Dollar trades mildly higher in quiet trading today so far, but Euro is a bit stronger. On the other hand, Sterling and Canadian Dollar are the relatively weaker ones. All these four currencies have something to look at this week, which might trigger strong moves. In particular, the greenback could be lifted if Fed indicates that this week’s rate cut is the last in the current mid-cycle adjustment. Dollar will also face tests of GDP, PCE, NFP and ISM too. Sterling and Euro will look into Brexit developments. The Loonie will look into BoC and GDP.

Technically, there is no confirmation in Dollar strength yet. 1.1062 minor support in EUR/USD and 0.6810 minor support in AUD/USD need to be taken out to confirm bottoming in Dollar. Also, USD/JPY needs to take out 108.93 temporary top to confirm rise resumption. USD/CAD is the trickier one as it’s now close to 1.3016 key support but there is no sign of sustainable rebound yet.

In Asia, Nikkei closed up 0.30%. Hong Kong HSI is up 0.88%. China Shanghai SSE is up 0.65%. Japan 10-year JGB yield is up 0.0126 at -0.133.

EU leaders circulating text of three months Brexit extension

It’s widely reported that, despite objection by French President Emmanuel Macron, EU27 leaders were already circulating the draft texts of granting UK a three month Brexit extension to January 31, 2020. But Brexit could happen earlier on November 30 or December 31 if both sides were able to ratify the agreement in respective parliament in time.

The draft noted: “The period provided for in article 50 (3) TEU as extended by the European council decision (EU) 2019/584 is hereby further extended until 31 January 2020. In the event that the parties to that agreement complete their respective ratification procedures and notify the depositary of the completion of these procedures in November 2019, in December 2019 or in January 2020, the withdrawal agreement will enter into into force respectively on [the first of the month of the relevant month].”

EU diplomats will meet in Brussels to discuss the proposal today, a few hours before UK Commons section on general election. Prime Minister Boris Johnson called for generally election on December 12 but it’s believed that he wouldn’t secure two-thirds majority support for the motion.

Former BoJ Shirakawa saw Japanification of policy in the world

Former BoJ Governor Masaaki Shirakawa said in a summit in Shanghai that there is a “Japanification” of monetary and fiscal policy in the world. And, “policy makers and mainstream academics are still obsessed with a specter of deflation.” He added that the goal of monetary and fiscal stimulus should only be to “bring future demand to the present”. But, “the capacity to front-load will be restrained by the country’s potential growth rate, which will be kept low as perpetual low interest rates keep inefficient firms alive.”

Fed, BoC and BoJ to meet, loads of important data too

Three central banks will meet this week. Fed, BoC and BoJ. Fed is generally expected to cut interest rate for the third time, by -25bps to 1.50-1.75%. Traders would be eager to hear Fed indicates that’s the last cut in the current “mid-cycle adjustment”. BoC and BoJ are expected to stand pat. BoC’s statement should reiterate the neutral stance, with focuses on global and trade developments.

In addition to that, there are a large number of important economic data featured. From US, consumer confidence, GDP, PCE inflation and ISM manufacturing are the main focuses. Eurozone GDP and CPI flash. UK will release PMI manufacturing. Canada GDP, Australia CPI, China PMIs will also be featured.

Here are some highlight for the week:

- Monday: Japan corporate service price index; Eurozone M3; UK CBI realized sales; US goods trade balance, wholesale inventories.

- Tuesday: Japan Tokyo CPI; UK M4 money supply, mortgage approvals; US S&P Case Shiller house price, consumer confidence,m pending home sales.

- Wednesday: Japan retail sales; Australia CPI; French GDP; German CPI, unemployment; Swiss KOF; UK BRC shop price; US GDP, ADP employment, FOMC rate decision; BoC rate decision.

- Thursday: New Zealand building permit, ANZ business confidence; Australia building approvals, import prices, private sector credit; BoJ rate decision, Japan industrial production, consumer confidence, housing starts; China PMIs; Germany retail sales; Eurozone CPI flash, GDP, unemployment rate; Canada GDP, IPPI and RMPI; US personal income and spending, employment cost index, jobless claims, Chicago PMI.

- Friday: Australia PPI, AiG manufacturing index; Japan unemployment rate; China Caixin PMI manufacturing; Swiss CPI, retail sales, PMI; UK PMI manufacturing; US non-farm payroll, ISM manufacturing, construction spending.

AUD/USD Daily Outlook

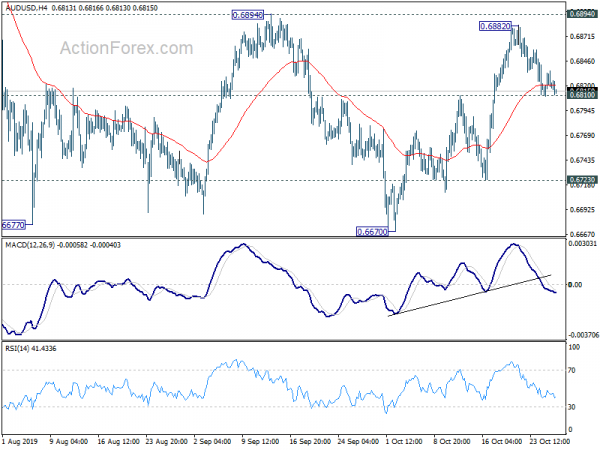

Daily Pivots: (S1) 0.6808; (P) 0.6822; (R1) 0.6835; More…

Intraday bias in AUD/USD remains neutral with focus on 0.6810 resistance turned support. Firm break there should confirm completion of corrective rise from 0.6670. Intraday bias will be turned back to the downside for 0.6723 first. Break will bring retest of 0.6677 low. In any case, outlook will stay bearish as long as 0.6894 resistance holds and larger down trend is expected to resume sooner or later. However, firm break of 0.6894 will dampen our bearish view and turn focus back to 0.7082 key resistance.

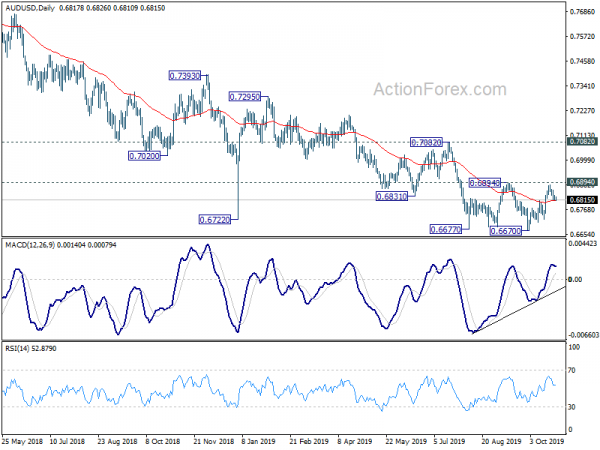

In the bigger picture, decline from 0.8135 (2018 high) is seen as resuming the long term down trend from 1.1079 (2011 high). Next target is 0.6008 (2008 low). On the upside, break of 0.7082 resistance is needed to be the first sign of medium term bottoming. Otherwise, outlook will remain bearish even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Index Y/Y Sep | 0.50% | 0.50% | 0.60% | 0.50% |

| 7:00 | EUR | Germany Import Price Index M/M Sep | 0.10% | -0.60% | ||

| 9:00 | EUR | Eurozone M3 Money Supply Y/Y Sep | 5.70% | 5.70% | ||

| 11:00 | GBP | CBI Realized Sales M/M Oct | -25% | -16% | ||

| 12:30 | USD | Wholesale Inventories Aug P | 0.30% | 0.20% | ||

| 12:30 | USD | Goods Trade Balance (USD) Sep | -73.5B | -72.8B |