Australian and New Zealand Dollar rise broadly on optimism that US and China are “ahead of schedule” in completing the phase one trade deal. Dollar and Canadian are not too far away but buying is relatively refrained ahead of Fed and BoC rate announcement. On the other hand, European majors are softer as political uncertainty in UK continue. Yen is also weak following strength in treasury yields.

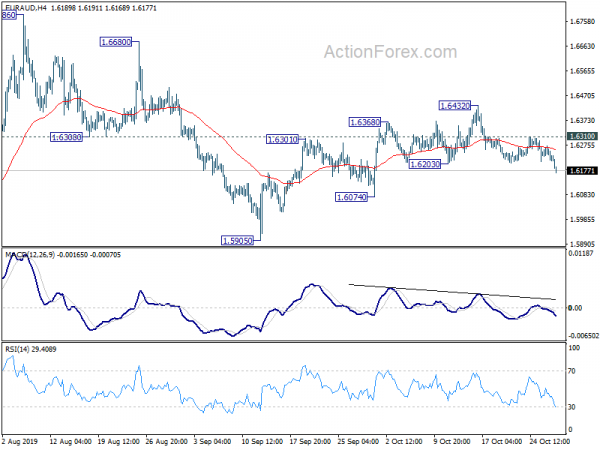

Technically, EUR/AUD’s break of 1.6203 support now suggests that corrective recovery from 1.5905 has completed at 1.6432 already. Deeper fall would be seen back to retest 1.5905 low. The question now is whether EUR/USD would follow and break through 1.1062 minor support for retesting 1.0879 low. Or, AUD/USD would break through 0.6894 resistance to add to the case of medium term bullish reversal. Or, both would happen at the same time. Meanwhile, USD/JPY’s break of 108.93 suggests resumption of whole rise from 104.45 to 109.31 key resistance next.

In Asia, Nikkei closed up 0.47%. Hong Kong HSI and China Shanghai SSE buck the positive sentiment and is down -0.39% and -0.54% respectively. Singapore Strait Times is up 0.40%. Japan 10-year JGB yield is up 0.0216 at -0.110. Overnight, DOW rose 0.49% overnight, while S&P 500 rose 0.56%. NASDAQ rose 1.01%. 10-year yield rose 0.052 to 1.853.

Trump ahead of schedule in China trade deal, S&P500 hit record

US President Donald Trump indicated on Monday that they are “ahead of schedule” on preparing the trade agreement with China for signing at APEC summit in Chile on November 16-17. He said “we’ll call it Phase One but it’s a very big portion.” Also, the deal would “take care of the farmers” and “also take care of a lot of the banking needs.” Meanwhile, US Trade Representative said it is studying whether to extend tariff suspensions on USD 34B of Chinese imports. The exemptions would expire on December 28 this year.

S&P 500 hit new record high at 3044.08 and touched 61.8% projection of 2728.81 to 3027.98 from 2855.94 at 3040.82. Firm break of this projection level will be an indication of underlying medium term momentum. Next target will be 100% projection at 3155.11.

UK Johnson failed to trigger election, accepted Brexit extension

UK Prime Minister Boris Johnson failed in his attempt for snap election, as he got only 299 votes in favor, well short of 424 needed, or two-third absolute majority. After the defeat, he told the parliament, “we will not allow this paralysis to continue and, one way or another, we must proceed straight to an election. This House cannot any longer keep this country hostage.”

Johnson would try an easier route on Tuesday, by proposing a one-line bill that changes the date of the next election to December 12. In this case, he only need a simple majority in the Commons, rather than two-thirds. However, other MPs could set conditions to on the change that Johnson might not like.

Earlier, Johnson wrote to European Council President Donald Tusk to accept the Brexit flextension granted. But he also emphasized, “this unwanted prolongation of the UK’s membership of the EU is damaging to our democracy.” “I would also urge EU member states to make clear that a further extension after 31st January is not possible. This is plenty of time to ratify our deal.”

RBNZ Hawkesby: Tactical rate cut demonstrate determination to meet inflation target

RBNZ Assistant Governor Christian Hawkesby said in a speech the -50bps rate cut back in August was a “tactical decision”. A key part was that front-loading would “give inflation the best chance of meeting our policy objectives”. In particular, “it would demonstrate our ongoing determination to ensure inflation increases to the mid-point of the target”. Such commitment should ” support a lift in inflation expectations and an eventual lift in actual inflation.”

The “regret analysis” suggested ” it would be better to do too much too early, than do too little too late.” The alternative approach could risk “inflation remaining stubbornly below target,”. Inflation expectations could “drift lower” and create an “even more challenging task to achieve our objectives.”

On the data front

Japan Tokyo CPI core was unchanged at 0.5% yoy in October, well below expectation of 0.7% yoy. UK data will be the main focus in European session, with nationwide house price, mortgage approvals and M4 money supply featured. Later in the day, US will release S&P Case Shiller house price and pending home sales. But major focus will be on Conference Board consumer confidence.

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.6208; (P) 1.6240; (R1) 1.6265; More…

EUR/AUD’s break of 1.6203 support suggests that corrective recovery from 1.5905 has completed at 1.6432. Intraday bias is back on the downside for retesting 1.5984/5905 key support zone. Decisive break there will carry larger bearish implication. On the upside, however, break of 1.6310 minor resistance will turn bias back to the upside for 1.6432 resistance again.

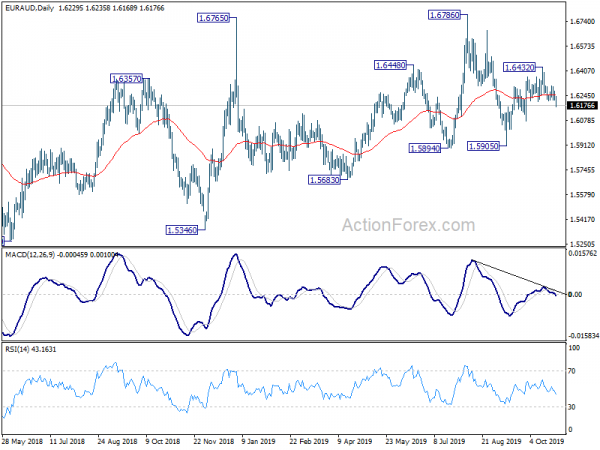

In the bigger picture, as long as 1.5894 support holds, outlook remains bullish. Firm break of 1.6786 will resume up trend from 1.1602 (2012 low). Next upside target is 61.8% retracement of 2.1127 (2008 high) to 1.1602 at 1.7488. However, sustained break of 1.5894 will have 55 week EMA (now at 1.6058) firmly taken out too. That should indicate medium term topping and target 1.5346 key support next.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Core Y/Y Oct | 0.50% | 0.70% | 0.50% | |

| 07:00 | GBP | Nationwide Housing Prices M/M Oct | 0.00% | -0.20% | ||

| 09:30 | GBP | Mortgage Approvals Sep | 65K | 66K | ||

| 09:30 | GBP | M4 Money Supply M/M Sep | 0.30% | 0.40% | ||

| 13:00 | USD | S&P/CS Composite-20 HPI Y/Y Aug | 2.10% | 2.00% | ||

| 14:00 | USD | Consumer Confidence | 128.2 | 125.1 | ||

| 14:00 | USD | Pending Home Sales M/M Sep | 0.90% | 1.60% |