Quick update: Sterling jumps sharply after BoE governor Mark Carney’s comments. He said that "these are some of the issues that the MPC will debate in the coming months," Carney said. "Some removal of monetary stimulus is likely to become necessary if the trade-off facing the MPC continues to lessen and the policy decision accordingly becomes more conventional."

Euro retreats sharply on report that markets has overreacted to ECB President Draghi’s comment yesterday. Bloomberg quoted unnamed source saying that Draghi’s comments were intended to strike a balance between recognizing Eurozone’s strength while maintaining that policy accommodation is still needed. In particular, the reactions were hyper sensitive to Draghi’s comment that "the threat of deflation is gone and reflationary forces are at play". EUR/USD hits as high as 1.1387 earlier today but is now back at 1.1330 after breaching 1.13 handle briefly. EUR/GBP also breached 0.8851/8865 key resistance zone earlier today but is back at 0.8830. Meanwhile, the development also triggered recovery in USD/CHF to as high as 0.9646.

Technically, Euro would likely turn into consolidation first before traders make up their mind on what to believe in. As long as 1.1118 support holds, EUR/USD stays bullish for further rally. As long as 124.64 support holds, EUR/JPY also stays bullish. And, as long as 0.8718 support holds, EUR/GBP also remains bullish in near term.

ECB Vice Constancio: Slack is bigger than they judge

ECB Vice President Vitor Constancio questioned whether the central bank’s measures of the slack of the economy is correct. He pointed out that "domestic factors of inflation starting with wage and cost developments and then also price decisions are not responding the way we would expect in view of our more common estimates of this slack." He said that unemployment in Eurozone is at 9.3% according to "normal international standard" of measurement. However, it would be 18% if ECB uses the broader concept as in US. Hence, the slack is "bigger" than ECB could judge some time ago.

BoE Cunliffe wants more time before hiking

BoE Deputy Governor Jon Cunliffe said he would prefer more time to see how things evolve before raising interest rate. He pointed to slowing consumer spending as households’ real incomes were squeezed by higher inflation. While some of the effect would be offset by growth in business investment and exports, he "wanted to see how that plays out". Meanwhile, looking at domestic inflation pressure, Cunliffe said the data "gives us a bit of time to see how this evolves". While inflation above target is "not a comfortable place" for any MPC member, it’s important to see how much was generated domestically, comparing to the consequence of Sterling’s depreciation. He highlighted slow wage growth as averages earnings rose just 1.7% in the three months to April, lowest since January 2015.

IMF lowered US growth forecast

Yesterday, IMF lowered US growth forecast in 2017 to 2.1%, down from April projection of 2.3%. For 2018, growth projection was also lowered to 2.1%, down from 2.5%. IMF director of the Western Hemisphere Department Alejandro Werner said that given the uncertainty of US President Donald Trump’s policies, "we have removed the assumed fiscal stimulus from our forecast". Also, IMF noted that even with an "ideal constellation of pro-growth policies, the potential growth dividend is likely to be less than that projected in the budget and will take longer to materialize." That is, IMF is not convinced that Trump’s policy, even if implemented, could bring 3% growth in US by 2020.

On the data front

US wholesale inventories rose 0.3% in May versus expectation of 0.2%. Trade deficit narrowed slightly to USD -66.0b in May. Eurozone M3 money supply rose 5.0% yoy in May. Swiss UBS consumption indicator rose to 1.39 in May. German import price index dropped -1.0% mom in May.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1227; (P) 1.1288 (R1) 1.1398; More….

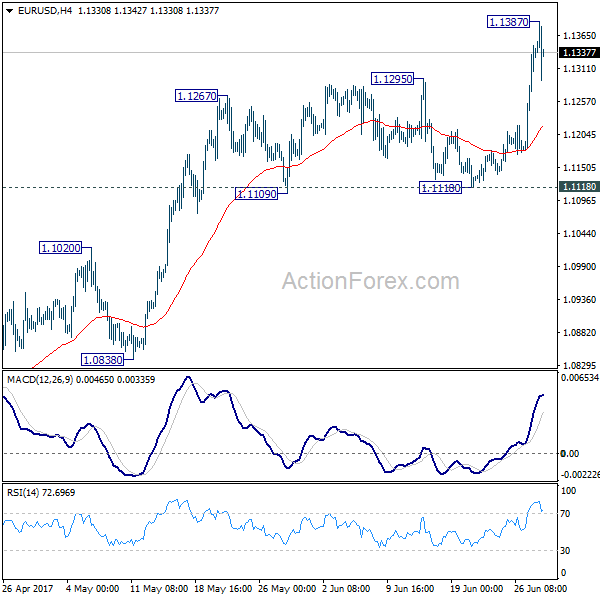

EUR/USD surges to as high as 1.1387 today but retreats sharply since then. A temporary top should be in place and intraday bias is turned neutral for consolidation first. Downside of retreat is expected to be contained well above 1.1118 support to bring rally resumption. Above 1.1387 will extend the larger rally to 1.1615 resistance next. However, break of 1.1118 will now confirm short term topping and bring deeper pull back.

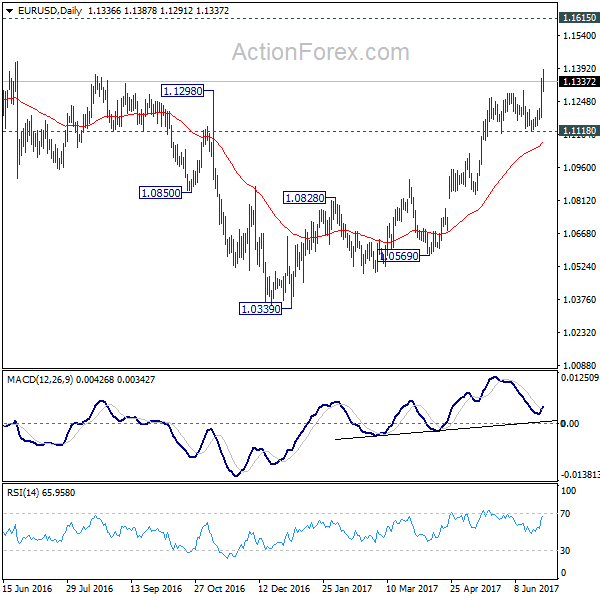

In the bigger picture, the break of 1.1298 resistance further affirm medium term reversal. That is an important bottom was formed at 1.0339 on bullish convergence condition is seen in weekly MACD. Further rise would be seen to 55 month EMA (now at 1.1776). Sustained break there will pave the way to 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 next. This will now remain the favored case as long as 1.1118 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 06:00 | EUR | German Import Price Index M/M May | -1.00% | -0.60% | -0.10% | |

| 06:00 | CHF | UBS Consumption Indicator May | 1.39 | 1.48 | 1.34 | |

| 08:00 | EUR | Eurozone M3 Y/Y May | 5.00% | 5.00% | 4.90% | |

| 12:30 | USD | Advance Goods Trade Balance May | -66.0B | -66.2B | -67.1B | -67.0B |

| 12:30 | USD | Wholesale Inventories May P | 0.30% | 0.20% | -0.50% | -0.40% |

| 14:00 | USD | Pending Home Sales M/M May | 0.80% | -1.30% | ||

| 14:30 | USD | Crude Oil Inventories | -2.5M |