Dollar strengthens broadly today but upside is somewhat limited by mixed US economic data. Canadian Dollar is following as the second strongest as oil prices recover mildly. On the other hand, both Swiss Franc and Euro are paring some of this week’s gains. Weakness also spread to Sterling, which is also pressured by poor retail sales data. For the week, Yen is currently the weakest, followed by Kiwi. Franc is the strongest, followed by Canadian.

Technically, while upside momentum in USD/JPY is relatively weak, with 109.79 minor support intact, further rise is still expected to 110.89 projection level next. With today’s sharp fall, EUR/USD’s fall is back on 1.1066 support and break will indicate near term bearishness. Nevertheless, that might not happen until next week.

In Europe, currently, FTSE is up 0.93%. DAX is up 0.70%. CAC is up 1.04%. German 10-year yield is up 0.0053 at -0.208. Earlier in Asia, Nikkei rose 0.45%. Hong Kong HSI rose 0.60%. China Shanghai SSE rose 0.05%. Singapore Strait Times rose 0.09%. Japan 10-year JGB yield dropped -0.0113 to 0.000.

US housing starts has strongest gain since 2016, industrial production dropped -0.3%

US housing starts jumped 16.9% mom to 1.61m annualized rate in December, well above expectation of 1.38m. That’s the largest percentage gain since October 2016. Building permits dropped -3.9% mom to 1.42m, below expectation of 1.47m.

Industrial production dropped -0.3% mom in December, below expectation of 0.0% mom. Capacity utilization dropped to 77.0%, below expectation of 77.2%.

Fed Bullard could wait and see through 2020 on interest rates

St. Louis Fed President James Bullard indicated he’s comfortable to wait for the impacts of the three rate cuts last year before deciding the next month on interest rates. He told Reuters, “we eased substantially in 2019” and, “we will see how much impact we have in the first half of 2020 and probably all the way through 2020, and then we will see where we are.”

He also noted that 2019 was “a year where we really came to grips with the idea that we were not going to go to 1990s or 2000 level interest rates in the United States.” “Not only did we quit trying…but we turned around and went the other way.”

For 2020, Bullard believes there could be positive surprise. If trade uncertainty lifts, US “might grow faster than 2019, and it is that kind of dynamic that would lead us back to a better expected inflation environment”.

UK retail sales dropped -0.8%, ex-fuel sales dropped -0.6%

UK retail sales contracted sharply in December. Headline sales dropped -0.8% mom versus expectation of 0.8% rise. Ex-fuel sales dropped -0.6% mom versus expectation of 0.5% rise. “Anecdotal evidence from a number of stores stated that goods did not sell as well as expected,” the ONS said.

In the three months to December, both the amount spent and quantity bought decline, by -0.9% and -1.0% respectively. More importantly, from three-month to three-month respectively, sales hasn’t grown since October.

Eurozone CPI finalized at 1.3% in Dec, services inflation led

Eurozone CPI was finalized at 1.3% yoy in December, up from November’s 1.0% yoy. the highest contribution to the annual euro area inflation rate came from services (+0.80%), followed by food, alcohol & tobacco (+0.38%), non-energy industrial goods (+0.12%) and energy (+0.02%).

EU inflation was at 1.6%, up from 1.3% yoy a month ago. The lowest annual rates were registered in Portugal (0.4%), Italy (0.5%) and Cyprus (0.7%). The highest annual rates were recorded in Hungary (4.1%), Romania (4.0%), Czechia and Slovakia (both 3.2%). Compared with November, annual inflation fell in two Member States, remained stable in three and rose in twenty-three.

China GDP grew 6.0% in Q4, 6.1% in 2019 overall

China’s GDP grew 6.0% yoy in Q4, matched market expectations. Overall growth in 2019 was at 6.1%, slowed from 2018’s 6.6%. That’s the slowest annual growth since 1990. In December, industrial production grew 6.9% yoy, above expectation of 6.2% yoy, strongest pace in nine months. Retail sales rose 8.0% yoy, above expectation of 7.9% yoy. Fixed asset investment rose 5.4% ytd yoy, above expectation of 5.2%.

The set of data suggests stabilization in the Chinese economy. Yet, there is question regarding the sustainability, not to mention the chance of a rebound. US-China trade deal phase one should provide some short-term support. But uncertainties lie in the medium to long term we core issues to be resolved with the US in phase two negotiations. At the same time, large chunk of the tariffs remains in place.

New Zealand BusinessNZ manufacturing index dropped to 49.3

New Zealand BusinessNZ Manufacturing Index dropped to 49.3 in December, down from 51.2. That’s the second consecutive decrease and the lowest reading since September. NZ Senior Economist, Craig Ebert said that “the December result was disappointing. After a couple of months flirting with positivity, the PMI dipped back just below the breakeven line again”.

Looking at some details, production dropped from 49.4 to 48.2. Employment rose from 49.1 to 49.9 but stayed below 50. New orders dropped from 54.0 to 51.0. Finished stocks jumped from 49.2 to 52.0. Delivers dropped from 52.6 to 50.7.

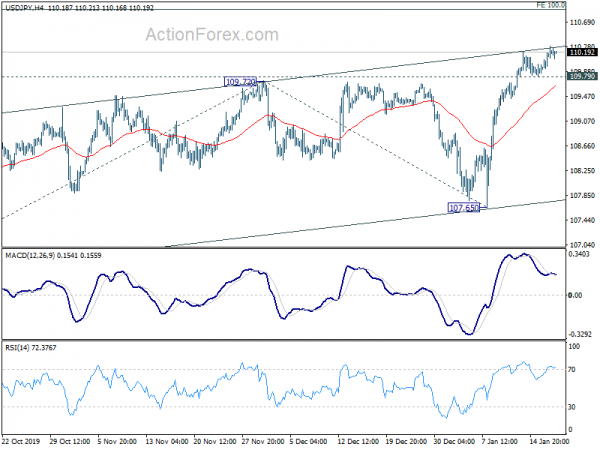

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 109.96; (P) 110.07; (R1) 110.28; More..

Intraday bias in USD/JPY remains on the upside with 109.79 minor support intact. Current rise from 104.45 is in progress and should target 100% projection of 106.48 to 109.72 from 107.65 at 110.89 next. Nevertheless, break of 109.79 support will confirm short term topping and bring deeper pull back.

In the bigger picture, USD/JPY is staying in long term falling channel that started at 118.65 (Dec. 2016). There is no clear indication of trend reversal yet. Hence, rise from 104.45 is seen as a correction and down trend could still extend through 104.45 low. However, sustained break of the channel resistance will be an important sign of bullish reversal and target 114.54 resistance for confirmation.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | Business NZ Manufacturing Index Dec | 49.3 | 51.4 | 51.2 | |

| 02:00 | CNY | GDP Y/Y Q4 | 6.00% | 6.00% | 6.00% | |

| 02:00 | CNY | Retail Sales Y/Y Dec | 8.00% | 7.90% | 8.00% | |

| 02:00 | CNY | Industrial Production Y/Y Dec | 6.90% | 6.20% | 6.20% | |

| 02:00 | CNY | Fixed Asset Investment YTD Y/Y Dec | 5.40% | 5.20% | 5.20% | |

| 03:00 | AUD | HIA New Home Sales M/M Nov | -0.50% | -0.50% | ||

| 04:30 | JPY | Tertiary Industry Index M/M Nov | 1.30% | 1.00% | -4.60% | |

| 07:30 | CHF | Producer and Import Prices M/M Dec | 0.10% | 0.00% | -0.40% | |

| 07:30 | CHF | Producer and Import Prices Y/Y Dec | -1.70% | -2.50% | -2.50% | |

| 09:00 | EUR | Eurozone Current Account (EUR) Nov | 33.9B | 34.3B | 32.4B | |

| 09:30 | GBP | Retail Sales M/M Dec | -0.80% | 0.80% | -0.60% | -0.80% |

| 09:30 | GBP | Retail Sales Y/Y Dec | 0.90% | 2.60% | 1.00% | 0.80% |

| 09:30 | GBP | Retail Sales ex-Fuel M/M Dec | -0.60% | 0.50% | -0.60% | -0.80% |

| 09:30 | GBP | Retail Sales ex-Fuel Y/Y Dec | 0.70% | 2.90% | 0.80% | 0.60% |

| 10:00 | EUR | Eurozone CPI Y/Y Dec F | 1.30% | 1.30% | 1.30% | |

| 10:00 | EUR | Eurozone CPI Core Y/Y Dec | 1.30% | 1.30% | 1.30% | |

| 13:30 | USD | Building Permits Dec | 1.42M | 1.47M | 1.48M | 1.47M |

| 13:30 | USD | Housing Starts Dec | 1.61M | 1.38M | 1.37M | 1.38M |

| 13:30 | CAD | Foreign Securities Purchases (CAD) Nov | -1.75B | 12.32B | 11.32B | 11.31B |

| 14:15 | USD | Industrial Production M/M Dec | -0.30% | 0.00% | 1.10% | 0.80% |

| 14:15 | USD | Capacity Utilization Dec | 77% | 77.20% | 77.30% | 77.40% |

| 15:00 | USD | Michigan Consumer Sentiment Index Jan P | 99.4 | 99.3 |