The US-China trade deal phase one was finally signed but market reactions were muted. US stock indices hit record highs but gains were limited. On the other hand, there were notable fund flows into bonds and Swiss Franc over political uncertainties in Russia. In the currency markets, over the week, Swiss Franc is the strongest one, followed by Euro. Yen is the weakest, followed by Sterling. Dollar is mixed and will look into retail sales data today for the next move.

Technically, gold recovered after hitting 1535.91 but strength was very limited. With 1563.11 resistance intact, corrective fall from 1611.37 is expected to extend lower sooner or later. USD/JPY is engaging in sideway trading in tight range. We’d expect another rise through 110.21 temporary top to resume whole rally from 104.45. It would be an early sign of more Dollar rally if these two levels are broken.

In Asia, currently, Nikkei is up 0.08%. Hong Kong HSI is up 0.07%. China Shanghai SSE is down -0.31%. Singapore Strait Times is up 0.46%. Japan 10-year JGB yield is up 0.0047 at 0.012. Overnight, DOW rose 0.31%. S&P 500 rose 0.19%. NASDAQ rose 0.08%. 10-year year dropped -0.030 to 1.788.

US-China trade deal phase one signed to right the wrongs

US President Donald Trump finally signed the trade deal phase one with Chinese Vice Premier Liu He yesterday. Trump hailed that both countries are “righting the wrongs of the past and delivering a future of economic justice and security for American workers, farmers and families.” And the deal has “total and full enforceability.” On further tariff relieves, he added, “I will agree to take those tariffs off if we’re able to do phase two, otherwise we don’t have any cards to negotiate with.” Chinese President Xi Jinping said in a letter that the deal is “good for China, for the U.S. and for the whole world”. And, “in the next step, the two sides need to implement the agreement in earnest.”

Some core elements of the deal including an action plan for China to strengthen intellectual property protection within 30 days. The proposal would include “measures that China will take to implement its obligations” and “the date by which each measure will go into effect.” American companies will be ensured to work “without any force or pressure from the other Party to transfer their technology to persons of the other Party.” China will also increase purchases of US products by at least USD 200B over two years.

Questions remain on implementation of the deal even though Trade Representative Robert Lighthizer insisted there is a strong enforcement mechanism “with real teeth”. Some criticized that the enforcement mechanism is too simplistic, as it’s ultimately just a decision of one party pulling out.

Full US-China trade agreement phase one.

Suggested reading: US-China Phase I Trade Deal Signed, Execution & Phase II Negotiations the Next Focus

Chinese VP Liu: Correct choice for US to remove China as currency manipulator

Chinese Vice Premier Liu He said after signing the trade deal that “cooperation is the only correct option, especially in this new era… We don’t think tariffs are a good solution. Both sides need to solve problems through negotiation.” “China and the U.S. will make positive impacts on the whole world.”

Liu also noted that the negotiations were “cultural talks, not just economics…or just trade” and “after two years of talks, we realize that this is a systematic process.” “We will use the results of the phase one deal to prove that our negotiations are working to improve the economy.”

On currency manipulation, he said “it is the correct choice for the U.S. to remove China from the currency manipulator list. A week after the U.S. labeled China as a currency manipulator, the IMF issued a report that China did not manipulate the exchange rate. The U.S. realized this fact, and we welcome the U.S. meeting China halfway on this.”

On the data front

Japan PPI rose to 0.9% yoy in December, matched expectations. UK RIC house price balance improved to -2, up from -11. ECB monetary policy meeting accounts will be the major focus in European session. Later in the day, US will release retail sales, jobless claims, import price, Philly Fed survey, business inventories and NAHB housing index.

USD/JPY Daily Outlook

Daily Pivots: (S1) 109.80; (P) 109.90; (R1) 110.02; More..

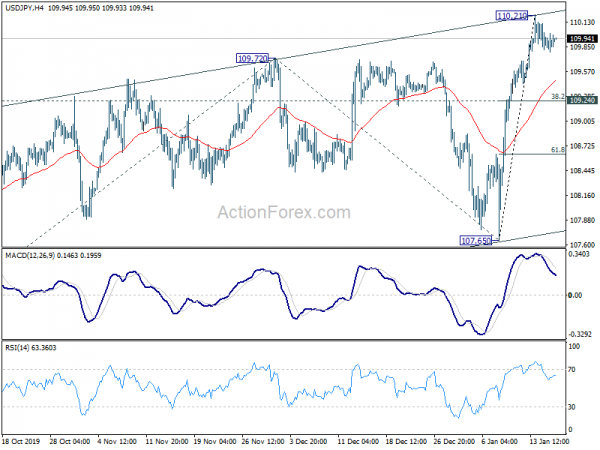

USD/JPY is staying in consolidation from 110.21 temporary top and intraday bias remains neutral first. Downside of retreat should be contained by 109.24 minor support to bring rally resumption. On the upside, break of 110.21 will extend whole rise from 104.45 to 100% projection of 106.48 to 109.72 from 107.65 at 110.89 next.

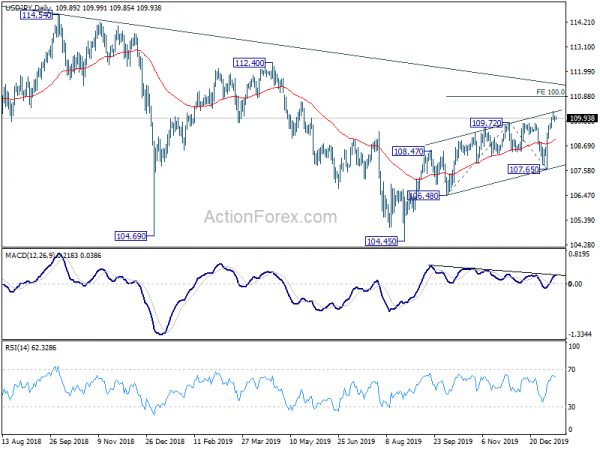

In the bigger picture, USD/JPY is staying in long term falling channel that started at 118.65 (Dec. 2016). There is no clear indication of trend reversal yet. Hence, rise from 104.45 is seen as a correction and down trend could still extend through 104.45 low. However, sustained break of the channel resistance will be an important sign of bullish reversal and target 114.54 resistance for confirmation.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | PPI Y/Y Dec | 0.90% | 0.90% | 0.10% | |

| 0:01 | GBP | RICS Housing Price Balance Dec | -2% | -5% | -12% | -11% |

| 7:00 | EUR | Germany CPI M/M Dec F | 0.50% | 0.50% | ||

| 7:00 | EUR | Germany CPI Y/Y Dec F | 1.50% | 1.50% | ||

| 12:30 | EUR | ECB Monetary Policy Meeting Accounts | ||||

| 13:30 | USD | Retail Sales M/M Dec | 0.30% | 0.20% | ||

| 13:30 | USD | Retail Sales ex Autos M/M Dec | 0.50% | 0.10% | ||

| 13:30 | USD | Initial Jobless Claims (Jan 10) | 220K | 214K | ||

| 13:30 | USD | Import Price Index M/M Dec | 0.30% | 0.20% | ||

| 13:30 | USD | Philadelphia Fed Manufacturing Survey Jan | 3.9 | 0.3 | ||

| 15:00 | USD | Business Inventories Nov | -0.10% | 0.20% | ||

| 15:00 | USD | NAHB Housing Market Index Jan | 76 | 76 | ||

| 15:30 | USD | Natural Gas Storage | -44B | |||

| 16:30 | USD | 4-Week Bill Auction | 1.49% |