Australian Dollar recovers broadly today on stronger than expected job data. Though, upside is limited so far as unemployment rate remains a long way from RBA’s rate of full employment. New Zealand Dollar is also among the strongest following better than expected GDP growth. Sterling is mixed as focus now turns to BoE rate decision and UK retail sales. For the week though, Canadian Dollar remains the strongest, with help from WTI oil price which breached 61 handle. Sterling remains the weakest one.

Technically, AUD/USD recovered well ahead of 0.6800 support and maintains near term bullishness. Focus is back to 0.6938 resistance and bring will resume recent rebound from 0.6670. EUR/AUD’s steep decline suggests rejection by 0.6323 resistance. Focus is back on 1.6063 support. Sterling pairs will be the major focuses today. In particular, 1.3050 support in GBP/USD, 142.47 support in GBP/JPY and 0.8508 resistance in EUR/GBP. We’d still expect further rise in the Pound as long as these levels hold. But break will bring deeper pull back in Sterling in general.

In Asia, Nikkei closed down -0.29%. Hong Kong HSI is down -0.40%. China Shanghai SSE is up 0.06%. Singapore Strait Times is down -0.17%. Overnight, DOW dropped -0.10%. S&P 500 dropped -0.04%. NASDAQ rose 0.05%. 10-year yield rose 0.035 to 1.924.

BoJ stands pat, expect economy to continue moderate expanding trend

BoJ left monetary policy unchanged as widely expected. Short-term policy rate was held at -0.1%. Purchase of JGB will continue to keep 10-year yield at around 0%, with monetary base expanding at JPY 80T per annum. Y. Harada and G. Kataoka dissented as usual in 7-2 vote.

The central bank said the economy is “likely to continue on a moderate expanding trend”. Impact of global slowdown is expected “to be limited”. Domestic demand is expected to “follow an uptrend” despite the impact of consumption tax hike. Exports are projected to “continue showing some weakness”, but are expected to be on “moderate increasing trend”. CPI is “likely to increase gradually toward 2 percent”.

Australia added 39.9k jobs, driven by part-time jobs

Australia employment grew 39.9k in November, well above expectation of 14k. Full-time jobs rose 4.2k while part-time jobs grew 35.7k. Unemployment rate dropped -0.1% to 5.2%, below expectation of 5.3%. Participation rate was unchanged at 66.0%.

Looking at some details, the largest increases in employment were recorded in Queensland (up 17.3k) and Victoria (up 13.7k). The only decrease was in New South Wales (down -2.8k). Unemployment rate increased by 0.1% in South Australia (6.3%), and by less than 0.1% in Western Australia (5.8%). Unemployment rate decreased by -0.2 pts in New South Wales (4.7%) and Victoria (4.6%), and by -0.1% in Queensland (6.3%)

Overall, unemployment rate remains well above RBA’s estimated full employment of 4.5%. More policy easing is still needed.

New Zealand GDP grew 0.7%, led by strong retail growth

New Zealand GDP grew 0.7% qoq in Q3, above expectation of 0.5% qoq. Q2’s growth rate was revised sharply lower from 0.5% qoq to 0.1% qoq. Looking at some details, primary industries grew 1.1%. Good-producing industries grew 0.5%. Services industries grew 0.4%.

Services growth, which account for 2/3 of the GDP, was led by retail. The 2.4% growth in retail and accommodation was also the fastest in eight years, dominated by electronics.

Also released, exports rose NZD 371m, or 7.6% yoy, to NZD 5.2B. Imports rose NZD 119m, or 2.0% yoy, to NZD 6.0B. Trade deficit came in at NZD 753m, slightly larger than expectation of NZD 700m.

Fed Evans: It’s important that we overshoot inflation

Chicago Fed President Charles Evans said yesterday that the US economy is doing “remarkably well”. And he expected “the economy to continue to growth, labor markets to continue to be strong.” He echoed comments of many other Fed officials and said monetary policy is in “a good place”. He emphasized that ” inflation would have to go above 2% by some meaningful amount for me to really think that we need something more restrictive.” And it’s “extremely important that we get inflation up to 2% …I actually think it’s important that we overshoot.”

New York Fed President John Williams said “I feel very good about how the economy’s been this year, how it’s progressed and feel very good about how it’s going to look next year.” He expected the economy to growth by about 2% in 2020, with unemployment staying close to current 3.5%. Also, he expected inflation to approach Fed’s 2% target.

Richmond Fed President Thomas Barkin “the major reason the consumer is strong is they have jobs and not only do they have jobs but real wages are up”. He said that Fed’s rate cuts this year “have helped some, but they’ve helped in the context of what’s been a very strong consumer all year long.”

Looking ahead

BoE rate decision will be a major focus today. Interest rate is expected to be held at 0.75%, asset purchase target at GBP 435B. The question is whether the two policymakers who voted for a cut last time would continue to do so. UK will also release retail sales. Swiss will release trade balance.

Later today, Canada will release ADP employment and wholesale sales. US will release jobless claims, Philly Fed survey, current account and existing home sales.

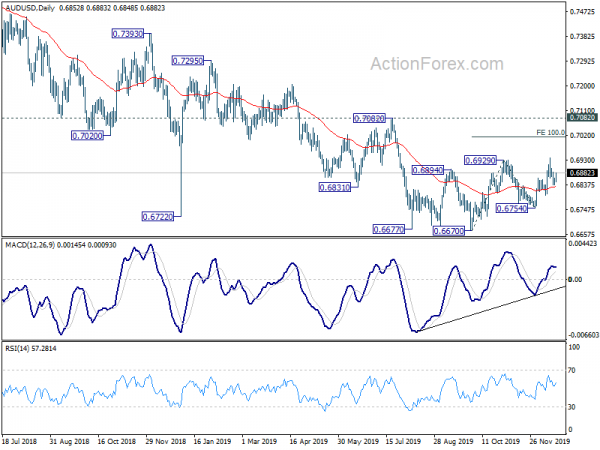

AUD/USD Daily Report

Daily Pivots: (S1) 0.6840; (P) 0.6852; (R1) 0.6866; More…

AUD/USD recovered after hitting 0.6838 but stays well below 0.6938 resistance. Intraday bias remains neutral first. For now, further rally will remain in favor as long as 0.6838 holds. On the upside, above 0.6938 will extend the rebound from 0.6670 to 100% projection of 0.6670 to 0.6929 from 0.6754 at 0.7013 next. However, break of 0.6838 will turn bias back to the downside for 0.6754 support instead.

In the bigger picture, with 0.7082 resistance intact, there is no clear confirmation of trend reversal yet. That is, down trend from 0.8135 (2018 high) is still expect to continue to 0.6008 (2008 low). However, decisive break of 0.7082 will confirm medium term bottoming and bring stronger rally back to 55 month EMA (now at 0.7502).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| JPY | BoJ Interest Rate Decision | -0.10% | -0.10% | -0.10% | ||

| 21:45 | NZD | Trade Balance (NZD) Nov | -753M | -700M | -1013M | -1039M |

| 21:45 | NZD | GDP Q/Q Q3 | 0.70% | 0.50% | 0.50% | 0.10% |

| 0:30 | AUD | Employment Change Nov | 39.9K | 14K | -19K | -24.8K |

| 0:30 | AUD | Unemployment Rate s.a. Nov | 5.20% | 5.30% | 5.30% | |

| 7:00 | CHF | Trade Balance (CHF) Nov | 3.55B | 3.50B | ||

| 9:30 | GBP | Retail Sales M/M Nov | 0.50% | -0.10% | ||

| 9:30 | GBP | Retail Sales Y/Y Nov | 2.40% | 3.10% | ||

| 9:30 | GBP | Retail Sales ex-Fuel Y/Y Nov | 1.60% | 2.70% | ||

| 9:30 | GBP | Retail Sales ex-Fuel M/M Nov | 0.30% | -0.30% | ||

| 12:00 | GBP | BoE Interest Rate Decision | 0.75% | 0.75% | ||

| 12:00 | GBP | BoE Asset Purchase Facility | 435B | 435B | ||

| 12:00 | GBP | MPC Official Bank Rate Votes | 0–2–7 | 0–2–7 | ||

| 12:00 | GBP | MPC Asset Purchase Facility Votes | 0–0–9 | 0–0–9 | ||

| 13:30 | CAD | ADP Employment Change Nov | 66.6K | -22.6K | ||

| 13:30 | CAD | Wholesale Sales M/M Oct | 1.10% | 1.00% | ||

| 13:30 | USD | Initial Jobless Claims (Dec 13) | 225K | 252K | ||

| 13:30 | USD | Current Account (USD) Q3 | -122B | -128B | ||

| 13:30 | USD | Philadelphia Fed Manufacturing Survey Dec | 8.5 | 10.4 | ||

| 15:00 | USD | Existing Home Sales Nov | 5.45M | 5.46M | ||

| 15:30 | USD | Natural Gas Storage | -73B |