Australian Dollar weakens broadly today following more dovish than expected RBA minutes. New Zealand Dollar is currently the second weakest together with Swiss Franc. On the other hand, Euro, Sterling and Yen are the stronger ones. Dollar is mixed on confusing messages regarding US-China trade deal. So far, it seems like the US is relatively upbeat while some Chinese officials are pessimistic.

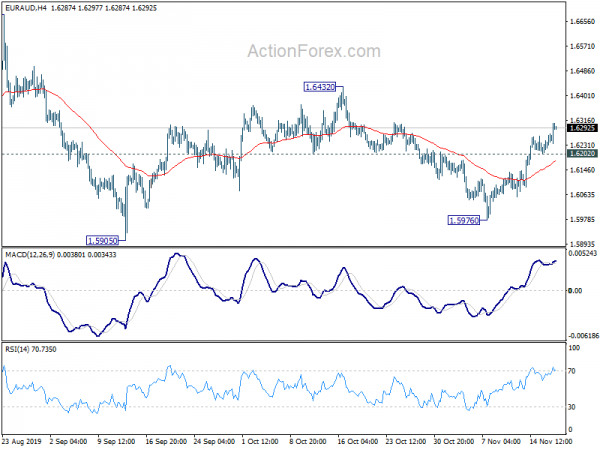

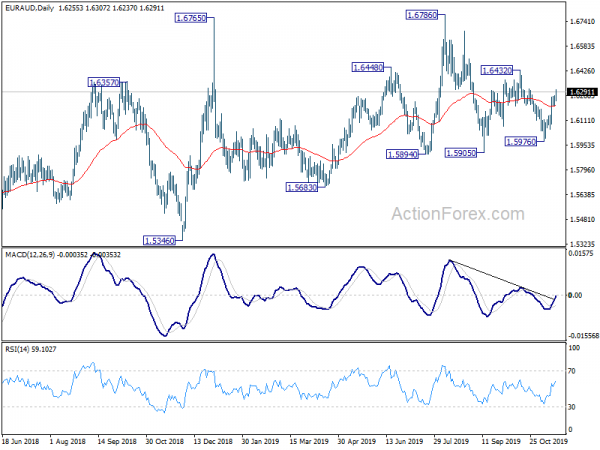

Technically, EUR/USD’s break of 1.1073 resistance suggests that pull back from 1.1175 has completed at 1.0989. Rise from 1.0879 might not be over yet. Focus is now back on 1.1175 resistance. On the other hand, AUD/USD’s recovery from 0.6769 was very weak and fall from 0.6929 is expected to extend lower. The developments keep EUR/AUD as one of the biggest movers this week and EUR/AUD could re-accelerate back to 1.6432 resistance.

In Asia, Nikkei closed down -0.53%. Hong Kong HSI is up 1.12%. China Shanghai SSE is up 0.49%. Singapore Strait Times is down -0.67%. Japan 10-year JGB yield is down -0.0073 at -0.094. Overnight, DOW rose 0.11%. S&P 500 rose 0.05%. NASDAQ rose 0.11%. 10-year yield dropped to -0.026 to 1.808. 10-year yield will likely lose 1.8% handle, which would weigh down USD/JPY.

Trump had cordial meeting with Fed Powell, and protested on high interest rates

Fed Chair Jerome Powell had a meeting with US President Donald Trump at the White House yesterday, together with Treasury Secretary Steven Mnuchin. Fed said in a statement that the meeting was to “discuss the economy, growth, employment and inflation.”. Powell’s comments were “consistent” with his remarks at the Congressional hearing last week. And he “did not discuss the economy, growth, employment and inflation.”

Trump said in twitter that the meeting was “very good & cordial”. “Everything was discussed including interest rates, negative interest, low inflation, easing, Dollar strength & its effect on manufacturing, trade with China, E.U. & others, etc.” He also “protested” that Fed’s interest rate is “too high relative to the interest rates of other competitor countries”. And, “our rates should be lower than all others (we are the U.S.). Too strong a Dollar hurting manufacturers & growth!”

BoJ Kuroda: Plenty of scope to deepen negative interest rate

BoJ Governor Haruhiko Kuroda said in the semi-annual parliament testimony that “there is plenty of scope to deepen negative rates from the current -0.1%.” However, he emphasized “I’ve never said there are no limits to how much we can deepen negative rates, or that we have unlimited means to ease policy.”

Kuroda also reiterated that “Japan’s economy is expected to continue expanding and inflation will gradually head towards our 2% target”. And, “we need to remain vigilant to downside risks, particularly those regarding the global economy.” He also noted that “the effect of China’s policy measures is taking somewhat long to appear. But China’s economy will likely sustain growth of around 6% for the time being.”

RBA minutes noted a case to ease further

Australian Dollar stays generally pressured today as RBA’s November meeting minutes struck a more dovish than expected tone. Board members noted that “a case could be made to ease monetary policy”. They refrained from easing further this month because of the concerns about “the negative effects of lower interest rates on savers and confidence”. They, however, retained the view that lower interest rates could support economic growth via traditional channels, such as “a lower exchange rate, higher asset prices and higher cash flows for borrowers.

Suggested readings on RBA:

- RBA Minutes: Members Considered Rate Cut This Month. Disappointing Job Report Raises the Case for Further Easing

- RBA Minutes Signal that the Board is in “Monitoring” Mode

On the data front

New Zealand PPI input rose 0.9% qoq in Q3, above expectation of 0.2% qoq. PPI output rose 1.0% qoq, above expectation of 0.4% qoq. Swiss will release trade balance in European session. Eurozone will release current account. UK will release CBI industrial order expectations. Later in the day, Canada will release manufacturing shipments. US will release housing starts and building permits.

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.6222; (P) 1.6246; (R1) 1.6288; More…

EUR/AUD’s rise from 1.5976 resumed after brief consolidation and intraday bias is back on the upside. Further rally should be seen to 1.6432 resistance first. Sustained break there will pave the way to retest 1.6786 high. On the downside, below 1.6202 minor support will turn bias back to the downside for 1.5894/5905 key support zone instead.

In the bigger picture, as long as 1.5894 support holds, outlook remains bullish. Firm break of 1.6786 will resume up trend from 1.1602 (2012 low). Next upside target is 61.8% retracement of 2.1127 (2008 high) to 1.1602 at 1.7488. However, sustained break of 1.5894 will have 55 week EMA (now at 1.6071) firmly taken out too. That should indicate medium term topping and target 1.5346 key support next.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | PPI – Input Q/Q Q3 | 0.90% | 0.20% | 0.30% | |

| 21:45 | NZD | PPI – Output Q/Q Q3 | 1.00% | 0.40% | 0.50% | |

| 0:30 | AUD | RBA Meeting Minutes | ||||

| 7:00 | CHF | Trade Balance (CHF) Oct | 4.24B | 4.02B | ||

| 9:00 | EUR | Eurozone Current Account (EUR) Sep | 22.3B | 26.6B | ||

| 11:00 | GBP | CBI Industrial Order Expectations Nov | -30 | -37 | ||

| 13:30 | USD | Building Permits Oct | 1.39M | 1.39M | ||

| 13:30 | USD | Housing Starts Oct | 1.32M | 1.26M | ||

| 13:30 | CAD | Manufacturing Shipments M/M Sep | -0.50% | 0.80% |