The forex markets remain generally steady in early US session. ECB rate decision triggered little reactions as widely expected. Also, markets was also indifferent to poor PMIs from Eurozone. Meanwhile, weak durable goods orders report from US was shrugged off. And positive news regarding US-China trade deal was ignored. The only exception is that Canadian dollar is riding on rebound in oil price and strengthens mildly.

Technically, USD/CAD is set to taken on 1.3016 key support level. Decisive break there will be a strong sign of medium term bearish reversal. Both AUD/USD and EUR/AUD reflect some weakness in Australian Dollar, which might persist for a while. USD/JPY, EUR/JPY and GBP/JPY are staying in tight range. There is prospect of upside breakouts should S&P 500 head toward record high.

In Europe, FTSE is up 0.92%. DAX is up 0.54%. CAC is up 0.37%. German 10-year yield is up 0.0204 at -0.370. Earlier in Asia, Nikkei rose 0.55%. Hong Kong HSI rose 0.87%. China Shanghai SSE dropped -0.02%. Singapore Strait Times rose 0.78%. Japan 10-year JGB yield dropped -0.0083 to -0.146.

ECB stands pat, incoming data confirmed protracted weakness in growth dynamics

ECB left monetary policy unchanged as widely expected. Main refinancing rate is held at 0.00%. Marginally lending and deposit rates are held at 0.25% and -0.50% respectively. Forward guidance was unchanged that key ECB interest rates will remain at present or lower levels “until it has seen the inflation outlook robustly converge to a level sufficiently close to, but below, 2% within its projection horizon, and such convergence has been consistently reflected in underlying inflation dynamics.”

In the post meeting press conference, President Mario Draghi warned that “the incoming data since the last Governing Council meeting in early September confirm our previous assessment of a protracted weakness in the euro area growth dynamics, the persistence of prominent downside risk, and muted inflation pressures.”

And, “the Governing Council reiterated the need for a highly accommodative stance of monetary policy for a prolonged period of time to support underlying inflation pressures and headline inflation developments over the medium term.” Also, “the Governing Council continues to stand ready to adjust all of its instruments as appropriate to ensure that inflation moves toward its aim in a sustained manner in line with its commitment to symmetry.”

Eurozone PMI composite at 50.2, points to just 0.1% growth in Q4

Eurozone PMI Manufacturing was unchanged at 45.7 in October, below expectation of 46.0. PMI Services rose slightly to 51.8, up from 51.6, but missed expectation of 51.9. PMI Composite rose to 50.2, up from 50.1.

Chris Williamson, Chief Business Economist at IHS Markit said: “The eurozone economy started the fourth quarter mired close to stagnation, with the flash PMI pointing to a quarterly GDP growth rate of just under 0.1%. The manufacturing downturn remains the fiercest since 2012, and continues to infect the service sector… A further deterioration in jobs growth adds to the risk that the trade-led weakening is spreading further to the household sector”.

“The survey indicates that Mario Draghi’s tenure at the helm of the ECB ends on a note of near-stalled GDP, slower jobs growth, near-stagnant prices and growing pessimism about the outlook, piling pressure on Christine Lagarde to drive new solutions to the eurozone’s renewed malaise.”

German PMIs: Increasing strains on domestic economy

Germany PMI Manufacturing rose to 41.9 in October, up from 41.7, and missed expectation of 42.0. That was just a marginal improvement from September’s 10-year low. PMI Services dropped to 51.2, down from 51.4, missed expectation of 51.7. That’s also the worst reading in 37 months. PMI Composite rose to 48.6, little change from seven-year low of 48.5 in September.

Phil Smith, Principal Economist at IHS Markit said: “Hopes of a return to growth in Germany in the final quarter have been somewhat dashed by the October flash PMI numbers, which show business activity in the eurozone’s largest economy contracting further and underlying demand continuing to soften… Perhaps most concerning are the signs of increasing strain on the domestic economy, with growth of service sector activity slowing to the weakest since September 2016 and employment now in decline for the first time in six years.”

France PMI composite rose to 52.6, manufacturing still lags

France PMI Manufacturing rose to 50.5 in October, up from 50.1 and beat expectation of 50.3. PMI Services also rose to 52.9, up from 51.1, and beat expectation of 51.8. PMI Composite rose notably to 52.6, up from 50.8.

Eliot Kerr, Economist at IHS Markit said: “The private sector rebounded at the start of the start of the fourth quarter. A recovery in manufacturing output coupled with faster growth in services saw total activity rise solidly. That said, the rate of expansion in manufacturing continued to notably lag behind that registered in the service sector, extending the trend seen throughout the majority of 2019 so far. Nonetheless, the data are consistent with the continuation of solid gains in both official economic output and employment heading into the end of the year.”

Navarro: US-China trade deal phase 1 adopts the entire IP chapter in May’s deal

White House economic adviser Peter Navarro told Fox Business Network that the “good news” about US-China trade deal phase one is that “it adopted virtually the entire chapter in the deal last May that they reneged on for IP”. Hence, “practically it means, if they steal our IP we’ll be able to take retaliatory action without them retaliating.”

Separately, it’s reported that China aims to buy at least USD 20B of American farm products in the first year, as part of the phase one deal. That would bring purchases back to the level in 2017, before trade war began. In the second year of a final deal, purchases could rise further to USD 40B-50B, when all punitive tariffs are removed.

US initial jobless claims dropped to 212k, durable goods orders dropped -1.1%

US initial jobless claims dropped -6k to 212k in the week ending October 19, below expectation of 216k. Four-week moving average of initial claims dropped -0.75k to 215k. Continuing claims dropped -1k to 1.682m in the week ending October 12. Four-week moving average of continuing claims rose 6.5k to 1.677m.

Durable goods orders dropped -1.1% in September to USD 248.2B, well below expectation of -0.5%. Ex-transport orders dropped -0.3%, versus expectation of -0.2%. Ex-defense orders dropped -1.2%.

Japan PMI manufacturing dropped to 48.5, lowest since June 2016

Japan PMI Manufacturing dropped to 48.5 in October, down from 48.9 and missed expectation of 49.2. That’s the sixth successive sub-50 reading, and lowest since June 2016. PMI Services dropped to 50.3, down from 52.8. PMI Composite dropped to 49.8, down from 51.5.

Joe Hayes, Economist at IHS Markit said: “Japan’s economy hit a widely-expected bump in October following the consumption tax increase which took effect during the month. However, the impact has been somewhat obscured by the typhoon, which panelists, particularly in the service sector, were disrupted by…. Overall it seems that temporary domestic factors have been the primary cause of reduced output at the start of the fourth quarter, suggesting there is potential for some pay-back in November.”

Australia PMI composite dropped to 50.7, subdued start of Q4

Australian CBA PMI Manufacturing dropped to 50.1 in October, down from 50.3. CBA PMI Services dropped sharply from 52.4 to 50.8. PMI Composite dropped from 52.0 to 50.7. The reading suggested subdued business conditions at the start of Q4. Output rose at a softer pace amid the weakest new order growth since April. Business confidence also softened and firms raised their staffing levels only marginally. Meanwhile, input costs continued to increase at a marked pace, leading firms to raise their own selling prices to the greatest extent since last November in a bid to protect profit margins.

CBA Chief Economist, Michael Blythe said: “The trade war and other uncertainties mean businesses are deferring capex and consumers are putting off spending. The resulting drop in production has pulled global manufacturing PMIs lower, taking services PMIs along for the ride. Australian manufacturing and service firms are not immune to these global trends. The ongoing weakness in the flash PMI readings for October should be judged against this global backdrop. Australia is faring a little better than the global trend. PMI readings remain in expansion territory, albeit just. Employment is still growing and longer-run expectations are still positive”.

EUR/USD Mid-Day Outlook

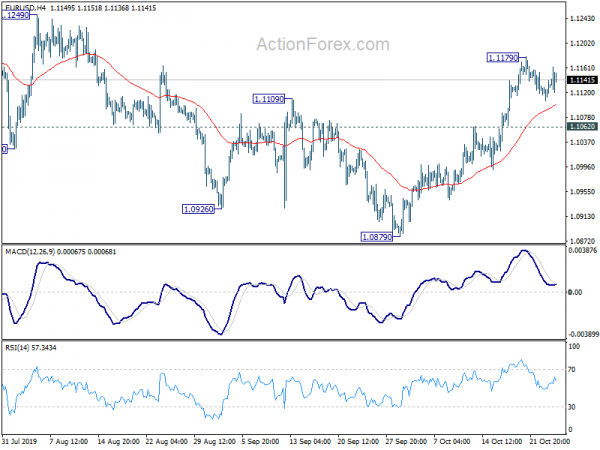

Daily Pivots: (S1) 1.1111; (P) 1.1126; (R1) 1.1145; More…

EUR/USD is staying in consolidation from 1.1179 and intraday bias remains neutral first. Another retreat could be seen. But downside should be contained by 1.1602 support to bring another rally. On the upside, break of 1.1179 will resume the rally from 1.0879 to 1.1412 key resistance next. However, break of 1.1062 will turn focus back to 1.0879 low instead.

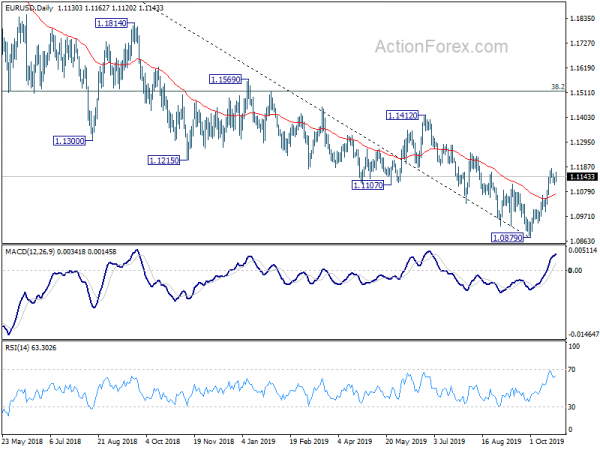

In the bigger picture, at this point, rebound from 1.0879 is seen as a corrective move first. Hence, upside should be limited by 38.2% retracement of 1.2555 to 1.0879 at 1.1519. And, down trend from down trend from 1.2555 (2018 high) would resume at a later stage. However, sustained break of 1.1519 will dampen this bearish view and bring stronger rise to 61.8% retracement at 1.1915 next.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:00 | AUD | CBA Manufacturing PMI Oct P | 50.1 | 49 | 50.3 | |

| 22:00 | AUD | CBA Services PMI Oct P | 50.8 | 52.2 | 52.4 | |

| 00:30 | JPY | Jibun Bank Manufacturing PMI Oct P | 48.5 | 49.2 | 48.9 | |

| 08:15 | EUR | France Manufacturing PMI Oct P | 50.5 | 50.3 | 50.1 | |

| 08:15 | EUR | France Services PMI Oct P | 52.9 | 51.8 | 51.1 | |

| 08:30 | EUR | Germany Manufacturing PMI Oct P | 41.9 | 42 | 41.7 | |

| 08:30 | EUR | Germany Services PMI Oct P | 51.2 | 51.7 | 51.4 | |

| 08:30 | GBP | BBA Mortgage Approvals Sep | 42.310K | 42.576K | 42.527K | |

| 08:30 | EUR | Eurozone Manufacturing PMI Oct P | 45.7 | 46 | 45.7 | |

| 08:30 | EUR | Eurozone Services PMI Oct P | 51.8 | 51.9 | 51.6 | |

| 11:45 | EUR | ECB Interest Rate Decision | 0.00% | 0.00% | 0.00% | |

| 11:45 | EUR | ECB Deposit Rate Decision | -0.50% | -0.50% | -0.50% | |

| 12:30 | EUR | ECB Press Conference | ||||

| 12:30 | USD | Initial Jobless Claims (Oct 18) | 212K | 216K | 214K | 218K |

| 12:30 | USD | Durable Goods Orders Sep | -1.10% | -0.50% | 0.20% | 0.30% |

| 12:30 | USD | Durable Goods Orders ex Transportation Sep | -0.30% | -0.20% | 0.50% | 0.30% |

| 13:45 | USD | Manufacturing PMI Oct P | 50.5 | 51.1 | ||

| 13:45 | USD | Services PMI Oct P | 51 | 50.9 | ||

| 14:00 | USD | New Home Sales Sep | 710K | 713K | ||

| 14:30 | USD | Natural Gas Storage | 87B | 104B |