Both Euro and Swiss Franc are generally firm today after ECB and SNB rate decisions, as not much reactions are being triggered. Though, as for today, Australian Dollar is the strongest one so far. Sterling, on the other hand, pares back some of recent gains as traders lighten up position, awaiting UK election results. Dollar is a touch weaker after poor job data but loss is limited. US President Donald Trump is set to have a high-stake meeting with trade advisers to decide whether to go ahead with December 15 tranche of tariffs on China. The decision would likely sharp Dollar’s next move.

Technically, EUR/USD and AUD/USD are on track to test recent resistance at 1.1179 and 0.6929 respectively. 1.3158 support in USD/CAD would be a level to watch to gauge further weakness in the greenback. As for Sterling, 1.3012 resistance turned support in GBP/USD, 141.50 resistance turned support in GBP/JPY, and 55 day EMA (0.8621) in EUR/GBP are the levels to watch. As long as these level holds, more upside would remain in favor in the Pound even in case of volatility.

In Europe, currently, FTSE is up 0.38%. DAX is down -0.13%. CAC is down -0.14%. German 10-year yield is up 0.014 at -0.306. Earlier in Asia, Nikkei rose 0.14%. Hong Kong HSI rose 1.31%. China Shanghai SSE dropped -0.30%. Singapore Strait Times rose 0.69%. Japan 10-year JGB yield dropped -0.014 to -0.017.

US initial jobless claims surged to 253, highest since Sep 2017

US initial jobless claims surged 49k to 253k in the week ending December 7, well above expectation of 211k. That’s also the highest level since September 30, 2017. Four-week moving average of initial claims rose 6.25k to 224k.

Continuing claims dropped -31k to 1.667m in the week ending November 30. Four-week moving average of continuing claims dropped -6.25k to 1.676m.

PPI came in at 0.0% mom, 1.1% yoy in November, below expectation of 0.2% mom, 1.2% yoy. Core PPI was at -0.2% mom, 1.3% yoy, below expectation of 0.2% mom, 1.6% yoy.

ECB stands pat, Lagarde noted signs on stabilization and mild increase in underlying inflation

ECB keeps main refinancing rate unchanged at 0.00% as widely expected. Marginal lending facility rate and deposit rate are held at 0.25% and -0.50% respectively too. Forward guidance is maintained that “The Governing Council expects the key ECB interest rates to remain at their present or lower levels until it has seen the inflation outlook robustly converge to a level sufficiently close to, but below, 2% within its projection horizon, and such convergence has been consistently reflected in underlying inflation dynamics.”

President Christine Lagarde said in the post-meeting press conference that incoming data pointed to “muted inflation pressures and weak euro area growth dynamics”. However, there were “some initial signs of stabilisation” in slowdown and a “mild increase” in underlying inflation. Job and wages growth continue to “underpin the resilience” of Eurozone economy too.

There were some slight adjustments in the new Eurosystem staff macroeconomic projections. GDP growth are forecast to be at 1.2% in 2019 (revised up from Sep’s 1.1%), 1.1% in 2020 (revised down from 1.2%) and 1.4% in both 2021 (unchanged) and 2022. HICP inflation is projected to be at 1.2% in 2019 (unchanged), 1.1% in 2020 (revised up from 1.0%), 1.4% in 2021 (revised down from 1.5%) and 1.6% in 2022.

Eurozone industrial production dropped -0.5%, led by capital goods

Eurozone industrial production dropped -0.5% mom in October, below expectation of -0.3% mom. Production of capital goods fell by -2.0% mom and energy by -0.7% mom, while production of non-durable consumer goods rose by 0.4% mom, intermediate goods by 0.6% mom, and durable consumer goods by 1.9% mom.

EU 28 industrial production dropped -0.4% mom. Among Member States for which data are available, the largest decreases in industrial production were registered in Denmark and Greece (both -2.6% mom), and in Latvia and Lithuania (both -2.3% mom). The highest increases were observed in Portugal (+3.1% mom), Slovenia (+2.0% mom) and Poland (+1.1% mom).

Ifo: No ground to fear an economy-wide recession in Germany

Ifo institute said Germany’s economy stabilized in Q3 but remains divided, with manufacturing industry “caught in recession”. Though, spread of industrial weakness has been “limited to industry-oriented service providers”. There has been “no indirect transmission to consumer- and construction-related sectors. At present, there is “no grounds” to fear an “economy-wide recession”. Ifo forecasts GDP growth to accelerate form 0.5% in 2019 to 1.1% in 2020, and then 1.5% in 2021.

For Eurozone, economic momentum is “not expected to get any worse at this juncture”, even though it will “take several quarters before” a “tangible recovery”. GDP is expected to growth 1.2% in 2019, 1.2% in 2020, and then 1.3% in 2021.

Released form Germany, CPI was finalized at -0.8% mom, 1.1% yoy in November.

SNB left policy rate at -0.75%, downgrades inflation forecasts slightly

SNB kept policy rate unchanged at -0.75% as widely expected. It also reiterated the willingness for FX intervention as necessary. Franc is seen as remaining “highly valued”, and the foreign exchange market is “still fragile”. “Negative interest and the willingness to intervene counteract the attractiveness of Swiss franc investments and thus ease the upward pressure on the currency”. In this way, the SNB “stabilises price developments and supports economic activity.”

Conditional inflation forecasts were lowered slightly. 2019 inflation forecast was unchanged at 0.4%. For 2020, inflation forecast was downgraded from 0.2% to 0.1%. For 2021, inflation forecast was also downgraded from 0.6% to 0.5%. GDP is expected to growth by around 1% in 2019. SNB expects growth at 1.5-2.0% in 2020, reflecting “gradual firming” in global activity.

In the press conference, SNB Chairman Thomas Jordan emphasized that negative interest rate “remains necessary” after being introduced five years ago. While the policy “attracts criticism”, policy makers “are convinced that the benefit clearly hold sway”. He also pledged to monitor the impact of negative interest “precisely” and “take the side-effects seriously”.

Suggested reading:

Released from Swiss, PPI dropped -0.4% mom, -2.5% yoy in November.

BoJ Amamiya: Global risks warrant most attention, domestic demand to decelerate temporarily

BoJ Deputy Governor Masayoshi Amamiya said in a speech that “Japan’s economy is likely to continue on an expanding trend, albeit at a moderate pace.” Currently, downside risks, “mainly regarding developments in the global economy” require the “most attention”. “Exports and production are projected to continue showing some weakness for the time being, with a pick-up in the global economy being delayed.”

But the impact of global slowdown on domestic demand “has been limited so far”, with growth in all three sectors of corporate, household and public sectors. While growth in domestic demand would “decelerate temporarily” due to global slowdown and consumption tax hike, it will remain firm in “somewhat longer-term perspective”.

Nevertheless, Amamiya reiterated BoJ’s usual message. “In a situation where downside risks to economic activity and prices, mainly regarding developments in overseas economies, are significant, the Bank will not hesitate to take additional easing measures if there is a greater possibility that the momentum toward achieving the price stability target will be lost.”

From Japan, machinery orders dropped -6.0% mom in October, much worse than expectation of 0.9% mom.

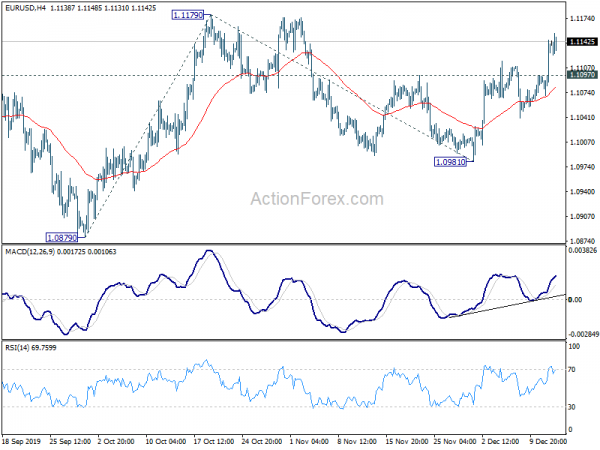

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1084; (P) 1.1115; (R1) 1.1159; More…

Intraday bias in EUR/USD remains on the upside for the moment. Further rise should be seen to retest 1.1179 resistance first. Decisive break there will confirm resumption of whole rally from 1.0879. Next target will be 100% projection of 1.0879 to 1.1179 from 1.0981 at 1.1281. On the downside, below 1.1097 minor support will delay the bullish case and turn bias neutral first.

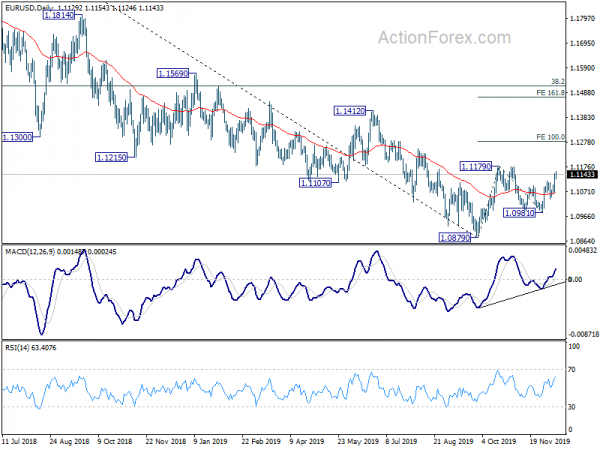

In the bigger picture, rebound from 1.0879 is seen as a corrective move first. In case of another rise, upside should be limited by 38.2% retracement of 1.2555 to 1.0879 at 1.1519. And, down trend from 1.2555 (2018 high) would resume at a later stage. However, sustained break of 1.1519 will dampen this bearish view and bring stronger rise to 61.8% retracement at 1.1915 next.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Food Price Index M/M Nov | -0.70% | -0.30% | ||

| 23:50 | JPY | Machinery Orders M/M Oct | -6.00% | 0.90% | -2.90% | |

| 00:00 | AUD | Consumer Inflation Expectations Dec | 4.00% | 4.00% | ||

| 00:01 | GBP | RICS Housing Price Balance Nov | -12% | -5% | -5% | -6% |

| 00:30 | AUD | RBA Bulletin | ||||

| 06:45 | CHF | SECO Economic Forecasts | ||||

| 07:00 | EUR | Germany CPI M/M Nov F | -0.80% | -0.80% | -0.80% | |

| 07:00 | EUR | Germany CPI Y/Y Nov F | 1.10% | 1.10% | 1.10% | |

| 07:30 | CHF | Producer and Import Prices M/M Nov | -0.40% | 0.20% | -0.20% | |

| 07:30 | CHF | Producer and Import Prices Y/Y Nov | -2.50% | -2.40% | ||

| 08:30 | CHF | SNB Interest Rate Decision | -0.75% | -0.75% | -0.75% | |

| 08:30 | CHF | SNB Press Conference | ||||

| 10:00 | EUR | Eurozone Industrial Production M/M Oct | -0.50% | -0.30% | 0.10% | |

| 12:45 | EUR | ECB Interest Rate Decision | 0.00% | 0.00% | 0.00% | |

| 13:30 | EUR | ECB Press Conference | ||||

| 13:30 | USD | PPI M/M Nov | 0.00% | 0.20% | 0.40% | |

| 13:30 | USD | PPI Y/Y Nov | 1.10% | 1.20% | 1.10% | |

| 13:30 | USD | PPI Core M/M Nov | -0.20% | 0.20% | 0.30% | |

| 13:30 | USD | PPI Core Y/Y Nov | 1.30% | 1.60% | 1.60% | |

| 13:30 | USD | Initial Jobless Claims (Dec 6) | 252K | 211K | 203K | |

| 15:30 | USD | Natural Gas Storage | -76B | -19B |