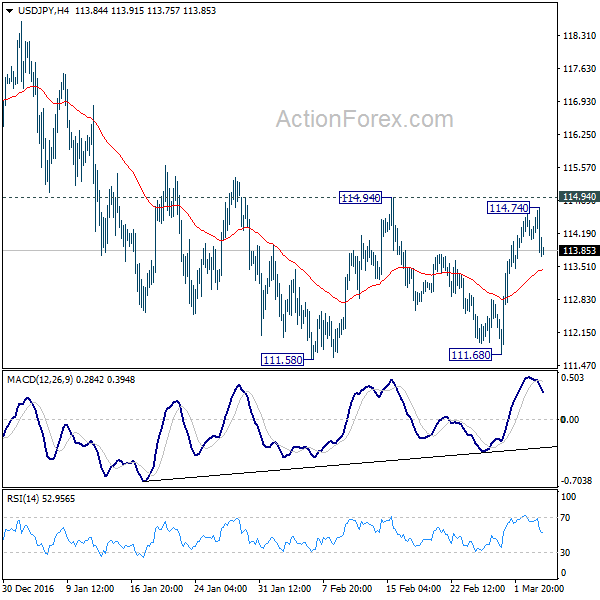

The Japanese Yen jumps broadly in Asian session today on risk aversion as North Korea fired four ballistic missiles into nearby waters. Some analysts pointed out that the missile tests reminded the markets of the unpredictability of Kim Jong Un leadership. Japan prime minister Shinzo Abe warned that the missile launches "clearly show that this is a new level of threat" from North Korea". Nikkei responded by trading down around -0.5% at the time of writing and stays in red for the whole session. Yen surges against all most currencies today. In particular, USD/JPY’s rejection from 114.94 near term resistance since last Friday maintains it’s neutral outlook for the moment. Released in Asia, Australia TD securities inflation dropped -0.3% mom in February. Australia retail sales rose 0.4% mom in January, in line with consensus.

China to target 6.5% growth this year

In China, Chinese Premier Li Keqiang suggested at the National People’s Congress that the government’s GDP growth target for this year is "around 6.5%, or higher if possible", down from 2016’s 6.5-7.0%. Inflation target stays at around 3% and a fiscal deficit at around 3% of GDP. The growth target of money supply M2 has been lowered, by -1 percentage point, to 12%. As suggested in the Work Report, the RMB exchange rate will "be further liberalized, and the currency’s stable position in the global monetary system will be maintained". A number of Chinese macroeconomic data would be released including trade balance and inflation.

NFP to highlight the week, with RBA and ECB featured

The economic calendar is rather light today with only Eurozone retail sales PMI, Sentix investor confidence and US factory orders featured. RBA and ECB will meet this week. And both central banks are expected to stand pat. Main focus will be on US non-farm payroll report this week. Fed chair Janet Yellen’s speech last Friday proved hawkish, indicating that the FOMC would "evaluate whether employment and inflation are continuing to evolve in line with our expectations, in which case a further adjustment of the federal funds rate would likely be appropriate". CME’s 30-day Fed funds futures priced in almost 80% chance of a rate hike next week. We do not expect the February employment (due Friday) and inflation (due next week) would derail the scenario. But a strong set of NFP report will solidify the case for a March hike and push Dollar further higher.

- Tuesday: RBA rate decision; German factory orders; Eurozone GDP; Swiss foreign currency reserves; US trade balance, Canada trade balance, Ivey PMI

- Wednesday: China trade balance; German industrial production; Swiss CPI; UK budget release; Canada housing starts, labor productivity, building permits; US non-farm productivity

- Thursday: China CPI and PPI; Swiss unemployment rate; ECB rate decision; Canada new housing price index; US import price index, jobless claims

- Friday: Japan BSI large manufacturing; Australia home loan; Germany trade balance; UK productions, trade balance; Canada employment; US non-farm payroll

USD/JPY Daily Outlook

Daily Pivots: (S1) 113.61; (P) 114.18; (R1) 114.56; More…

USD/JPY dips mildly today on broad based rebound in Yen. The rejection from 114.94 resistance argues that the correction from 118.65 is possibly not completed yet. But still, in case of another fall, we’d still expect strong support from 38.2% retracement of 98.97 to 118.65 at 111.13 to contain downside and bring rebound. On the upside, decisive break of 114.94 will indicate that it’s completed with a double bottom pattern (111.58, 111.68). In such case, intraday bias will be turned to the upside for retesting 118.65.

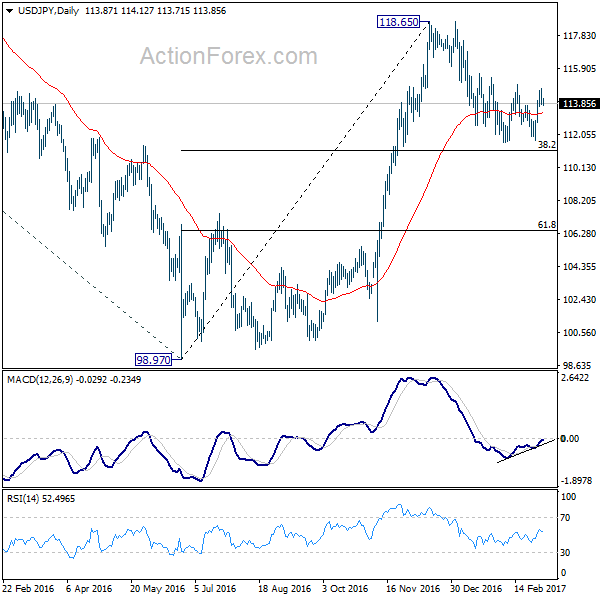

In the bigger picture, price actions from 125.85 high are seen as a corrective pattern. The impulsive structure of the rise from 98.97 suggests that the correction is completed and larger up trend is resuming. Decisive break of 125.85 will confirm and target 61.8% projection of 75.56 to 125.85 from 98.97 at 130.04 and then 135.20 long term resistance. Rejection from 125.85 and below will extend the consolidation with another falling leg before up trend resumption.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:00 | AUD | TD Securities Inflation M/M Feb | -0.30% | 0.60% | ||

| 0:30 | AUD | Retail Sales M/M Jan | 0.40% | 0.40% | -0.10% | |

| 9:10 | EUR | Eurozone Retail PMI Feb | 50.1 | |||

| 9:30 | EUR | Eurozone Sentix Investor Confidence Mar | 18.5 | 17.4 | ||

| 15:00 | USD | Factory Orders Jan | 1.00% | 1.30% |