Euro soared overnight as propelled by comments from ECB President Mario Draghi, taking out key resistance levels against Dollar and Yen. The common currency remains firm in Asian session. On the other hand, Dollar and Yen are trading among the weakest ones. The greenback is additional pressured, together with US stocks, as delay in healthcare vote in Senate again raised questions on US President Donald Trump’s ability to push through economic agenda. Draghi’s comment also pushed German bond yields higher, which was then followed in US bond markets. Yen suffered deeply with the rebound in bond yields. Meanwhile, Canadian Dollar is helped by the rebound in oil prices, partly thanks to the decline in Dollar. WTI crude oil is back above 44 even though there is no clear momentum to regain 45 handle yet. Gold is back above 1250, also as a reaction to Dollar selloff.

Stocks tumbled as Senate postponed healthcare vote

US Senate Republicans postponed the vote on the healthcare bill that overhauls Obamacare. Senate Majority Leader Mitch McConnell is pushing to vote ahead of July 4 and pledged to "press on". US President Donald Trump warned that it’s crucial to reach an agreement because Obamacare was "melting down". However, there is so far still no consensus among Republicans on the form of the bill and thus, not enough votes are secured. And the markets perceive the development as another sign that Trump continues to lose political support. And it would continue to be hard for him to push through economic policies and tax reforms. That’s seen as a key reason for the selloff in US stocks.

DOW closed down -98.89 pts, or -0.46%, at 21310.66. S&P 500 lost -19.69 pts, or -0.81%, to 2419.38. NASDAQ dropped -100.53 pts, or -1.61%, to close at 6146.62. NASDAQ’s rebound in the past two weeks failed below 6341.70 high. Yesterday’s sharp fall suggests that the correction from 6341.70 is now extending with another falling leg. Focus is back on 55 day EMA (now at 6114.40), which is close to medium term channel support. A firm break there will open up the case for deeper fall to 38.2% retracement of 5034.31 to 6341.70 at 5842.31. That could drag down other major indices and be a negative factor for Dollar.

Diverging views from Fed officials, market shrugged

Fed chair Janet Yellen maintained that "it will be appropriate to the attainment of our goals to raise interest rates very gradually to levels that are likely to remain quite low, although there is uncertainty about this, to remain low by historical standards for a long time." Philadelphia Fed President Patrick Harker said that he’s "sticking to my outlook that we’re on the right path". And, "in the case of inflation, I’ve seen the factors exerting downward pressure as temporary." He still see "another rate hike as appropriate for 2017". Minneapolis Fed President Neel Kashkari questioned "what’s the rush" for another rate hike in his speech. Kashkari is a known dove who dissented both of Fed’s hikes this year. And he said that "we’re not seeing wages climb very fast, and we’re not seeing inflation. That tells me the economy is not on the verge of overheating." Overall, the markets had little reactions to the Fedspeaks.

Optimistic Draghi propelled Euro higher

ECB President Mario Draghi’s comment pushed Euro sharply higher overnight. German bond yield was also lifted with 10 year yield jumping to 1 month high at 0.35%. 2 year yield hit -0.56%, highest in a year. The key takeaways from Draghi are that firstly, he isn’t concerned with recent slowdown in Eurozone inflation. He noted that the slowdowns "are on the whole temporary and should not cause inflation to deviate from its trend over the medium term, so long as monetary policy continues to maintain the solid anchoring of inflation expectations." Secondly, he is optimistic on growth as "all the signs now point to a strengthening and broadening recovery in the euro area". And, "political winds are becoming tailwinds." He noted there is "newfound confidence in the reform process, and newfound support for European cohesion, which could help unleash pent-up demand and investment."

And most importantly, Draghi opened up the ways to stop of even reverser the massive quantitative easing program. He said that "as the economy continues to recover, a constant policy stance will become more accommodative, and the central bank can accompany the recovery by adjusting the parameters of its policy instruments – not in order to tighten the policy stance, but to keep it broadly unchanged." That is, Draghi is hinting that monetary policy in 2018 will be less accommodative. And he’s paving the way to tweaking policies ahead. It’s affirming the view that ECB will announce scaling back of asset purchase, at least, in September.

France and Germany to drive an impetus in EU

Frans Timmermans, deputy head of the EU’s executive European Commission, expressed his optimism on EU’s development and said that integration is a "foregone conclusion". He acknowledged that "over the last years, rightly or wrongly, the impression was created that Germany is too dominant." But now, France is taking "steps in a more assertive way" and that’s good for Europe, France and especially Germany. He noted there will be an "impetus" driven by France and Germany ahead and other member states are getting organized.

Hammond and Davis at odds on Brexit transition

In UK, it’s reported that Chancellor of Exchequer Philip Hammond and Brexit Minister David Davis are at odds over the Brexit deal. Hammond warned in a speech that negotiations would be jeopardized if parties allowed "petty politics to interfere with economic logic". And he reiterated the warnings about a "cliff edge" of tariffs". He urged the government to work out a transitional arrangement that "allows the complex supply chains and business relationships that crisscross our continent to continue to deliver value". On the other hand, Davis said that UK would be straight out of the customs union and any transition period will likely end in 2022. He commented that Hammond’s time lines were "not quite consistent with one another".

On the data front

German import price, Eurozone M3 and Swiss UBS consumption indicator will be released in European session. US will release trade balance, wholesales inventories and pending home sales.

EUR/JPY Daily Outlook

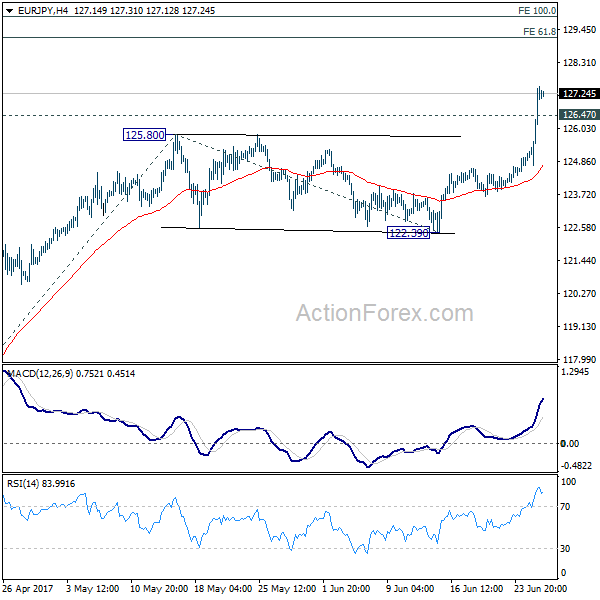

Daily Pivots: (S1) 125.58; (P) 126.52; (R1) 128.32; More…

EUR/JPY soared sharply to as high as 127.47 so far and remains firm. The break of 126.09 key resistance carries larger bullish implications. Intraday bias remains on the upside and current rally would target 61.8% projection of 114.84 to 125.80 from 122.39 at 129.16 first. That’s also close to medium term projection level at 129.89. On the downside, below 126.47 minor support will turn bias neutral and bring retreat first, before staging another rally.

In the bigger picture, the break of 126.09 support turned resistance should have confirmed completion of down trend form 149.76 (2014 high), at 109.03 (2016 low). Current rise from 109.03 should target 100% projection of 109.03 to 124.08 from 114.84 at 129.89 first. Break there will pave the way to 61.8% retracement of 149.76 to 109.03 at 134.20 and above. Medium term outlook will now remain bullish as long as 122.39 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 06:00 | EUR | German Import Price Index M/M May | -0.60% | -0.10% | ||

| 06:00 | CHF | UBS Consumption Indicator May | 1.48 | |||

| 08:00 | EUR | Eurozone M3 Y/Y May | 5.00% | 4.90% | ||

| 12:30 | USD | Advance Goods Trade Balance May | -66.2B | -67.1B | ||

| 12:30 | USD | Wholesale Inventories May P | 0.20% | -0.50% | ||

| 14:00 | USD | Pending Home Sales M/M May | 0.80% | -1.30% | ||

| 14:30 | USD | Crude Oil Inventories | -2.5M |