Sterling surges broadly today as YouGov predicts a Conservative Win in the upcoming UK election, which puts Brexit on the right track. The Pound also takes Euro slightly higher somewhat. On the other hand, Australian Dollar is generally weaker after poor capital expenditure data. Yen recovers mildly but stays soft after selloff on record closes in US stock indices. For the week, Sterling is so far the strongest one, followed by New Zealand Dollar. Yen and Aussie are the weakest.

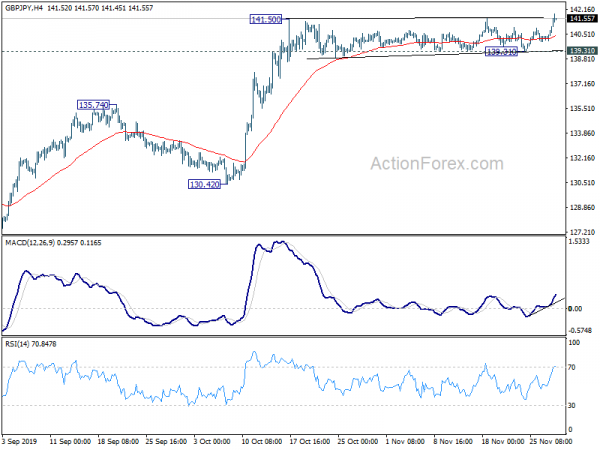

Technically, EUR/GBP’s break of 0.85721 support suggests resumption of recent fall from 0.9324 to 0.8472 key support. We’d be expecting downside to be contained there due to loss of momentum. But we’ll see. GBP/JPY also breaks 141.57 resistance to resume the rally from 126.54. Next target is trend line resistance at 143.85. GBP/USD, though, is still bounded in range and focus will be on 1.3012 resistance. USD/JPY’s break of 109.48 resistance indicates resumption of rise from 104.45. Strong rebound from 55 day EMA was a sign of near term bullishness. Next target is trend line resistance at 111.80.

In Asia, Nikkei is down -0.16%. Hong Kong HSI is down -0.26%. China Shanghai SSE is down -0.41%. Singapore Strait Times is down -0.48%. Japan 10-year JGB yield is up 0.0126 at -0.098, back above -0.1 handle. Overnight, DOW rose 0.15%. S&P 500 rose 0.42%. NASDAQ rose 0.66%. All closed at new record highs. 10-year yield rose 0.027 to 1.767.

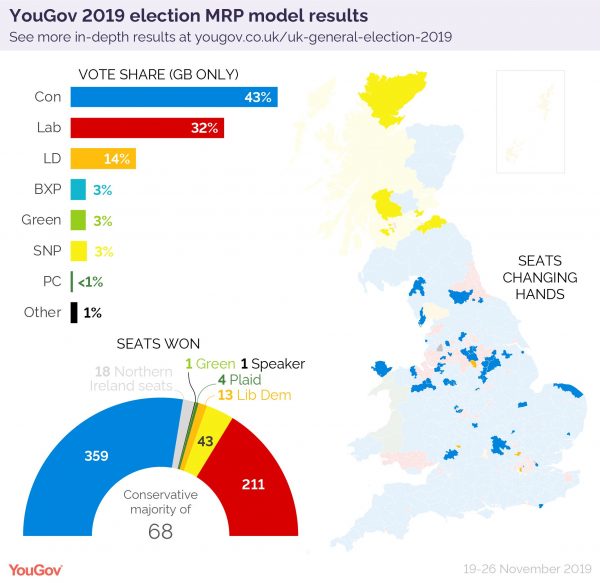

YouGov predicts 68 Conservative majority in UK Dec elections

Sterling jumps broadly after YouGov projected that the Conservative Party is on track to win its biggest majority in more than three decades in the upcoming election on December 12. The results, if realized, would put UK on track for Brexit with a deal finally on January 31.

According to the poll, Conservatives would win 359 seats, giving it a majority of 68. Labour is predicted to win 211 seats, SNP 43, and Lib Dems 13. “As expected, the key thing deciding the extent to which each of these seats is moving against Labour are how that seat voted in the European Union referendum,” said Chris Curtis, YouGov’s political research manager. “This is allowing the Tories to overturn quite substantial majorities.”

Trump signed HKHRDA into law, China and Hong Kong government oppose

US President Donald Trump finally signed the bipartisan supported Hong Kong Human Rights and Democracy Act overnight. A second bill to ban export of crown-control munitions to Hong Kong was also signed. Trump said, “I signed these bills out of respect for President Xi, China, and the people of Hong Kong. They are being enacted in the hope that Leaders and Representatives of China and Hong Kong will be able to amicably settle their differences leading to long term peace and prosperity for all. ”

Republican Senator Marco Rubio, a main driver and sponsor of the bill, said, “In an overwhelming display of bipartisan unity, Congress passed our Hong Kong Human Rights and Democracy Act, and I applaud President Trump for signing this critical legislation into law. I look forward to continuing to work with the administration to implement this law.” Democrat House Speaker Nancy Pelosi said, “If America does not speak out for human rights in China because of commercial interests, we lose all moral authority to speak out elsewhere”.

The Chinese Foreign Ministry said the act “severely infringed on Hong Kong affairs, seriously interfered in China’s internal politics, and gravely violated international laws and the basic principles of international relations”. It added, “it is a blatant move of hegemony that the Chinese government and the Chinese people firmly oppose”. The China-appointed Hong Kong Government also said, “the two acts are unreasonable”, and they “will also send an erroneous signal to protesters, which is not conducive to alleviating the situation in Hong Kong”.

The HKHRDA aims to back Hongkongers in defend of their autonomy, promised by China in the Sino-British Joint Declaration. Hong Kong’s status will be reviewed by the US State Department, annually, to justify continuation of the favorable trading terms. The law also threatens sanctions for human rights violations by Hong Kong Government officials.

Market reactions are so far muted as the main risk remains on outcome of US-China trade deal phase one. Talks are ongoing and no one has eve dropped a hint on when it will be completed.

Fed Beige Book: Modest expansion but manufacturing stagnant

In Fed’s Beige Book report, it’s noted that economic activity expanded “modestly” in the period. Most Districts reported “stable to moderately” growing consumer spending. More Districts reported expectation in manufacturing, but the “majority” continued to experience no growth.

Employment continued to “rise slightly over all”. But reports were “mixed” in manufacturing employment, with reports of rising headcounts and layoffs. “Moderate wage growth” continued across move districts and wage pressures “intensified” for low-skill positions. Prices rose at a “moderate pace” and “firms generally expected higher prices going forward.

On the data front

Japan retail sales dropped -7.1% yoy in October, much worse than expectation of -4.4% yoy. That’s also the biggest contraction since 2015 and consumers cut spending after the sales tax hike. New Zealand ANZ Business Confidence rose to -26.4 in November, up from -42.4. Australia private capital expenditure dropped -0.2% in Q3, below expectation of 0.0%.

Swiss GDP, Eurozone M3 and confidence indicators, Germany CPI will be featured in European session. Canada will release current account later in the day.

GBP/JPY Daily Outlook

Daily Pivots: (S1) 140.42; (P) 140.98; (R1) 141.90; More…

GBP/JPY’s recent rally resumes and hits as high as 141.85 so far. Intraday bias is back on the upside. Rise from 126.54 should target trend line resistance (now at 143.80) next. Sustained break will pave the way to 148.87 key resistance next. On the downside, break of 139.31 support is needed to indicate short term topping. Otherwise, outlook will remain bullish in case of retreat.

In the bigger picture, consolidation pattern from 122.75 (2016 low) is still in progress with rise from 126.54 as the third leg. Further rise should be seen back to 148.87/156.59 resistance zone. For now, we’d expect strong resistance from there to limit upside. On the downside, sustained break of 135.74 will suggest that such rebound has completed. Deeper decline could the be seen to retest 126.54 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Retail Trade Y/Y Oct | -7.10% | -4.40% | 9.20% | |

| 0:00 | NZD | ANZ Business Confidence Nov | -26.4 | -42.4 | ||

| 0:30 | AUD | Private Capital Expenditure Q3 | -0.20% | 0.00% | -0.50% | -0.60% |

| 6:45 | CHF | GDP Q/Q Q3 | 0.10% | 0.30% | ||

| 9:00 | EUR | Eurozone M3 Money Supply Y/Y Oct | 5.50% | 5.50% | ||

| 10:00 | EUR | Eurozone Business Climate Nov | -0.24 | -0.19 | ||

| 10:00 | EUR | Eurozone Economic Sentiment Indicator Nov | 101 | 100.8 | ||

| 10:00 | EUR | Eurozone Services Sentiment Nov | 9.3 | 9 | ||

| 10:00 | EUR | Eurozone Consumer Confidence Nov | -7.2 | -7.2 | ||

| 10:00 | EUR | Eurozone Industrial Confidence Nov | -9.1 | -9.5 | ||

| 13:00 | EUR | Germany CPI M/M Nov P | -0.50% | 0.10% | ||

| 13:00 | EUR | Germany CPI Y/Y Nov P | 1.30% | 1.10% | ||

| 13:30 | CAD | Current Account (CAD) Q3 | -6.4B |