macroeconomic data.”

Here are some highlights:

- World output: 2020 at 3.3% (revised down by -0.1%), 2021 at 3.4% (revised down by -0.2%).

- Advanced economies: 2020 at 1.6% (-0.1%), 2021 at 1.6% (unchanged).

- US: 2020 at 2.0% (-0.1%), 2021 at 1.7% (unchanged).

- Eurozone: 2020 at 1.3% (-0.1%), 2021 at 1.4% (unchanged).

- Germany: 2020 at 1.1% (-0.1%), 2021 at 1.4% (unchanged).

- Japan: 2020 at 0.7% (+0.2%), 2021 at 0.5% (unchanged).

- UK: 2020 at 1.4% (unchanged), 2021 at 1.5% (unchanged).

- Canada: 2020 at 1.8% (unchanged), 2021 at 1.8% (unchanged).

- China: 2020 at 6.0% (+0.2%), 2021 at 5.8% (-0.1%).

- India: 2020 at 5.8% (-1.2%), 2021 at 6.5% (-0.9%).

On the data front

UK employment data is the major focus in European session. Downside surprises could add to the odd of a BoE rate cut next week and pressure Sterling. Germany will also release ZEW economic sentiment. Later in the day, Canada will release manufacturing sales.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6857; (P) 0.6873; (R1) 0.6891; More…

Intraday bias in AUD/USD remains neutral first, with focus on 0.6849 support. Outlook is unchanged that rebound from 0.6670 could have completed with three waves up to 0.7031. Break of 0.6849 will turn bias to the downside for 0.6754 support. Decisive break there will confirm this bearish case. On the upside, however, break of 0.6933 will turn focus back to 0.7031 resistance instead.

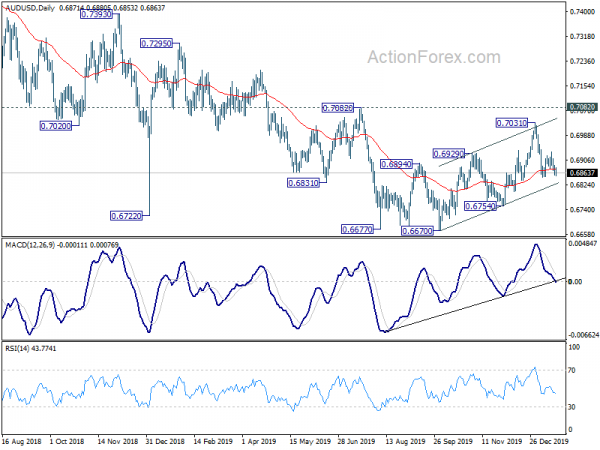

In the bigger picture, with 0.7082 resistance intact, there is no clear confirmation of trend reversal yet. That is, down trend from 0.8135 (2018 high) is still expect to continue to 0.6008 (2008 low). However, decisive break of 0.7082 will confirm medium term bottoming and bring stronger rally back to 55 month EMA (now at 0.7484).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 3:00 | JPY | BoJ Interest Rate Decision | -0.10% | -0.10% | -0.10% | |

| 9:30 | GBP | Claimant Count Change Dec | 33.4K | 28.8K | ||

| 9:30 | GBP | Claimant Count Rate Dec | 3.50% | |||

| 9:30 | GBP | ILO Unemployment Rate (3M) Nov | 3.80% | 3.80% | ||

| 9:30 | GBP | Average Earnings Excluding Bonus 3M/Y Nov | 3.40% | 3.50% | ||

| 9:30 | GBP | Average Earnings Including Bonus 3M/Y Nov | 3.40% | 3.20% | ||

| 10:00 | EUR | Germany ZEW Economic Sentiment Jan | 15.2 | 10.7 | ||

| 10:00 | EUR | Germany ZEW Current Situation Jan | -12.4 | -19.9 | ||

| 10:00 | EUR | Eurozone ZEW Economic Sentiment Jan | 16.3 | 11.2 | ||

| 13:30 | CAD | Manufacturing Sales M/M Nov | 0.30% | -0.70% |