Dollar rebounds broadly in early US session after positive surprise in job data. However, upside is relatively limited at the time of writing, capped by disappointing wage growth. For now the greenback remains the weakest one for the week. Canadian Dollar’s fortune reversed after much worse than expected employment data. It’s not the worst performing one for today, and second worst for the week.

Technically, despite the strong rebound in the greenback, there are a few near term levels to take out. Those include 1.1066 minor support in EUR/USD, 0.6813 minor support in AUD/USD. 0.9926, minor resistance in USD/CHF, 109.20 minor resistance in USD/JPY. At least, these levels should be taken out firmly to indicate bottoming in Dollar in general.

In Europe, currently, FTSE is up 1.03%. DAX is up 0.49%. CAC is up 0.77%. German 10-year yield is up 0.0080 at -0.284. Earlier in Asia, Nikkei rose 0.23%. Hong Kong HSI rose 1.07%. China Shanghai SSE rose 0.43%. Singapore Strait Times rose 0.65%.Japan 10-year JGB yield rose 0.022 to -0.017.

US non-farm payrolls rose 266k, unemployment rate dropped to 3.5%

US Non-Farm Payroll report showed 266k growth in November, well above expectation of 183K. Job growth averaged 180k per months thus far in 2019, versus 223k monthly average in 2018. Manufacturing jobs rose 54k, versus -43k contraction back in November.

Unemployment rate dropped to 3.5%, down from 3.6%, better than expectation of 3.6%. That also matches the lowest since 1969Participation rate was little changed at 63.2%. Average hourly earnings rose 0.2% mom in November, below expectation of 0.3% mom.

Canada employment dropped -71.2k, unemployment rate surged to 5.9%

Canada employment dropped -71.2k in November, well below expectation of 10.0k. Unemployment rate surged to 5.9%, up from 5.5% and was way worst than expectation of 5.5%. Employment declined in Quebec, Alberta and British Columbia, while it was little changed in the other provinces.

In the goods-producing sector, fewer people worked in manufacturing (-28k) and in natural resources (-6.5k), with most of the declines in each of these industries observed in Quebec. The employment decrease in the services-producing sector was mostly accounted for by public administration, where the number of workers fell by -25k.

Germany industrial production dropped -1.7% in October

Released in European session, Germany industrial production dropped -1.7% mom in October, well below expectation of 0.2% mom. France trade deficit narrowed to EUR -4.7B in October, versus expectation of EUR -4.8B. Italy retail sales dropped -0.2% mom in October, below expectation of 0.5% mom. Swiss foreign currency reserves rose to CHF 783B in November, up from CHF 779B.

Japan household spending dropped -5.1%, due to sales tax hike

A batch of economic data is released from Japan today. Overall household spending dropped -5.1% yoy in October, worse than expectation of -3.0% yoy. The decline in spending was the first time in 11 month, and biggest fall since March 2016. It’s also a sharp reversal from the 9.5% rise in September, fastest growth on record.

Apparently, the September and October figures were results of the sales tax hike in October, from 8% to 10%. Additionally, impacts from typhoon also accelerated the decline in spending. Overall spending might contract as a whole Q4, before some moderate pick up in Q1.

Also released, labor cash earnings rose 0.5% yoy in October, above expectation of 0.2% yoy. Leading indicator dropped -0.1 to 91.8, below expectation of 92.0.

Australia AiG construction dropped to 40, 15th straight month of contraction

Australia AiG Performance of Construction Index dropped to 40.0 in November, down from 43.9. The result indicates sharper decline in the construction industry on aggregate. It’s also the 15th straight month of contractionary reading. As AiG said, “this on-going weakness in business conditions was associated with a steeper fall in employment and a continued reduction in deliveries from suppliers.”

USD/CAD Mid-Day Outlook

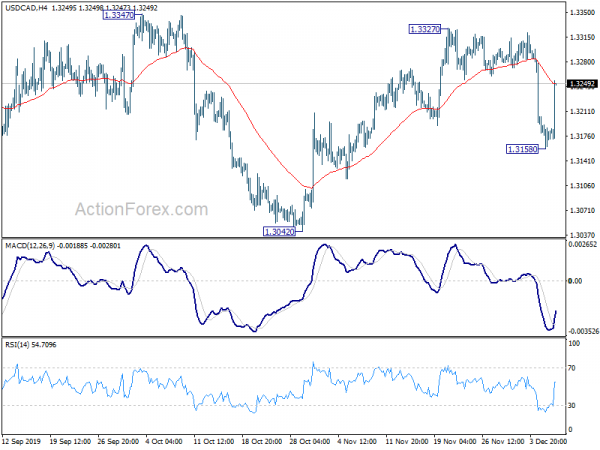

Daily Pivots: (S1) 1.3159; (P) 1.3181; (R1) 1.3203; More…

USD/CAD rebounds strongly in early US session, and dampens the original bearish view. However, it’s staying well below 1.3327 resistance. Intraday bias is turned neutral first. On the upside, break of 1.3327 will resume the rise form 1.3042 and target 1.3382 key structural resistance next. on the downside, through, break of 1.3158 will extend the fall from 1.3327 to retest 1.3042 low.

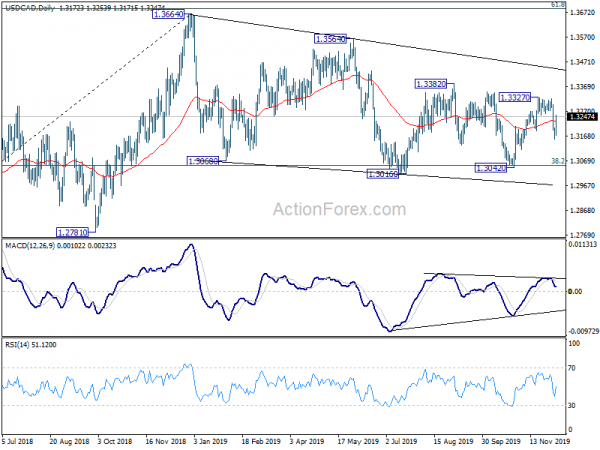

In the bigger picture, 38.2% retracement of 1.2061 to 1.364 at 1.3052 remains intact. Medium term rise from 1.2061 low is in favor to resume sooner or later. Firm break of 61.8% retracement of 1.4689 (2016 high) to 1.2061 at 1.3685 will confirm and target 1.4689 high. However, sustained break of 1.3052 will confirm completion of up trend from 1.2061 (2017 low). Further fall should be seen to 61.8% retracement at 1.2673 next.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Construction Index Nov | 40 | 43.9 | ||

| 23:30 | JPY | Labor Cash Earnings Y/Y Oct | 0.50% | 0.20% | 0.50% | 0.30% |

| 23:30 | JPY | Overall Household Spending Y/Y Oct | -5.10% | -3.00% | 9.50% | |

| 05:00 | JPY | Leading Economic Index Oct P | 91.8 | 92 | 91.9 | |

| 07:00 | EUR | Germany Industrial Production M/M Oct | -1.70% | 0.20% | -0.60% | |

| 07:45 | EUR | France Trade Balance (EUR) Oct | -4.7B | -4.8B | -5.6B | -5.4B |

| 08:00 | CHF | Foreign Currency Reserves (CHF) Nov | 783B | 779B | ||

| 09:00 | EUR | Italy Retail Sales M/M Oct | -0.20% | 0.50% | 0.70% | |

| 13:30 | USD | Nonfarm Payrolls Nov | 266K | 183K | 128K | 156K |

| 13:30 | USD | Unemployment Rate Nov | 3.50% | 3.60% | 3.60% | |

| 13:30 | USD | Average Hourly Earnings M/M Nov | 0.20% | 0.30% | 0.20% | 0.40% |

| 13:30 | CAD | Net Change in Employment Nov | -71.2K | 10.0K | -1.8K | |

| 13:30 | CAD | Unemployment Rate Nov | 5.90% | 5.50% | 5.50% | |

| 15:00 | USD | Michigan Consumer Sentiment Index Dec P | 97 | 96.8 | ||

| 15:00 | USD | Wholesale Inventories Oct | 0.20% | 0.20% |