Dollar was sold off deeply overnight after Fed left interest rate unchanged. Most importantly, Fed chair Jerome Powell indicated that there is no need for any rate hike unless inflation materially surprises on the upside. Considering that Fed projects inflation to be around target through 2022, interest rate might just stay at current level through the projection horizon. The greenback is currently the second worst performing one for the week, just better than Yen. Swiss Franc and Euro are the strongest ahead of ECB and SNB meeting today. Sterling is mixed as UK elections are awaited.

Technically, the overall bearishness in Dollar is back after yesterday’s selloff. EUR/USD’s break of 1.1116 should now pave the way to 1.1179 resistance. Break there will resume whole rebound from October’s low of 1.0879. USD/CHF’s break of 0.9841 support suggests that the Rebound since August low at 0.9659 has completed and deeper fall would be seen back to this support. AUD/USD’s rise from 0.6754 resumed for 0.6929 resistance. Break will resume whole rise from October low of 0.6670. USD/JPY (108.27 support) and USD/CAD (1.3158 support). are two pairs to watch to confirm further Dollar weakness.

In Asia, Nikkei closed up 0.14%. Hong Kong HSI is up 1.40%. China Shanghai SSE is down -0.34%. Singapore Strait Times is up 0.89%. Japan 10-year JGB yield is down -0.0168 at -0.020. Overnight, DOW rose 0.11%. S&P 500 rose 0.29%. NASDAQ rose 0.44%. 10-year yield dropped -0.043 to 1.790, back below 1.8 handle.

Fed projections suggest hikes in 2021 and 2022, but Powell and inflation suggest no

Fed left federal funds rate unchanged at 1.50-1.75% as widely expected. The decision was made by unanimous vote, with no dissent. Fed sounds cautious as “business fixed investment and exports remain weak”, with inflation running below target and market-based measures of inflation compensation remain low. Nevertheless, “current stance of monetary policy is appropriate”.

In the press conference, Powell reinforced his recent messages that both the economy and monetary policy right now are “in a good place”. Outlook remains a “favorable one despite global developments and ongoing risks”. And, “as long as incoming information about the economy remains broadly consistent with this outlook, the current stance of monetary policy likely will remain appropriate.”

More importantly, he added that “we don’t have to worry so much about inflation”. It would take a “persistent” jump in inflation to warrant higher interest rates. At the same time, unemployment can remain at quite low levels for an extended period of time “without unwarranted upward pressure on inflation”.

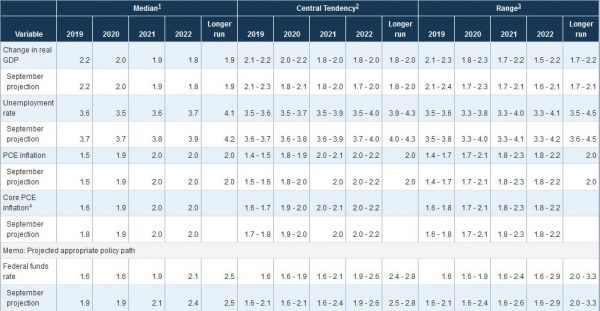

In the new economic projections, GDP forecasts were left unchanged. Unemployment rate projections were lowered to 3.5% in 2020, 3.6% in 2021 and 3.7% in 2022 respectively. Core PCE inflation projections were also left unchanged for 2020 (1.9%), 2021 (2.0) and 2022 (2.0%).

Federal funds rate projections revised lower as expected. Most importantly, median projections show federal funds rate at 1.6% in 2020, that is, no more rate cut next year. Then, interest rate will climb to 1.9% (one hike) in 2021 and 2.1% (another hike) in 2022. However, that contradicts Powell’s comments. That is, core inflation are not projected to overshoot persistently, and there wouldn’t be any need to hike interest rates.

Suggested readings on FOMC:

- Fed Set a Neutral Tone and Signaled that Rate will Stay Unchanged Throughout 2020

- FOMC Review: Fed Signals It Is On Hold Throughout 2020

- Three’s a Charm. Fed Leaves Rates Unchanged after 75 bps in Consecutive Cuts

- Fed Caps off Eventful 2019 with Steady Rate Decision

- FOMC Recap: Statement Little Changed But Q&A Had Some Excitement

- Dollar index breaks key support on Fed Powell and projections

- Fed chair Jerome Powell’s press conference live stream

- Fed stands pat, projections no move in 2020 and a hike in 2021

- (FED) Federal Reserve Issues FOMC Statement

Trump to hold high-stake meeting to decide on China tariffs on Thursday

While there were rumors flying around regarding US delay of the December 15 tranche of tariffs on China, nothing has been confirmed by any named official so far. It’s reported that President Donald Trump is going to hold a high-stake meeting on Thursday with all his trade advisers to make the final decision.

Officials are seen as rather split on the issue. It’s believed that China hawks like Peter Navarro would most likely prefer to hit the button on new tariffs. On the other hand, Treasury Secretary Steven Mnuchin could prefer a hold. Trade Representative Robert Lighthizer’s position is relatively unclear.

The political implication of the situation is rather significant though. It’s rather clear now that Trump’s administration hasn’t seen enough commitments from China to justify at least a delay without debate. The ball is suddenly back on the US’s court. A tariff delay without sufficient concessions from China would in no doubt weaken Trump’s hand for the next phase of trade talks, or even the closure of phase one.

On the other hand, the impact of tariffs imposed so far could be seen by some as relatively muted, or at least not as disastrous as some claimed. Trump’s team could instead go for more tariffs while emphasizing to the public that they won’t be painful. Either way, the decision would be know rather soon.

BoJ Amamiya: Global risks warrant most attention, domestic demand to decelerate temporarily

BoJ Deputy Governor Masayoshi Amamiya said in a speech that “Japan’s economy is likely to continue on an expanding trend, albeit at a moderate pace.” Currently, downside risks, “mainly regarding developments in the global economy” require the “most attention”. “Exports and production are projected to continue showing some weakness for the time being, with a pick-up in the global economy being delayed.”

But the impact of global slowdown on domestic demand “has been limited so far”, with growth in all three sectors of corporate, household and public sectors. While growth in domestic demand would “decelerate temporarily” due to global slowdown and consumption tax hike, it will remain firm in “somewhat longer-term perspective”.

Nevertheless, Amamiya reiterated BoJ’s usual message. “In a situation where downside risks to economic activity and prices, mainly regarding developments in overseas economies, are significant, the Bank will not hesitate to take additional easing measures if there is a greater possibility that the momentum toward achieving the price stability target will be lost.”

ECB and SNB to stand pat today, some previews

ECB and SNB rate decisions are the major focuses for today. SNB is widely expected to keep interest rate unchanged at -0.75%. The central bank would continue to note that Swiss Franc is overvalued. Negative interest rate remains necessary, as well as the readiness to intervene.

Christine Lagarde will hold her first meeting as ECB President. New round of monetary easing was already announced back in September while forward guidance was firmly set too. There is no expectation on any policy change for today, and possible for the near future. Instead, focuses will be on new Eurosystem staff macro economic projections, as well as information regarding the upcoming strategic reviews.

Here are some suggested readings:

- ECB Preview: Time for a Strategic Review – Not Monetary Policy Messages

- SNB Meeting: No Rate Cuts Yet, Just FX Intervention

- Punting Our ECB Rate Cut Call

On the data front

Japan machine orders dropped -6.0% mom in October versus expectation of 0.9% mom rise. Australian consumer inflation expectations was unchanged at 4.0% in December. US RICS house price balance dropped to -12 in November. Germany will release CPI final. Swiss will release PPI. Eurozone will release industrial productions. US will release PPI, jobless claims later today. Canada will release housing price index.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1084; (P) 1.1115; (R1) 1.1159; More…

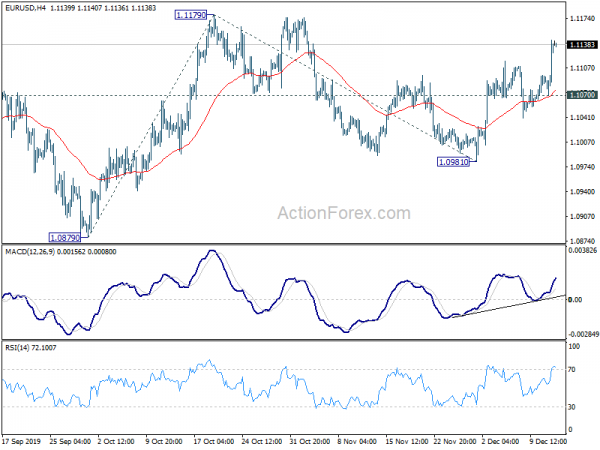

EUR/USD’s rise from 1.0981 resumed by breaking 1.1116 and hits as high as 1.1144 so far. Intraday bias is back on the upside for 1.1179 resistance first. Current development revives the case that correction from 1.1179 has completed and rise from 1.0879 is ready to resume. Break of 1.1179 will confirm and target 100% projection of 1.0879 to 1.1179 from 1.0981 at 1.1281 next. On the downside, below 1.1070 minor support will dampen the bullish view and turn bias neutral first.

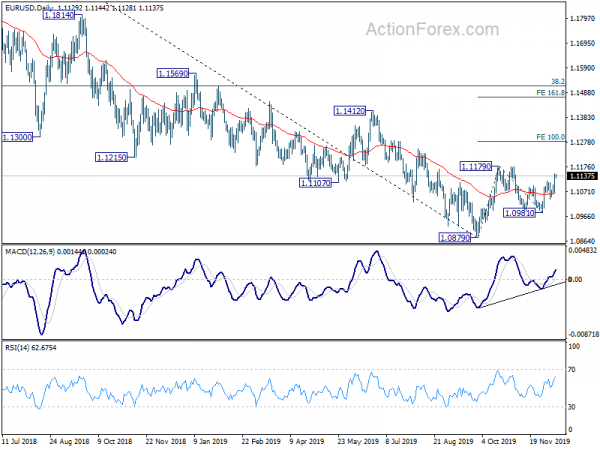

In the bigger picture, rebound from 1.0879 is seen as a corrective move first. In case of another rise, upside should be limited by 38.2% retracement of 1.2555 to 1.0879 at 1.1519. And, down trend from 1.2555 (2018 high) would resume at a later stage. However, sustained break of 1.1519 will dampen this bearish view and bring stronger rise to 61.8% retracement at 1.1915 next.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Food Price Index M/M Nov | -0.70% | -0.30% | ||

| 23:50 | JPY | Machinery Orders M/M Oct | -6.00% | 0.90% | -2.90% | |

| 0:00 | AUD | Consumer Inflation Expectations Dec | 4.00% | 4.00% | ||

| 0:01 | GBP | RICS Housing Price Balance Nov | -12% | -5% | -5% | -6% |

| 0:30 | AUD | RBA Bulletin | ||||

| 6:45 | CHF | SECO Economic Forecasts | ||||

| 7:00 | EUR | Germany CPI M/M Nov F | -0.80% | -0.80% | ||

| 7:00 | EUR | Germany CPI Y/Y Nov F | 1.10% | 1.10% | ||

| 7:30 | CHF | Producer and Import Prices M/M Nov | 0.20% | -0.20% | ||

| 7:30 | CHF | Producer and Import Prices Y/Y Nov | -2.40% | |||

| 8:30 | CHF | SNB Interest Rate Decision | -0.75% | -0.75% | ||

| 8:30 | CHF | SNB Press Conference | ||||

| 10:00 | EUR | Eurozone Industrial Production M/M Oct | -0.30% | 0.10% | ||

| 12:45 | EUR | ECB Interest Rate Decision | 0.00% | 0.00% | ||

| 13:30 | EUR | ECB Press Conference | ||||

| 13:30 | USD | PPI M/M Nov | 0.20% | 0.40% | ||

| 13:30 | USD | PPI Y/Y Nov | 1.20% | 1.10% | ||

| 13:30 | USD | PPI Core M/M Nov | 0.20% | 0.30% | ||

| 13:30 | USD | PPI Core Y/Y Nov | 1.60% | 1.60% | ||

| 13:30 | USD | Initial Jobless Claims (Dec 6) | 211K | 203K | ||

| 13:30 | CAD | New Housing Price Index M/M Oct | 0.20% | 0.20% | ||

| 15:30 | USD | Natural Gas Storage | -19B |