Trading in the forex markets continue to be relative quiet today. Sterling is mildly softer as consolidations continues. It’s weighed down slightly by Boris Johnson’s move to block transition period extension. Australian Dollar is the second weakest after RBA minutes affirm the chance of more easing. On the other hand, Euro is currently the stronger one, helped by the recovery in EUR/GBP. New Zealand Dollar is second strongest, following improvement in business confidence.

Technically, outlooks are generally unchanged though. GBP/USD, GBP/JPY and EUR/GBP are extending this week’s near term consolidation. We’d expect 1.3050 support in GBP/USD, 142.47 support in GBP/JPY and 0.8508 resistance in EUR/GBP to hold, followed by more rally in the Pound later. USD/CHF and USD/JPY are two pairs to watch today, which could hint on the next direction of Dollar. Break of 0.9805 in USD/CHF will extend the fall from 1.0023 towards 0.9659 low. On the other hand, break of 109.72 resistance in USD/JPY will resume the rally from 104.45.

In Asia, Nikkei closed up 0.47%. Hong Kong HSI is up 1.10%. China Shanghai SSE is up 1.33%. Singapore Strait Times is down -0.07%. Overnight, DOW rose 0.36%, S&P 500 rose 0.71%. NASDAQ rose 0.91%. All three indices hit new record highs. 10-year yield rose 0.073 to 1.892.

UK Johnson said to amend Brexit bill to prevent extending transition period

Sterling dips mildly as new development puts the prospect of no-deal Brexit back on table. The newly elected House of Commons will likely have its first vote on the Brexit Withdrawal Agreement on Friday, which will likely be passed with the Conservative’s majority. UK is set to leave the EU on January 31.

However, it’s reported that Boris Johnson will attempt to include text in the legislation that prevents the government from extending the transition period, beyond end of 2020. The move is believed to be based on the Conservative’s manifesto of not extending the implementation first. However, that would also give UK and EU only eleven months to complete the negotiation of a trade agreement, something which usually takes years.

Separately, BoE Governor Mark Carney said that “the worst-case scenario is effectively a no-deal, disorderly Brexit. The probability of that scenario has gone down because of the election result and the intention of the new government”. Nevertheless, “the scenario itself and the risks that we protect the system against has not itself changed, it’s just become less likely.”

RBA minutes suggest more easing on weak wages growth

Minutes of December RBA meeting suggest that the central bank is still on track to further easing next year, probably in February. Employment and wages growth would remain the main reason for doing so. It’s noted that “current rate of wages growth was not consistent with inflation being sustainably within the target range”. Also, “nor was it consistent with consumption growth returning to trend”. Furthermore, private sector wages growth has indeed “levelled out in recent quarters, following its gentle upward trend of the previous couple of years”.”

RBA members also discussed the effect of lower interest rates on confidence, including business and consumer. However, “while members recognised the negative confidence effects for some parts of the community arising from lower interest rates, they judged that the impact of these effects was unlikely to outweigh the stimulus to the economy from lower interest rates.”

Suggested readings on RBA minutes:

- RBA Hinted Further Easing in 1Q20

- RBA Minutes Highlight Importance of February Meeting

- RBA Headed For A Cut In Feb 2020?

New Zealand ANZ business confidence rose to -13.2, commodity prices and low interest rates working their magic

New Zealand ANZ Business Confidence improved to -13.2 in December, up from -26.4. It’s the best reading since October 2017. Nevertheless, confidence remained negative across all sectors, worst in agriculture (-35.1) and beat in retail (-6.5). Activity outlook also improved to 17.2, up from 12.9, best in manufacturing (23.7), worst in construction (9.5). Outlook reading was the best since April 2018.

ANZ said: “New Zealand businesses are rolling into the end of the year in much better heart than was looking likely just a few months ago, particularly manufacturers. Challenges remain, and time will tell how sustainable the lift in sentiment and activity proves to be, with headwinds for the economy still present and global risks not having gone away, for all that some geopolitical risks are now less prominent. But for now, surprisingly strong commodity prices and low interest rates are working their magic, and 2019 is ending on a much better note than it began.”

Looking ahead

UK employment data will be the main feature in European session. Eurozone will release trade balance. Later in the day, US will release new residential construction and industrial production. Canada will release manufacturing shipments.

AUD/USD Daily Report

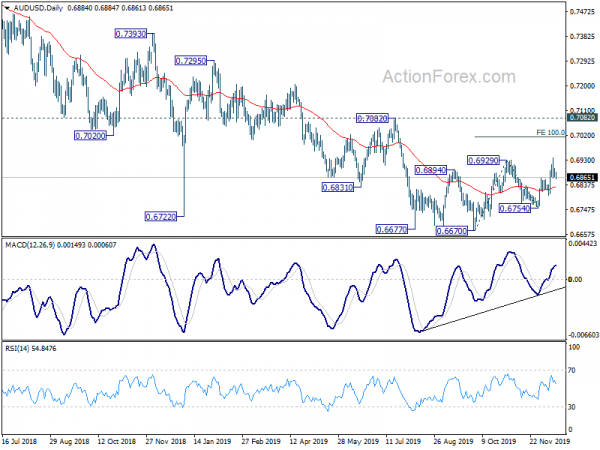

Daily Pivots: (S1) 0.6869; (P) 0.6884; (R1) 0.6898; More…

AUD/USD’s correction from 0.6938 is still in progress and intraday bias stay neutral. While deeper retreat could be seen, further rise remains mildly in favor as long as 0.6800 support holds. On the upside, above 0.6938 will extend the rebound from 0.6670 to 100% projection of 0.6670 to 0.6929 from 0.6754 at 0.7013 next. However, break of 0.6800 will turn bias back to the downside for 0.6754 support instead.

In the bigger picture, with 0.7082 resistance intact, there is no clear confirmation of trend reversal yet. That is, down trend from 0.8135 (2018 high) is still expect to continue to 0.6008 (2008 low). However, decisive break of 0.7082 will confirm medium term bottoming and bring stronger rally back to 55 month EMA (now at 0.7502).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 20:00 | NZD | Westpac Consumer Survey Q4 | 109.9 | 103.1 | ||

| 0:00 | NZD | ANZ Business Confidence Dec | -13.2 | -26.4 | ||

| 0:30 | AUD | Home Loans Oct | 0.60% | 1.40% | -3.00% | |

| 0:30 | AUD | RBA Meeting Minutes | ||||

| 9:30 | GBP | Claimant Count Change Nov | 20.2K | 33.0K | ||

| 9:30 | GBP | Claimant Count Rate Nov | 3.40% | |||

| 9:30 | GBP | ILO Unemployment Rate (3M) Oct | 3.90% | 3.80% | ||

| 9:30 | GBP | Average Earnings Including Bonus 3M/Y Oct | 3.40% | 3.60% | ||

| 9:30 | GBP | Average Earnings Excluding Bonus 3M/Y Oct | 3.40% | 3.60% | ||

| 10:00 | EUR | Eurozone Trade Balance (EUR) Oct | 18.7B | 18.3B | ||

| 11:00 | GBP | CBI Industrial Order Expectations Dec | -25 | -26 | ||

| 13:30 | USD | Housing Starts Nov | 1.340M | 1.314M | ||

| 13:30 | USD | Building Permits Nov | 1.410M | 1.461M | ||

| 13:30 | CAD | Manufacturing Shipments M/M Oct | 0.00% | -0.20% | ||

| 14:15 | USD | Industrial Production M/M Nov | 0.80% | -0.80% | ||

| 14:15 | USD | Capacity Utilization Nov | 77.20% | 76.70% |