New Zealand Dollar remains the strongest one today as boosted by RBNZ’s hold. But risk aversion is picking up momentum and sends Swiss Franc and Yen generally higher. Hong Kong stocks led the global markets lower again as unrest in the city continues. Neither the Hong Kong nor the Chinese government display any political intelligence in providing any resolution. Traders also turned cautious after US President Donald Trump warned yesterday that tariffs on China would be “substantially” higher if both sides fail to reach a deal. On the other hand, Australian and Canadian Dollars are the weakest.

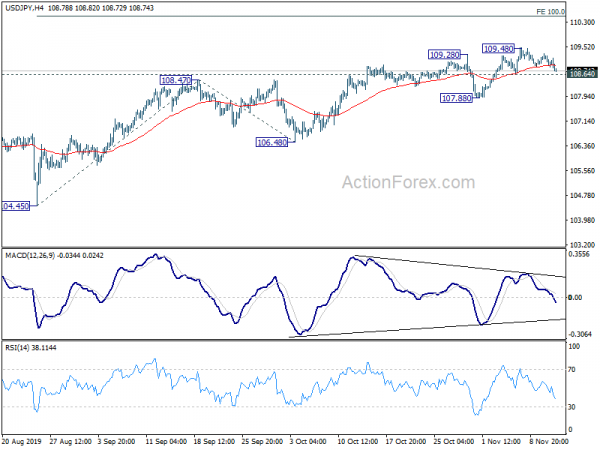

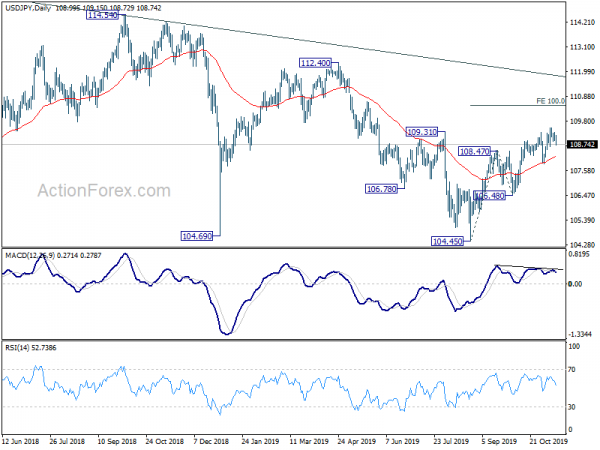

Technically, Yen crosses are generally seen as in consolidation for now, including USD/JPY, EUR/JPY and GBP/JPY. But break of 108.64 minor support in USD/JPY will be an early sign of sustainable strength in the Yen and could bring deeper fall to 117.88 structural support. In that case, we might see selloff in other Yen crosses accelerates. AUD/USD is now edging closer to 0.6809 near term support. Break will indicate completion of recent rebound from 0.6677 and pave the way back to this low.

In other markets, DOW open lower by -0.3%. 10-year yield is down -0.0477 at 1.870, back below 1.9 handle. In Europe, FTSE is down -0.35%. DAX is down -0.52%. CAC is down -0.18%. German 10-year yield is down -0.052 at -0.301, back below -0.3 handle. Earlier in Asia, Nikkei dropped -0.85%. Hong Kong HSI dropped -1.82%. China Shanghai SSE dropped -0.33%. Singapore Strait Times dropped -0.87%. Japan 10-year JGB yield dropped -0.0115 to -0.047.

US CPI picked up t 1.8%, but core slowed to 2.3%

US CPI rose 0.4% mom in October versus expectation of 0.3%. Core CPI rose 0.2% mom, matched expectation. Annually, headline CPI accelerated to 1.8% yoy, up from 1.7% yoy and beat expectation of 1.7% yoy. CPI core, on the other hand, slowed to 2.3% yoy, down from 2.4% yoy and missed expectation of 2.4% yoy.

UK CPI slowed to 1.5% yoy, missed expectation of 1.6% yoy

UK CPI slowed to 1.5% yoy in October, down from 1.7% yoy, missed expectation of 1.6% yoy. Core CPI was unchanged at 1.7% yoy, matched expectations. RPI slowed to 2.1% yoy, down from 2.4% yoy,missed expectation of 2.6% yoy.

PPI input dropped -5.1% yoy in October versus expectation of -1.8% yoy. PPI output rose 0.8% yoy, missed expectation of 1.3% yoy. PPI output core rose 1.3% yoy, missed expectation of 1.9% yoy.

Eurozone industrial production rose 0.1% mom, vs expectation of -0.2% mom

Eurozone industrial production rose 0.1% mom in September, above expectation of -0.2% mom. Over the year, Eurozone industrial production dropped -1.7% yoy. Production of non-durable consumer goods rose by 1.0% mom and capital goods by 0.6% mom, while production of durable consumer goods fell by -0.7% mom, energy by -0.8% mom and intermediate goods by -0.9% mom.

EU28 industrial production rose 0.2% mom, dropped -1.2% yoy. Among Member States for which data are available, the highest increases in industrial production were registered in Ireland (+8.8%), Hungary (+3.1%), Denmark, Croatia and Lithuania (all +2.5%). The largest decreases were observed in Malta (-3.7%), Portugal (-2.3%) and Estonia (-1.5%).

Also released, Germany CPI was finalized at 0.1% mom, 1.1% yoy in October.

SNB Jordan emphasized negative rates and readiness to intervene as necessary

SNB Chairman Thomas Jordan reiterated the stance on negative interest rate, and readiness for intervention at the meeting with the seven member Federal Council. the Council said in a statement that “inflation is down, the global low interest environment has grown further entrenched and the situation on foreign exchange markets remains fragile.” “Against this backdrop, Chairman Jordan emphasized that monetary policy with negative interest rates and the readiness to intervene is just as necessary as before.”

RBNZ stands pat, long-term inflation expectations remain anchored

New Zealand Dollar rebounds strongly after RBNZ surprised the markets by keeping OCR unchanged at 1.00%. There were some expectation of a cut to 0.75%. But RBNZ opted for a hold and just noted “interest rates will need to remain at low levels for a prolonged period”, and pledged to “add further monetary stimulus if needed.”

The RBNZ Committee noted “recent increases in wage and non-tradables inflation” as ‘expected outcome of monetary stimulus transmitting through the economy.” There was “slight decline in one- and two-year ahead survey measures of inflation expectations”. But “long-term inflation expectations remain anchored at close to the 2 percent target mid-point and market measures of inflation expectations have increased from their recent lows.”

Meanwhile the two options of keeping OCR at 1% versus lowering to 0.75% were debated. “Both actions were broadly consistent with the current OCR projection”. There was a consensus to stand pat. ” The Committee noted that the risks to the economy in the near term were tilted to the downside and agreed it would add further monetary stimulus if economic developments warranted it.”

More on RBNZ:

- RBNZ Unanimously Left OCR at 1%. Rate Cuts Next Yet Still Likely

- First Impressions: RBNZ Keeps the OCR at 1.0%

- (RBNZ) Official Cash Rate Unchanged at 1 Percent

Australia wage price index rose 0.5% qoq, consumer sentiment rose 4.5%

Australia Wage Price Index rose 0.5% qoq in Q3, matched expectations. The trend and seasonally adjusted indexes for Australia both rose 2.2% through the year. The ABS Chief Economist, Bruce Hockman stated “The rate of annual wage growth eased slightly in September after being stable over the past year, continuing to grow at a slightly faster rate than consumer prices over the past year. The largest contribution to wage growth over the quarter was jobs in the health care and social assistance industry.”

Westpac-MI Consumer Sentiment rose 4.5% to 97.0 in November, up from 92.8. Westpac said “This result continues to support the general view that consumers are somewhat unnerved by the announcement of low rates and media controversy around the banks’ responses.”

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 108.87; (P) 109.08; (R1) 109.24; More..

Intraday bias in USD/JPY remains neutral first, and with 108.64 minor support intact, further rise is in favor. On the upside, break of 109.48 will resume the rise from 104.45 to 100% projection of 104.45 to 108.47 from 106.48 at 110.50. However, break of 108.64 will suggest short term topping at 109.48. Rebound from 104.45 could have completed on bearish divergence condition in 4 hour and daily MACD, after failing to sustain above 109.31 key resistance. Intraday bias will be turned back to the downside for 107.88 support.

In the bigger picture, strong support was seen from 104.62 again. Yet, there is no confirmation of medium term reversal. Corrective decline from 118.65 (Dec. 2016) could still extend lower. But in that case, we’d expect strong support above 98.97 (2016 low) to contain downside to bring rebound. Meanwhile, on the upside, break of 112.40 key resistance will be a strong sign of start of medium term up trend.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Consumer Confidence Nov | 4.50% | -5.50% | ||

| 23:50 | JPY | Domestic Corporate Goods Price Index M/M Oct | -0.30% | 1.20% | 0.00% | |

| 23:50 | JPY | Domestic Corporate Goods Price Index Y/Y Oct | -0.40% | -0.30% | -1.10% | |

| 00:30 | AUD | Wage Price Index Q/Q Q3 | 0.50% | 0.50% | 0.60% | 0.50% |

| 01:00 | NZD | RBNZ Interest Rate Decision | 1.00% | 0.75% | 1.00% | |

| 02:00 | NZD | RBNZ Press Conference | ||||

| 07:00 | EUR | Germany CPI M/M Oct | 0.10% | 0.10% | 0.10% | |

| 07:00 | EUR | Germany CPI Y/Y Oct | 1.10% | 1.10% | 1.10% | |

| 09:30 | GBP | RPI M/M Oct | -0.20% | -0.10% | -0.20% | |

| 09:30 | GBP | RPI Y/Y Oct | 2.10% | 2.60% | 2.40% | |

| 09:30 | GBP | DCLG House Price Index Y/Y Jul | 1.30% | 1.50% | 1.30% | |

| 09:30 | GBP | CPI M/M Oct | -0.20% | 0.00% | 0.10% | |

| 09:30 | GBP | CPI Y/Y Oct | 1.50% | 1.60% | 1.70% | |

| 09:30 | GBP | Core CPI Y/Y Oct | 1.70% | 1.70% | 1.70% | |

| 09:30 | GBP | PPI – Input M/M Oct | -1.30% | -1.10% | -0.80% | -0.90% |

| 09:30 | GBP | PPI – Input Y/Y Oct | -5.10% | -1.80% | -2.80% | -3.00% |

| 09:30 | GBP | PPI – Output M/M Oct | -0.10% | 0.10% | -0.10% | |

| 09:30 | GBP | PPI – Output Y/Y Oct | 0.80% | 1.30% | 1.20% | |

| 09:30 | GBP | PPI – Core Output M/M Oct | -0.10% | 0.10% | -0.10% | |

| 09:30 | GBP | PPI – Core Output Y/Y Oct | 1.30% | 1.90% | 1.70% | |

| 10:00 | EUR | Eurozone Industrial Production M/M Sep | 0.10% | -0.20% | 0.40% | |

| 13:30 | USD | CPI M/M Oct | 0.40% | 0.30% | 0.00% | |

| 13:30 | USD | CPI Y/Y Oct | 1.80% | 1.70% | 1.70% | |

| 13:30 | USD | CPI Core M/M Oct | 0.20% | 0.20% | 0.10% | |

| 13:30 | USD | CPI Core Y/Y Oct | 2.30% | 2.40% | 2.40% |