Consolidative trading continues in the forex markets as major pairs are crosses are stuck in tight range. Yen weakened mildly overnight but there was no follow through selling through recent highs. European majors are also mildly softer, without sustainable decline. ECB meeting is a focus today but it will very likely be a non-event. Instead, the economic data would be the drivers, including Eurozone PMIs and US durable goods orders.

Technically, EUR/GBP would be one today watch today as consolidation from 0.8575 temporary low is about to complete. Break of this support will resume larger fall from 0.9324 to 0.8472 support next. On the other hand, EUR/AUD seems to have draw solid support from 1.6203 support. Further recovery would retain near term bullishness through 1.6432 resistance. But firm break of 1.6203 a sign of near term bearish reversal, for 1.5905 support. Price actions in these two crosses could be quick tricky.

In Asia, currently, Nikkei is up 0.59%. Hong Kong HSI is up 0.47%. China Shanghai SSE is down -0.22%. Singapore Strait Times is up 0.82%. Japan 10-year JGB yield is up 0.005 at -0.133. Overnight, DOW rose 0.17%. S&P 500 rose 0.28%. NASDAQ rose 0.19%. 10-year yield dropped -0.09 to 1.759.

Euro mildly softer ahead of Draghi’s last ECB meeting

Euro follows other European majors and is trading generally lower this wee. Focus turns to Mario Draghi’s last monetary policy meeting as ECB President today. After the stimulus package announced last month, no new measure is expected this time. Instead, Draghi could make use of the opportunity to defend the latest policy changes. In particular, the minutes for the September meeting revealed that the members were divided over QE resumption. This not only would be the focus in the Q&A session, but also a legacy left to the incoming president, Christina Lagarde.

Some suggested previews:

- ECB Preview – President Draghi’s Last Speech to Remain Dovish as He Leaves a Divided ECB to Lagarde

- Special Report On ECB: Draghi To Shout Out Loud

- Soft ECB Meeting Amid Draghi’s Departure

- As Lagarde Prepares to Take Over the Helm, Troubles Brew at the ECB; How Will Euro be Affected?

No EU decision on Brexit extension until Friday

EU27 is said to be generally supportive to giving UK another Brexit extensions. But there are some minor differences on the duration. A final decision might not be made until Friday. The question is on whether to follow European Council President Donald Tusk’s recommendation of a three-month delay through a “written procedure”. Or, leaders would likely to France’s idea of a shorter extension, possibly to November 15 only.

In UK, Prime Minister Boris Johnson failed to agree on a timetable for the Brexit bill with Labour leader Jeremy Corbyn yesterday. Johnson could opt for a general election if the parliament is seen as unwilling to vote for the Brexit deal. But it’s reported that his own Conservative party is 50/50 split on the idea of election. Meanwhile, Corbyn is also said to be facing significant pressure from Labour to resist any call for an imminent election.

Japan PMI manufacturing dropped to 48.5, lowest since June 2016

Japan PMI Manufacturing dropped to 48.5 in October, down from 48.9 and missed expectation of 49.2. That’s the sixth successive sub-50 reading, and lowest since June 2016. PMI Services dropped to 50.3, down from 52.8. PMI Composite dropped to 49.8, down from 51.5.

Joe Hayes, Economist at IHS Markit said: “Japan’s economy hit a widely-expected bump in October following the consumption tax increase which took effect during the month. However, the impact has been somewhat obscured by the typhoon, which panelists, particularly in the service sector, were disrupted by…. Overall it seems that temporary domestic factors have been the primary cause of reduced output at the start of the fourth quarter, suggesting there is potential for some pay-back in November.”

Australia PMI composite dropped to 50.7, subdued start of Q4

Australian CBA PMI Manufacturing dropped to 50.1 in October, down from 50.3. CBA PMI Services dropped sharply from 52.4 to 50.8. PMI Composite dropped from 52.0 to 50.7. The reading suggested subdued business conditions at the start of Q4. Output rose at a softer pace amid the weakest new order growth since April. Business confidence also softened and firms raised their staffing levels only marginally. Meanwhile, input costs continued to increase at a marked pace, leading firms to raise their own selling prices to the greatest extent since last November in a bid to protect profit margins.

CBA Chief Economist, Michael Blythe said: “The trade war and other uncertainties mean businesses are deferring capex and consumers are putting off spending. The resulting drop in production has pulled global manufacturing PMIs lower, taking services PMIs along for the ride. Australian manufacturing and service firms are not immune to these global trends. The ongoing weakness in the flash PMI readings for October should be judged against this global backdrop. Australia is faring a little better than the global trend. PMI readings remain in expansion territory, albeit just. Employment is still growing and longer-run expectations are still positive”.

On the data front

Eurozone PMIs will be major focus in European session. Later in the day, US will release jobless claims, durable goods orders, PMIs and new home sales.

EUR/USD Daily Outlook

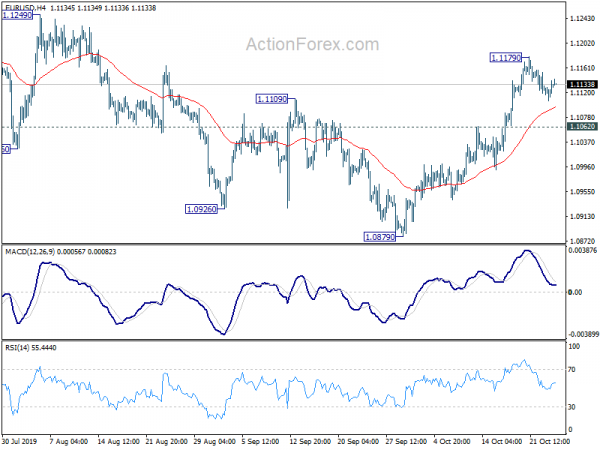

Daily Pivots: (S1) 1.1111; (P) 1.1126; (R1) 1.1145; More…

Intraday bias in EUR/USD remains neutral as consolidation from 1.1179 is extending. Deeper retreat cannot be ruled out. But downside should be contained by 1.1602 support to bring another rally. On the upside, break of 1.1179 will resume the rally from 1.0879 to 1.1412 key resistance next. However, break of 1.1062 will turn focus back to 1.0879 low instead.

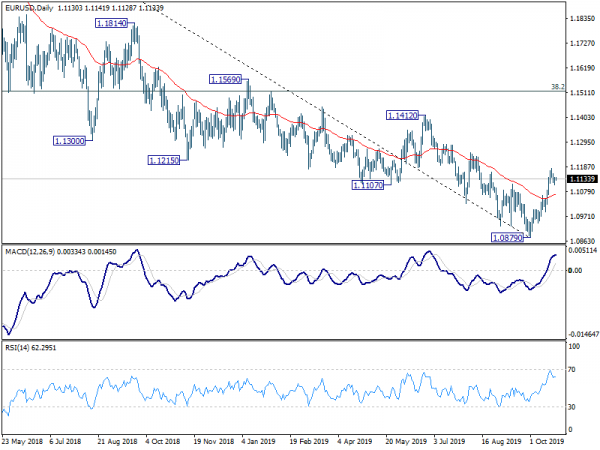

In the bigger picture, at this point, rebound from 1.0879 is seen as a corrective move first. Hence, upside should be limited by 38.2% retracement of 1.2555 to 1.0879 at 1.1519. And, down trend from down trend from 1.2555 (2018 high) would resume at a later stage. However, sustained break of 1.1519 will dampen this bearish view and bring stronger rise to 61.8% retracement at 1.1915 next.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:00 | AUD | CBA Manufacturing PMI Oct P | 50.1 | 49 | 50.3 | |

| 22:00 | AUD | CBA Services PMI Oct P | 50.8 | 52.2 | 52.4 | |

| 00:30 | JPY | Jibun Bank Manufacturing PMI Oct P | 48.5 | 49.2 | 48.9 | |

| 08:15 | EUR | France Manufacturing PMI Oct P | 50.3 | 50.1 | ||

| 08:15 | EUR | France Services PMI Oct P | 51.8 | 51.1 | ||

| 08:30 | EUR | Germany Manufacturing PMI Oct P | 42 | 41.7 | ||

| 08:30 | EUR | Germany Services PMI Oct P | 51.7 | 51.4 | ||

| 09:00 | EUR | Eurozone Manufacturing PMI Oct P | 46 | 45.7 | ||

| 09:00 | EUR | Eurozone Services PMI Oct P | 51.9 | 51.6 | ||

| 08:30 | GBP | BBA Mortgage Approvals Sep | 42.576K | |||

| 11:45 | EUR | ECB Interest Rate Decision | 0.00% | 0.00% | ||

| 11:45 | EUR | ECB Deposit Rate Decision | -0.50% | -0.50% | ||

| 12:30 | EUR | ECB Press Conference | ||||

| 12:30 | USD | Initial Jobless Claims (Oct 18) | 216K | 214K | ||

| 12:30 | USD | Durable Goods Orders Sep | -0.50% | 0.20% | ||

| 12:30 | USD | Durable Goods Orders ex Transportation Sep | -0.20% | 0.50% | ||

| 12:30 | USD | Nondefense Capital Goods Orders ex Aircraft Sep | -0.40% | -0.20% | ||

| 13:45 | USD | Manufacturing PMI Oct P | 50.5 | 51.1 | ||

| 13:45 | USD | Services PMI Oct P | 51 | 50.9 | ||

| 14:00 | USD | New Home Sales Sep | 710K | 713K | ||

| 14:30 | USD | Natural Gas Storage | 104B |