Yen remains generally weak today but it’s weakest spot was overtaken by New Zealand Dollar. Meanwhile, Dollar, Euro and Sterling are staying in recently established range against each other. Economic calendar is rather light and traders are generally holding their bets ahead of the key events later this week. In particular, BoC rate hike tomorrow will catch as much attention as Fed chair Janet Yellen’s testimony. Meanwhile, Euro could stay mixed until there are fresh inspirations about ECB’s timing for tapering. In other markets, gold recovered ahead of 1200 handle but struggled to find follow through buying above 1210. WTI crude oil is trying to regain 45 after dipping through 44 last week.

Fed Williams still expected another hike and balance sheet unwinding this year

San Francisco Fed President John Williams spoke in an event in Sydney today and reiterated his expectation of one more rate hike this year. Also, He expects Fed to start shrinking the balance sheet this year too. He noted that job data showed that US economy is strong and the slow down in inflation is transitory. However, he emphasized that if inflation did not accelerate as expected, Fed should adopt a slower rate path. The main focus for US will be on Fed chair Janet Yellen’s testimony to Senate Banking Committee on Wednesday.

Staying in US, it’s reported that Republicans are working on bringing up a revised version of the Senate healthcare bill later this week. And there could be a vote on the bill next week. The vote bill to replace Obamacare was forced to postpone due to insufficient support. And it remains unclear whether the new version would have enough vote to be passed. The issue has been dragging on US President Donald Trump’s work on tax reforms and other economic policies.

Australia business condition back to pre-crisis level, but confidence lags

Australia NAB business confidence rose 1 point to 9 in June. Business conditions gauge improved 4 points to 15. Most industrial performed well with strongest gains in wholesale, construction and manufacturing. On the other hand, mining was the worst performer due to falling commodity prices. The business conditions index is indicate back at pre-financial crisis level. But confidence lagged behind and recorded slower rise in recent months. NAB noted that "we continue to be pleasantly surprised by just how upbeat the business sector is, given the context of a fairly beleaguered household sector that has been weighed down by limited wages growth and record levels of debt". However, it also warned that long term outlook could easily "underperform the RBA’s upbeat expectations as important growth drivers (LNG exports, commodity prices and housing construction) begin to fade". Also from Australia, home loans rose 1.0% in May.

Kiwi tumbles after data

New Zealand dollar tumbles today as government data showed retail spending on credit and debit cards was unchanged in June. Some economists pointed out that’s an import miss as there was expectations of a boost from the British and Irish Lions’ rugby tour. The sharp fall in NZD/USD today, with daily MACD diving deeper below signal line, suggests short term topping at 0.7345. And that could be seen as rejection fro 0.7374 resistance too. Near term focus is back on 0.7961 support. Break will send NZD/USD to 55 day EMA (now at 0.7155) and below.

Elsewhere, UK BRC retail sales monitor rose 1.2% yoy in June. Japan M2 rose 3.9% yoy in June, machine tools orders rose 31.1% in June. Canada will release housing starts later today.

EUR/JPY Daily Outlook

Daily Pivots: (S1) 129.70; (P) 130.04; (R1) 130.33; More…

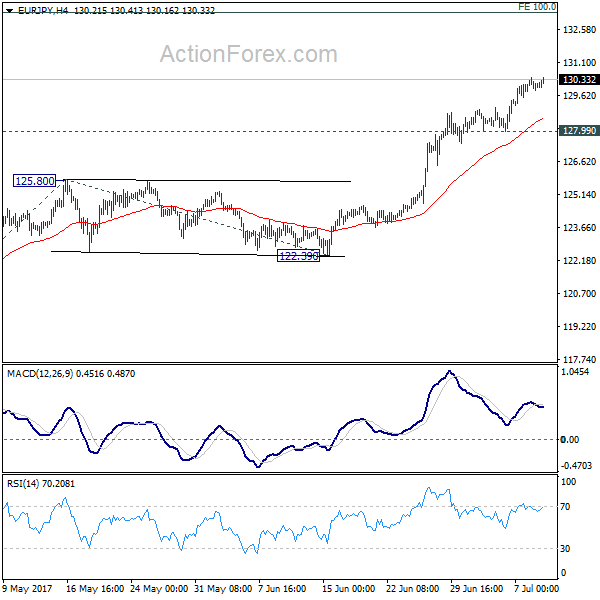

EUR/JPY’s rally continues today even though it’s losing upside momentum. Intraday bias remains on the upside. Current rally should target 100% projection of 114.84 to 125.80 from 122.39 at 133.35 next. On the downside, break of 127.99 support is needed to indicate short term topping. Otherwise, outlook will remain bullish in case of retreat.

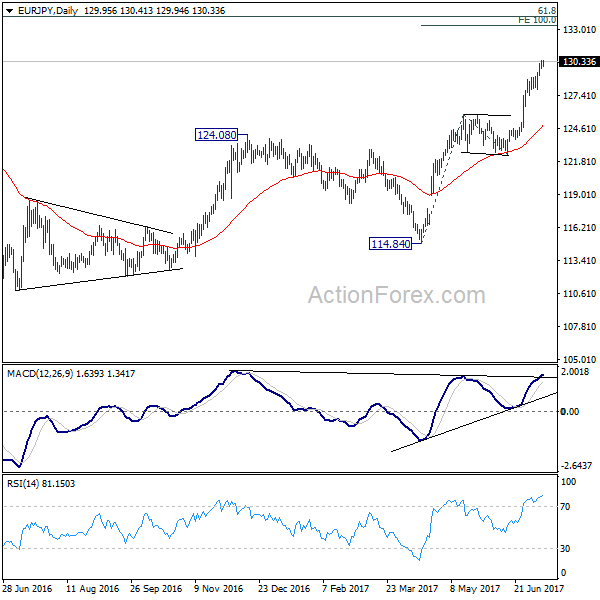

In the bigger picture, the break of 126.09 support turned resistance should have confirmed completion of down trend form 149.76 (2014 high), at 109.03 (2016 low). Current rise from 109.03 would now target 61.8% retracement of 149.76 to 109.03 at 134.20 and above. Medium term outlook will remain bullish as long as 122.39 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Retail Sales Monitor Y/Y Jun | 1.20% | 0.50% | -0.40% | |

| 23:50 | JPY | Japan Money Stock M2+CD Y/Y Jun | 3.90% | 3.90% | 3.90% | 3.80% |

| 1:30 | AUD | NAB Business Confidence Jun | 9 | 7 | 8 | |

| 1:30 | AUD | Home Loans May | 1.00% | 1.50% | -1.90% | |

| 6:00 | JPY | Machine Tool Orders Y/Y Jun P | 31.10% | 24.50% | ||

| 12:15 | CAD | Housing Starts Jun | 200K | 195K |