The markets are relatively indecisive today. It seems that rally in stock markets have passed a near term climax, awaiting fresh developments in US-China trade negotations. Treasury yields also turn mildly lower after yesterday’s rally. In the forex markets, Dollar struggles to ge through near term resistance against both Euro and Yen, and it’s giving back some gains. Major pairs and crosses are generally stuck in yesterday’s range for now.

Technically, 1.1062 support in EUR/USD remains a focus for the rest of the week. Break should indicate completion of recent corrective rebound from 1.0879, and bring retest of this low. Ideally, this should be accompaneid by break of 0.9977 resistance, which should than bring retest of 1.0027. 0.8575 tempoary low in EUR/GBP is also worth a watch. Break will resume recent fall from 0.9324.

In Europe, currently, FTSE is up 0.11%. DAX is up 0.28%. CAC is up 0.46%. German 10-year yield is down -0.0100 at -0.317. Earlier in Asia, Nikkei rose 0.22%. Hong Kong HSI rose 0.02%. China Shanghai SSE dropped -0.43%. Singapore Strait Times rose 0.43%. Japan 10-year JGB yield rose 0.0481 to -0.086.

IMF downgrades Eurozone growth and inflation forecasts

In the Regional Economic Outlook report, IMF downgraded Eurozone growth forecasts for both 2019 and 2020. It said that “global trade and manufacturing have weakened and so have these sectors in Europe… , European exports are softening and prospects for a recovery in global trade are not as strong as they were six months ago”. IMF also urged that “monetary policy should remain accommodative where inflationary pressures are still subdued, which is the case in most European economies.”

Eurozone economy is projected to slow sharply from 1.9% in 2018 to just 1.2% in 2019, revised down from 1.3%. Mild recovery is expected in 2020 by 1.4% (revised down from 1.5%), and stay there in 2021. Headline inflation to projected to slow from 1.8% in 2018 to 1.2% in 2019 (revised down from 1.3%), then climb to 1.4% in 2020 (revised down from 1.6%) and then 1.5% in 2021 (revised down from 1.7%).

Eurozone retail sales rose 0.1%, led by automotive fuels

Eurozone retail sales rose 0.1% mom in September, matched expectations. Volume of retail trade increased by 0.4% for automotive fuels and by 0.1% for non-food products while food, drinks and tobacco fell by 0.4%.

EU28 retail sales rose 0.2% mom. Among Member States for which data are available, the highest increases in the total retail trade volume were registered in Croatia (2.6%), Ireland (2.4%) and Romania (0.7%). The largest decreases were observed in Portugal (-2.4%), Latvia (-1.0%) and Slovenia (-0.7%).

Eurozone PMI Services finalized at 52.2, time needed for ECB policy changes to take effect

Eurozone PMI Services was finalized at 52.2 in October, up from September’s reading of 51.6. PMI Composite was finalized at 50.6, up from prior month’s 50.1. Looking at some member states, Germany PMI Composite improved to 48.9, hitting a 2-month high but stayed below 50. Ireland PMI Composite dropped to 89-month low of 50.6. Spain’s reading dropped to 71-month low of 51.2. Though, France and Italy improved to 52.6 and 50.6 respectively.

Chris Williamson, Chief Business Economist at IHS Markit said: “The euro area remained close to stagnation in October, with falling order books suggesting that risks are currently tilted towards contraction in the fourth quarter. While the October PMI is consistent with quarterly GDP rising by 0.1%, the forward looking data points to a possible decline in economic output in the fourth quarter…

“As for the immediate outlook, much depends on geopolitical issues such as US tariff developments and Brexit, though we will also be watching Christine Lagarde’s first policy meeting on 12th December to assess the appetite for further stimulus from the ECB. Time is needed for recent policy changes to take effect, though if the data flow continues to disappoint more action is on the cards for early next year.”

BoJ minutes noted increasing downside risks and discussed policy responses

In the minutes of September BoJ meeting, “members shared the view that, while slowdowns in overseas economies continued to be observed and their downside risks seemed to be increasing, it was becoming necessary to pay closer attention to the possibility that the momentum toward achieving the price stability target would be lost.”

One member warned “given the concern that the delay in the recovery in overseas economies would have a negative impact on Japan’s economic activity and prices, it was necessary to consider desirable policy responses while paying attention to the side effects.”

Another member also urged that BOJ must consider “all possible policy measures without preconception, including cutting the short-term policy interest rate, lowering the target level of 10-year JGB yields, expanding asset purchases, and accelerating the expansion of the monetary base”

Also, it’s noted noted that “there was relatively large room for monetary easing among yields in the short- to medium-term zone, and lowering the short-term policy interest rate was deemed appropriate.”

New Zealand unemployment rate rose to 4.2%, but RBNZ will still hold next week

New Zealand employment grew 0.2% in Q3, slowed from 0.6% in Q2, missed expectation of 0.3%. Unemployment rose rose sharply to 4.2%, up from 3.9%, higher than expectation of 4.1%. Labor force participation rate rose 0.1% to 70.4%. Labor cost index rose 0.6% qoq, matched expectations.

Despite the surge in unemployment rate, it’s still lower than the 4.4% forecast by RBNZ in the August Monetary Policy Statement. Then, there should be any change to RBNZ’s decision next week, when markets are expecting a hold. Nevertheless, the data still raises some concern over the sustainability of of impact of RBNZ’s -50bps rate cut back in August.

USD/CHF Mid-Day Outlook

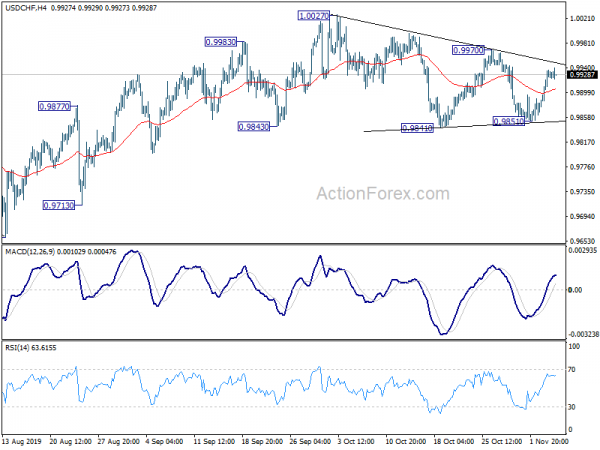

Daily Pivots: (S1) 0.9889; (P) 0.9913; (R1) 0.9950; More…

USD/CHF is staying in consolidation pattern from 1.0027 and intraday bias remains neutral. Further rise is expected as long as 0.9851 support holds. On the upside, break of 0.9970 will bring retest of 1.0027 resistance next. On the downside, though, break of 0.9851 will indicate completion of whole rise from 0.9659 and turn outlook bearish for retesting this low.

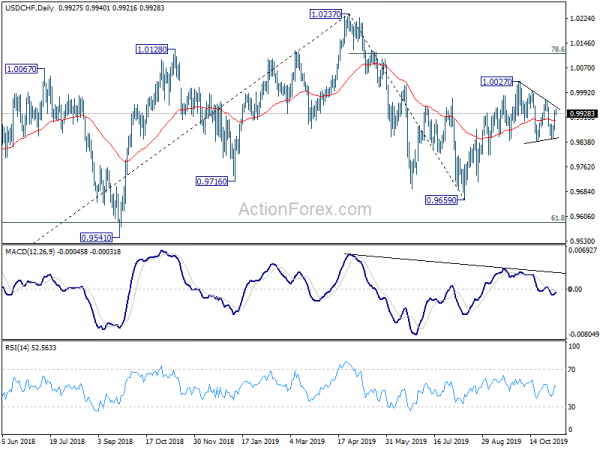

In the bigger picture, medium term outlook remains neutral as USD/CHF is staying in range of 0.9659/1.0237. In any case, decisive break of 1.0237 is needed to indicate up trend resumption. Otherwise, more sideway trading would be seen with risk of another fall. Meanwhile, break of 0.9695 support will target 0.9541 support instead.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Employment Change Q3 | 0.20% | 0.30% | 0.80% | 0.60% |

| 21:45 | NZD | Unemployment Rate Q3 | 4.20% | 4.10% | 3.90% | |

| 21:45 | NZD | Labour Cost Index Q/Q Q3 | 0.60% | 0.60% | 0.80% | |

| 23:50 | JPY | BoJ Minutes | ||||

| 07:00 | EUR | Germany Factory Orders M/M Sep | 1.30% | 0.10% | -0.60% | -0.40% |

| 08:45 | EUR | Italy Services PMI Oct | 52.2 | 51 | 51.4 | |

| 08:50 | EUR | France Services PMI Oct | 52.9 | 52.9 | 52.9 | |

| 08:55 | EUR | Germany Services PMI Oct | 51.6 | 51.2 | 51.2 | |

| 09:00 | EUR | Eurozone Services PMI Oct | 52.2 | 51.8 | 51.8 | |

| 10:00 | EUR | Eurozone Retail Sales M/M Sep | 0.10% | 0.10% | 0.30% | 0.60% |

| 10:00 | EUR | Retail Sales Y/Y Sep | 3.10% | 1.50% | 2.10% | 2.70% |

| 13:30 | USD | Nonfarm Productivity Q3 P | -0.30% | 1.00% | 2.30% | |

| 13:30 | USD | Unit Labor Costs Q3 P | 3.60% | 2.70% | 2.60% | |

| 15:00 | USD | Crude Oil Inventories | 1.9M | 5.7M | ||

| 15:00 | CAD | Ivey PMI Oct | 49.3 | 48.7 |