Yen surges broadly today as markets are back in risk averse mode, led by steep decline in Hong Kong stocks. On the other hand, Dollar and Australia are the weakest one for the moment. But some of the moves are consolidative and overall outlook is unchanged. That is, Yen’s rally is so far so far seen as corrective pull back. Meanwhile, Dollar is just in corrective pull back too.

Technically, EUR/USD’s decline is still expected to continue as long as 1.1092 minor resistance holds. USD/CHF’s rise is also expected to continue as long as 0.9911 minor support holds. USD/CAD’s rebound is also in progress as long as 1.3159 support holds. AUD/USD will be a focus this week. Further rise remains in favor as long as 0.6809 minor support holds. But break there will align the outlook with other Dollar pairs.

In Asia, Nikkei closed down -0.26%. Hong Kong HSI dropped -2.71%. China Shanghai SSE dropped -1.83%. Singapore Strait Times is down -0.92%. Japan 10-year JGB yield is down -0.0088 at -0.069.

BoJ opinions: Should seriously prepare for the next downturn

Summary of opinions of BoJ’s October 30-31 meeting noted that “inflation momentum has not been lost” and thus, the central should “maintain the current easing policy”. However, it was appropriate to “clarify” that the policy stance is “further tilted toward monetary accommodation”, by indicating the “downward bias” in policy rates.

Also, in the current situation where risks are skewed to the downside, the Bank should continue to examine whether additional monetary easing will be necessary”. As inflation expectations are “not anchored” to 2% target and observed inflation rate is “far from the target”, BoJ should “seriously prepare for the next economic downturn as one of the risk scenarios.

Also from Japan, bank lending rose 2.0% yoy in October, matched expectations. Current account surplus narrowed to JPY 1.49T in September, below expectation of JPY 1.66%. Machine orders dropped -2.9% mom in September, below expectation of 0.9% mom rise. .

Hong Kong HSI leads Asian stocks lower after police shot live ammo at a protester

Asian stocks trade broadly lower today as led by steep fall in the Hong Kong HSI. The index gapped lower as the five-month long protests extended from the weekend into Monday morning, in a number of districts including the CBD. The anti-police sentiments intensified last Friday after the death of a 22-year old university student, which is seen as the first proven fatality directly linked to police action. The situation worsened further today, before office hours, after an unarmed young man was shot by police with live ammo. The 21-year old remains in critical condition.

The gap down today and subsequent steep fall suggests that HSI’s corrective rise from 24899.93 has completed with three waves up to 27894.45. Immediate focus is now on 55 day EMA (now at 26806.62). Sustained break should send the index for retesting 24899.93 low.

The bearish development is supported by rejection from 55 week EMA too. Break of 24899.93 low will extend the down trend form 33530.66 through 61.8% retracement of 18278.80 to 33530.66 at 24105.01.

Fed Chair Powell to testify RBNZ to cut

Looking ahead, Fed Chair Jerome Powell’s Congressional testimony is a major focus in the week. Expectations of more rate cuts receded sharply since last week and traders would like to get more affirmation from Powell. US CPI will be an important piece of data to support Fed’s ending of “mid-cycle” adjustments. Retail sales and industrial production will also be watched.

RBNZ is widely expected to cut interest rate again, by -25bps to 0.75%. The focus will be on whether the central bank is open to more easing ahead. Also from down understand, Australia employment will be the key to whether RBA would cut interest rate again next year. Both will also look closely at Chinese data.

Elsewhere, UK will release CPI, employment and retail sales. Germany will release ZEW economic sentiment and GDP while Eurozone will release employment and GDP.

Here are some highlights for the week:

- Monday: UK GDP, industrial and manufacturing productions.

- Tuesday: Australia NAB business confidence; New Zealand inflation expectations; Japan machine tool orders; UK employment; German ZEW economic sentiment.

- Wednesday: Australia Westpac consumer sentiment; wage price index; RBNZ rate decision; Japan PPI; German CPI final; Eurozone industrial production; UK CPI, PPI; US CPI.

- Thursday: Japan GDP, tertiary industry index; Australia employment; China fixed asset investment, industrial production retail sales, unemployment rate; Germany GDP, Eurozone employment, GDP; Swiss PPI; UK retail sales, RICS house price balance; Canada new housing price index; UK PPI, jobless claims.

- Friday: New Zealand BusinessNZ manufacturing index; Eurozone CPI final, trade balance; Canada foreign securities purchases; US retail sales, Empire state manufacturing index, import prices, industrial production, business inventories.

USD/JPY Daily Outlook

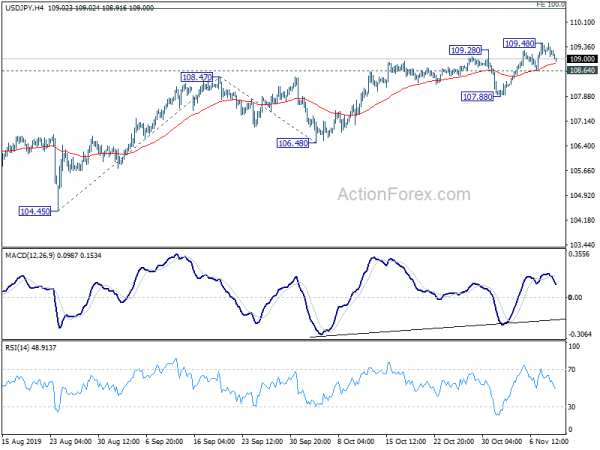

Daily Pivots: (S1) 109.05; (P) 109.27; (R1) 109.45; More…

A temporary top is in place at 109.48 in USD/JPY with retreat today. Intraday bias is turned neutral first. Further rally is expected as long as 108.64 support holds. On the upside, break of 109.48 will resume the rise from 104.45 to 100% projection of 104.45 to 108.47 from 106.48 at 110.50. However, break of 108.64 will turn focus back to 107.88 support.

In the bigger picture, strong support was seen from 104.62 again. Yet, there is no confirmation of medium term reversal. Corrective decline from 118.65 (Dec. 2016) could still extend lower. But in that case, we’d expect strong support above 98.97 (2016 low) to contain downside to bring rebound. Meanwhile, on the upside, break of 112.40 key resistance will be a strong sign of start of medium term up trend.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BoJ Summary of Opinions | ||||

| 23:50 | JPY | Bank Lending Y/Y Oct | 2.00% | 2.00% | 2.00% | |

| 23:50 | JPY | Current Account (JPY) Sep | 1.49T | 1.66T | 1.72T | |

| 23:50 | JPY | Machinery Orders M/M Sep | -2.90% | 0.90% | -2.40% | |

| 5:00 | JPY | Eco Watchers Survey: Current Oct | 36.7 | 40.7 | 46.7 | |

| 9:30 | GBP | GDP M/M Sep | -0.10% | -0.10% | ||

| 9:30 | GBP | GDP Q/Q Q3 P | 0.30% | -0.20% | ||

| 9:30 | GBP | GDP Y/Y Q3 P | 1.10% | 1.30% | ||

| 9:30 | GBP | Industrial Production M/M Sep | -0.10% | -0.60% | ||

| 9:30 | GBP | Industrial Production Y/Y Sep | -1.20% | -1.80% | ||

| 9:30 | GBP | Manufacturing Production M/M Sep | -0.20% | -0.70% | ||

| 9:30 | GBP | Manufacturing Production Y/Y Sep | -1.30% | -1.70% | ||

| 9:30 | GBP | Index of Services 3M/3M Sep | 0.40% | 0.40% | ||

| 9:30 | GBP | Goods Trade Balance (GBP) Sep | -10.1B | -9.8B | ||

| 12:00 | GBP | NIESR GDP Estimate (3M) Nov | 0.50% |