The forex markets are rather mixed today as traders are holding their bets ahead of signing of US-China trade deal phase one. Sentiments turned softer after US indicated that tariffs will stay in place before conclusion of phase two. But the impact is so far limited. Sterling pares back some losses as markets now await inflation data from UK. For the week, Yen is currently the weakest one, followed by New Zealand Dollar. Swiss Franc is the strongest, followed by Euro.

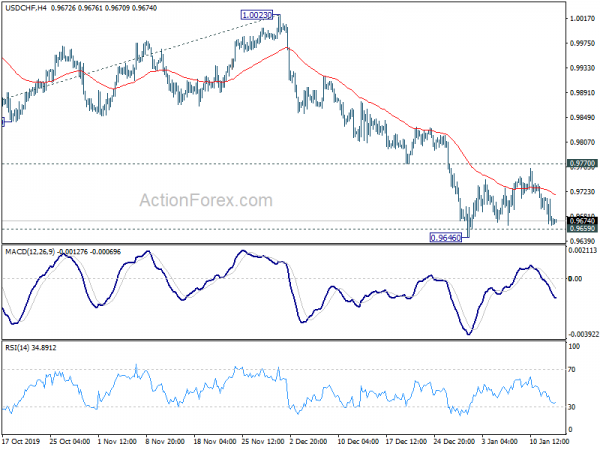

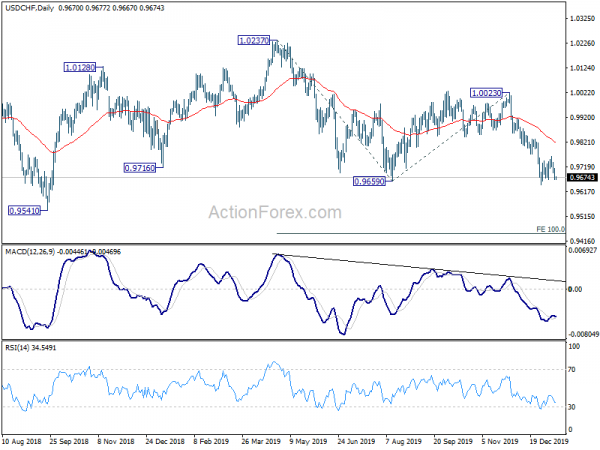

Technically, USD/CHF could be a focus today as it’s heading to 0.9646 support. Break will resume larger down trend from 1.0237 and target 0.9445 projection level. Correspondingly, after yesterday’s downside breakout, EUR/CHF is on track to 1.0648 projection level. GBP/CHF’s fall from 1.3310 resistance is also in favor to 1.2299 fibonacci level. We’ll see if Swiss could extend recent broad based strength.

In Asia, Nikkei closed down -0.45%. Hong Kong HSI is down -0.51%. China Shanghai SSE is down -0.35%. Singapore Strait Times is down -0.42%. Japan 10-year JGB yield is down -0.0051 at 0.011, staying positive. Overnight, DOW rose 0.11%. S&P 500 dropped -0.15%. NASDAQ dropped -0.24%. 10-year yield dropped -0.030 to 1.818.

Mnuchin: No further tariff relief on China until phase 2 trade deal

US Treasury Secretary Steven Mnuchin indicated yesterday that there was “no side agreements”, “no secret agreements”, regarding the trade deal phase one with China. That is, whether the US will further remove tariffs on Chinese goods “has nothing to do with the election or anything else”. Instead, “these tariffs will stay in place until there’s a phase two. If the president gets a phase two quickly, he’ll consider releasing tariffs as part of phase two.”

Mnuchin also reiterated that President Donald Trump has been very clear with his demand on China. “One was he wanted to reduce the trade deficit, and two — he wanted structural changes particularly around technology and other issues.”

The English version of the agreement is expected to be released today. Mnuchin said “people will be able to see there’s a very detailed dispute resolution process,” and “this is an enforceable agreement just as the president dictated it would be.”

US, EU and Japan to push WTO rules on subsidies and forced technology transfers

After a trilateral meeting yesterday, US, EU and Japan agreed to propose new global trade rules to the WTO address issues including subsidies and forced technology transfers. A joint statement was issued by US Trade Representative Robert Lighthizer, EU Trade Commissioner Phil Hogan and Japan Economy Minister Hiroshi Kajiyama. No specific country is mentioned in the statement, but the context is clearly directed to China.

Under the proposal four banned subsidy types would be added to WTO rules, including unlimited guarantees, subsidies to ailing enterprises without a restructuring plan, subsidies to firms unable to obtain long-term financing and certain forgiveness of debt. The three representatives also agreed to urge WTO members to address forced technology transfer issues and their commitment to effective means to stop harmful forced technology transfer policies and practices, including through export controls, investment review for national security purposes, their respective enforcement tools, and the development of new rules.

BoJ Kuroda pledges again to take additional easing if risks heighten

BoJ Governor Haruhiko Kuroda remained optimistic that inflation, at around 0.5% currently, would accelerate toward the 2% target. Though, he reiterated again that “we will adjust policy as necessary to maintain momentum toward our price stability target while examining risks.” And, “we will not hesitate to take additional easing steps if risks heighten to an extent that the momentum toward the price target is undermined.”

On the data front

Japan M2 rose 2.7% yoy in December, matched expectations. Machine tool orders dropped -33.6% yoy. UK inflation data will be the major focuses in European session, with CPI, RPI and PPI featured. Eurozone will release trade balance and industrial production. Later in the day, US will release Empire State manufacturing index, PPI. Fed will release Beige Book economic report.

USD/CHF Daily Outlook

Daily Pivots: (S1) 0.9656; (P) 0.9685; (R1) 0.9703; More…

USD/CHF is still staying in consolidation above 0.9646 and intraday bias remains neutral. With 0.9770 resistance intact, outlook remains bearish and further decline is expected. On the downside, break of 0.9646 will extend whole fall from 1.0237 and target 100% projection of 1.0237 to 0.9659 from 1.0023 at 0.9445. Nevertheless, on the upside, break of 0.9770 will indicate short term bottoming and turn bias to the upside for 55 day EMA (now at 0.9815) instead.

In the bigger picture, medium term outlook remains neutral as USD/CHF is staying sideway trading started from 1.0342 (2016 high). Fall from 1.0237 is a leg inside the pattern and could target 0.9186 (2018 low). In case of another rise, break of 1.0237 is needed to indicate up trend resumption. Otherwise, more sideway trading would be seen with risk of another fall.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Money Supply M2+CD Y/Y Dec | 2.70% | 2.70% | 2.80% | 2.70% |

| 6:00 | JPY | Machine Tool Orders Y/Y Dec P | -33.60% | -37.90% | ||

| 9:30 | GBP | DCLG House Price Index Y/Y Nov | 1.20% | 0.70% | ||

| 9:30 | GBP | CPI M/M Dec | 0.20% | 0.20% | ||

| 9:30 | GBP | CPI Y/Y Dec | 1.50% | 1.50% | ||

| 9:30 | GBP | Core CPI Y/Y Dec | 1.70% | 1.70% | ||

| 9:30 | GBP | RPI M/M Dec | 0.30% | 0.20% | ||

| 9:30 | GBP | RPI Y/Y Dec | 2.30% | 2.20% | ||

| 9:30 | GBP | PPI – Input M/M Dec | 0.30% | -0.30% | ||

| 9:30 | GBP | PPI – Input Y/Y Dec | -0.70% | -2.70% | ||

| 9:30 | GBP | PPI – Output M/M Dec | 0.00% | -0.20% | ||

| 9:30 | GBP | PPI – Output Y/Y Dec | 0.90% | 0.50% | ||

| 9:30 | GBP | PPI – Output Core M/M Dec | 0.00% | -0.10% | ||

| 9:30 | GBP | PPI – Output Y/Y Dec | 1.00% | 1.10% | ||

| 10:00 | EUR | Eurozone Trade Balance (EUR) Nov | 22.3B | 24.5B | ||

| 10:00 | EUR | Industrial Production M/M Nov | 0.30% | -0.50% | ||

| 13:30 | USD | Empire State Manufacturing Index Jan | 4.1 | 3.5 | ||

| 13:30 | USD | PPI M/M Dec | 0.20% | 0.00% | ||

| 13:30 | USD | PPI Y/Y Dec | 1.20% | 1.10% | ||

| 13:30 | USD | PPI Core M/M Dec | 0.20% | -0.20% | ||

| 13:30 | USD | PPI Core Y/Y Dec | 1.40% | 1.30% | ||

| 15:30 | USD | Crude Oil Inventories | 1.2M | |||

| 19:00 | USD | Fed’s Beige Book |