The forex markets are rather quiet in Asian session today, but risk aversion is dominating in stocks as lead by deep decline in Hong Kong. Institutional investors could be starting to light up their positions just ahead of an important December. US support of Hong Kong autonomy and democracy movement triggered furious reactions from China. Yet, it’s uncertain what China’s retaliations to the Hong Kong Human Rights and Democracy Act are. Also, it’s equally uncertain how trade negotiations are affected. One interpretation on US President Donald Trump’s “speedy” signing of the act is that, phase one trade deal is probably not that close and there’s nothing to wait for.

Staying in the currency markets, Yen is so far the weakest one for the week, following record runs in US stocks and recovery in treasury yields. It should be noted that 10-year JGB yield is currently at around -0.078, back above -0.1 handle. Australian Dollar is the second weakest, followed by Swiss Franc. On the other hand, Sterling is the strongest on optimism that a Conservative win in the upcoming election would finally clear up all Brexit uncertainty. Kiwi is the second strongest, followed by Canadian.

In Asia, currently, Nikkei is down -0.39%, Hong Kong HSI is down -2.11%. China Shanghai SSE is down -0.71%. Singapore Strait Times is down -0.46%. Japan 10-year JGB yield is up 0.011 at -0.078.

BoJ Kuroda pushes deregulation and structural reforms

BoJ Governor Haruhiko Kuroda told the parliament today that “a mix of fiscal and monetary policy isn’t enough” to boost the economy. It’s also important to “proceed with deregulation and structural reforms to heighten Japan’s medium- and long-term growth potential.”

Kuroda repeated his view that the ultra-look monetary policy could increase the effect of fiscal stimulus. However, he also emphasized “our monetary easing efforts are aimed at achieving our price target, not at helping fund government spending. There needs to be a clear line drawn on this point,”

Executive Director Eiji Maeda told the parliament that “current ultra-loose monetary environment is stimulating the economy by spurring capital expenditure and housing investment.” That will “push up” household income and asset prices. But policymakers are also “mindful” on the “excessive declines” in super-long yields. He warned that could ‘hurt public sentiment and economic activity by lowering the interest life insurers and pension funds earn from their investment”.

Japan industrial production posted largest contraction in nearly two years

Japan industrial production dropped sharply by -4.2% mom in October, missing expectation of -2.1% mom. That’s also the worst decline in nearly two years since January 2018. Output was seen as negatively impacted by temporary shutdowns of factories due to typhoon. Also slowing productions of big-ticket items following sales tax hike also weighed.

METI also noted that according to the Survey of Production Forecast in Manufacturing, production is expected to decrease in November and increase in December. Finance Minister Taro Aso said the government would consider more funding or cashless support to secure the economy’s recovery trend.

Also from Japan, unemployment rate was unchanged at 2.4% in October, matched expectations. Housing starts dropped -7.4% yoy versus expectation of -7.6% yoy. Tokyo CPI core edged up to 0.6% yoy in November, matched expectations. Consumer confidence rose to 38.7, up from 36.2.

UK Gfk consumer confidence unchanged at -14, upcoming election an opportunity to move UK out of doldrums

UK GfK Consumer Confidence was unchanged at -14 in November, matched expectations. General Economic Situation index over the next 12 months improved by 3 pts from -37 to -34, two points lower than -32 a year ago. Joe Staton, Client Strategy Director at GfK, says: “In the face of Brexit and election uncertainty, consumers are clearly in a ‘wait-and-see’ mode…

“The general election is potentially an opportunity to move us out of the doldrums – but for this to happen there must be a clear result. A hung parliament could be very damaging for consumer confidence and would surely deepen the obvious malaise that we see month after month.”

Looking ahead

Eurozone CPI will be the major focus in European session. Unemployment rate will also be featured. Swiss KOF, Germany unemployment, UK mortgage approvals will also be released. Later in the day, Canada GDP will be the main focus, while IPPI and RMPI will be featured.

USD/JPY Daily Outlook

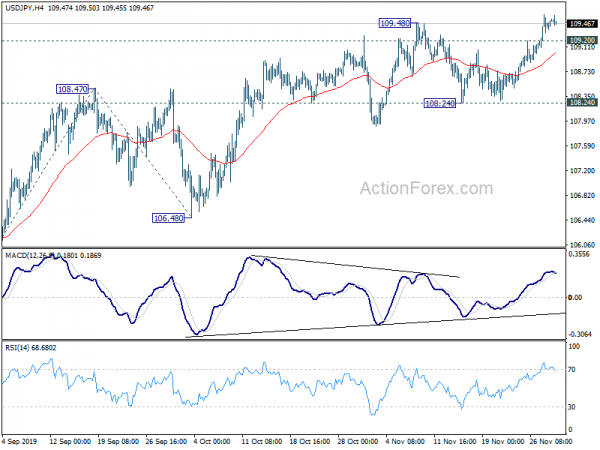

Daily Pivots: (S1) 109.37; (P) 109.47; (R1) 109.60; More..

Intraday bias in USD/JPY remains on the upside for the moment. Rise form 104.45 is still in progress and should target 100% projection of 104.45 to 108.47 from 106.48 at 110.50 next. On the downside, below 109.20 minor support will turn intraday bias neutral first. But break of 108.24 support is needed to indicate short term topping. Otherwise, outlook will remain bullish in case of retreat.

In the bigger picture, strong support was seen from 104.62 again. Yet, there is no confirmation of medium term reversal. Corrective decline from 118.65 (Dec. 2016) could still extend lower. But in that case, we’d expect strong support above 98.97 (2016 low) to contain downside to bring rebound. Meanwhile, on the upside, break of 112.40 key resistance will be a strong sign of start of medium term up trend.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Building Permits M/M Oct | -1.10% | 7.20% | 7.40% | |

| 23:30 | JPY | Tokyo CPI Core Y/Y Nov | 0.60% | 0.60% | 0.50% | |

| 23:30 | JPY | Unemployment Rate Oct | 2.40% | 2.40% | 2.40% | |

| 23:50 | JPY | Industrial Production M/M Oct P | -4.20% | -2.10% | 1.70% | |

| 0:01 | GBP | GfK Consumer Confidence Nov | -14 | -14 | -14 | |

| 0:30 | AUD | Private Sector Credit M/M Oct | 0.10% | 0.30% | 0.20% | |

| 5:00 | JPY | Housing Starts Y/Y Oct | -7.40% | -7.60% | -4.90% | |

| 5:00 | JPY | Consumer Confidence Index Nov | 38.7 | 35.4 | 36.2 | |

| 8:00 | CHF | KOF Leading Indicator Nov | 95 | 94.7 | ||

| 8:55 | EUR | Germany Unemployment Rate Nov | 5% | 5% | ||

| 8:55 | EUR | Germany Unemployment Change Nov | 5K | 6K | ||

| 9:30 | GBP | Mortgage Approvals Oct | 65K | 66K | ||

| 9:30 | GBP | M4 Money Supply M/M Oct | 0.50% | 0.70% | ||

| 10:00 | EUR | Eurozone Unemployment Rate Oct | 7.50% | 7.50% | ||

| 10:00 | EUR | Eurozone CPI Y/Y Nov P | 0.80% | 0.70% | ||

| 10:00 | EUR | Eurozone CPI – Core Y/Y Nov P | 1.20% | 1.10% | ||

| 13:30 | CAD | GDP M/M Sep | 0.20% | 0.10% | ||

| 13:30 | CAD | Raw Material Price Index Oct | 1.20% | 0.00% | ||

| 13:30 | CAD | Industrial Product Price M/M Oct | 0.10% | -0.10% | ||

| 13:30 | CAD | GDP Annualized Q/Q Q3 | 5.40% | 3.70% |