Sterling remains steady today as traders are all holding their bets ahead of tomorrow’s crucial vote on the new Brexit withdrawal agreement. Canadian Dollar follows as second weakest as oil price recovery cannot gather momentum. On the other hand, New Zealand and Australian Dollars firm up mildly. Over the week, however, the Pound remains the strongest one. Swiss Franc and Euro follow as the second strongest. Yen and Dollar are the weakest as easing global uncertainties.

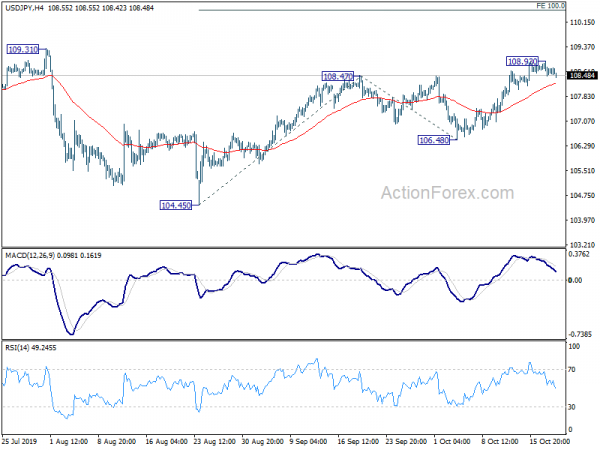

Technically, Yen crosses are losing upside momentum as seen in 4 hour MACD in USD/JPY, EUR/JPY and GBP/JPY. Some consolidation would be seen and would likely extend into early next week. EUR/USD and AUD/USD are both extending recent rebound. EUR/USD is eyeing 1.1249 resistance next and break there will further affirm the case of medium term bullish reversal. For now, while AUD/USD could be seen but we’d still expect strong resistance from 0.6894 to limit upside.

In Europe, currently, FTSE is down -0.13%. DAX is up 0.01%. CAC is down -0.51%. German 10-year yield is up 0.029 at -0.377. Earlier in Asia, Nikkei rose 0.18%. Hong Kong HSI dropped -0.48%. China Shanghai SSE dropped -1.32%. Singapore Strait Times dropped -0.38%. Japan 10-year JGB yield rose 0.0041 to -0.150.

FT predicts Johnson’s Brexit deal to be defeated by 318 to 321

Sterling remains steady today as traders are all holding their bets ahead of tomorrow’s crucial vote on the new Brexit withdrawal agreement. UK Prime Minister Boris Johnson will hold a cabinet meeting at 1500GMT in Downing Street today, in effort to secure support for the bill. At this point, there is no sign that Northern Ireland’s DUP is changing their stance against the plan. ERG chair is holding the cards on his chest. The group is due to meet tomorrow and make a recommendation but Guardian reported that most of the “Spartans” are likely to support. Labour MP John Mann has predicted that “more than nine” of his parliamentary colleagues will vote for Johnson’s deal

Financial Times predict that Johnson’s deal would be voted down by 318-321. The possible supporters include 259 Conservatives, 28 hardline Eurosceptic Conservatives, 20 independent Conservatives, 7 Labour rebels, 3 independents and 1 Lib Dem. The reported noted: “Analysis by the Financial Times suggests that unless the prime minister can persuade the DUP to drop its opposition, or persuade several Labour MPs or independent parliamentarians to support the deal, Mr Johnson will struggle to win a House of Commons majority.”

China GDP growth slowed to 6% in Q3, worst since 1992

China’s GDP growth slowed further to 6.0% yoy in Q3, down from 6.2% yoy in Q2 and missed expectation of 6.1% yoy. That’s also the worst pace since Q1 of 1992, the earliest quarterly data on record. National Bureau of Statistics spokesman Mao Shengyong said China was ” faced with mounting risks and challenges both at home and abroad”. But he attempted to tone down the situation and said ” the national economy maintained overall stability … and improved living standard.” He also added there was ample room for adjustments on monetary policy,

The weak data raised concern that the slowdown this year could be worse than originally expected, as trade war with US weigh. While there appears to be some progresses on trade negotiations, the imposed tariffs are remaining. Uncertainties continued to weigh on business sentiments too. Growth could slow further below 6% handle in Q4.

Nevertheless, on the positive side, industrial production grew 5.8% yoy in September, comfortably beat expectations of 5.0% yoy. That’s also a notably improvement from 4.4% yoy in August. Retail sales growth accelerated to 7.8% yoy, up from 7.5% yoy and matched expectations. Fixed asset investment, however, slowed to 5.4% ytd yoy, down from 5.5% and matched expectations.

Japan CPI core slowed to 0.3%, lowest since Apr 2017

Japan CPI core (all items ex-fresh food), slowed to 0.3% yoy in September, down from 0.5% yoy, matched expectation of 0.3% yoy. That’s also the lowest level in more than two years since April 2017, and drifted further away from BoJ’s 2% target. All items CPI slowed to 0.2% yoy, down from 0.3% yoy and matched expectations. CPI core-core (all items ex-fresh food and energy) slowed to 0.5% yoy, down form 0.6% yoy, matched expectation but remained sluggish.

Japan Finance minister Taro Aso said yesterday that the government was ready to ramp up stimulus to guard against risks from slowing global growth and US-China trade tensions. He said after a meeting of G20 finance leaders, “Given uncertainty over the global economy, exports are falling and weighing on manufacturers’ output. But the weakness has yet to spread to non-manufacturers or domestic demand.

Ado added, “if we need to compile some form of an economic stimulus package, we are ready to take various types of fiscal measures flexibly”. He also emphasized that “When you look back at the problems Japan faced, including deflation, they can’t be fixed by monetary policy alone. You need a coordinated monetary and fiscal response.”

Separately, the good news is that the government estimated the US-Japan trade deal will boost Japan’s economy by 0.8%. There will be around JPY 4T contribution to GDP based on its fiscal 2018 figures. Also, the deal will create around 280k jobs.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 108.42; (P) 108.68; (R1) 108.90; More…

Intraday bias in USD/JPY remains neutral for consolidation below 108.93 temporary top. Deep retreat could be seen to 4 hour 55 EMA (now at 108.22) and below. But downside should be contained well above 106.48 support to bring another rise. On the upside, above 108.93 will target 109.31 key resistance. Decisive break there will carry larger bullish implications next target will be 100% projection of 104.45 to 108.47 from 106.48 at 110.50.

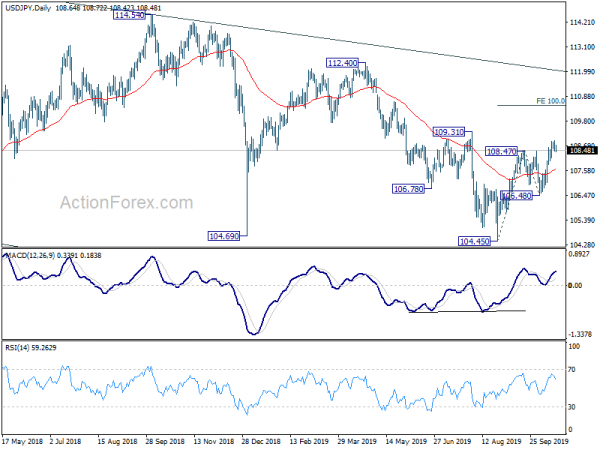

In the bigger picture,strong support was seen from 104.62 again. Yet, there is no confirmation of medium term reversal. Corrective decline from 118.65 (Dec. 2016) could still extend lower. But in that case, we’d expect strong support above 98.97 (2016 low) to contain downside to bring rebound. Meanwhile, on the upside, break of 112.40 key resistance will be a strong sign of start of medium term up trend.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | National CPI Core Y/Y Sep | 0.30% | 0.30% | 0.50% | |

| 2:00 | CNY | GDP Y/Y Q3 | 6.00% | 6.10% | 6.20% | |

| 2:00 | CNY | Retail Sales Y/Y Sep | 7.80% | 7.80% | 7.50% | |

| 2:00 | CNY | Industrial Production Y/Y Sep | 5.80% | 5.00% | 4.40% | |

| 2:00 | CNY | Fixed Asset Investment YTD Y/Y Sep | 5.40% | 5.40% | 5.50% | |

| 8:00 | EUR | Current Account (EUR) Aug | 27.0B | 21.3B | 20.5B |