The forex markets are rather steady in tight range in Asian session today. Over the week, Sterling is the weakest as Prime Minister Boris Johnson’s Brexit proposal appeared to be unwelcome by EU. And he’s facing fresh rebellions from his cabinet. Investors are a bit uneasy as political tensions between US and China heat up ahead of this week’s trade talks. US stock markets are broadly pressured overnight, carrying through to Asia. Though, there is no committed buying in Yen, nor Swiss Franc on risk aversion yet.

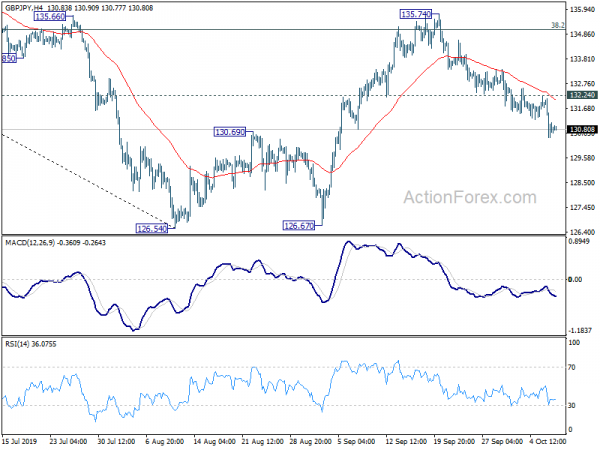

Technically, near term bearishness in the Pound is building up as GBP/USD is heading towards 1.1958 support. GBP/JPY is also targeting 126.54 low. EUR/USD’s recovery from 1.0879 appears to be completed at 1.1000 and further fall is likely to retest 1.0879. EUR/JPY is also a pair to watch as break of 117.07 would extend the fall from 120.01 to retest 115.86 low. Developments in EUR/USD and EUR/JPY could be indications on overall direction in Euro.

In Asia, Nikkei dropped -0.61%. Hong Kong HSI is down -0.64%. China Shanghai SSE is up 0.21%. Singapore Strait Times is down -0.69%. Japan 10-year JGB is down -0.0072 to -0.208. Overnight, DOW dropped -1.19%. S&P 500 dropped -1.56%. NASDAQ dropped -1.67%. 10-year yield dropped -0.004 to -2.041.

US-China political tensions heat up ahead of trade talks

Political tensions between US and China are heating up just ahead of the high-level trade negotiations on Thursday and Friday. US Commerce Depart expanded the trade blacklist of Chinese companies with involvements in China’s treatment of Uyghurs in Xinjiang. The decision targets 20 Chinese public security bureaus and eight companies. High profile technology companies include g video surveillance firm Hikvision, facial recognition technology leader SenseTime Group Ltd and Megvii Technology Ltd. Additionally, US has imposed visa restrictions on Chinese government and Communist Party officials allegedly responsible for the abuse of Uyghurs. But no detail on the list of officials was released.

In response to US actions, Chinese Embassy in Washington said the decisions “seriously violates the basic norms governing international relations, interferes in China’s internal affairs and undermines China’s interests. China deplores and firmly opposes that”. And, “Xinjiang does not have the so-called human rights issue claimed by the US. The accusations by the US side are merely made-up pretexts for its interference”.

Fed Powell: US economic expansion feels very sustainable

Fed Chair Jerome Powell said yesterday that the US economic expansion “feels very sustainable” even though “clearly things are slowing a bit”. And, the economy “may just be gathering itself – there’s no reason why the expansion can’t continue”. He added “policy is not on a preset course” and reiterated “we will be data dependent, assessing the outlook and risks to the outlook on a meeting-by-meeting basis. He also noted Fed will soon announce measures to add to the supply of reserves over time. However, the balance sheet for reserve management purposes is “in no sense is this QE”.

Separately, Chicago Fed President Charles Evans said “I wouldn’t mind another cut. I could see it either way”. “It would help for a little more insurance. Is it necessary and essential? I’m not sure. But I’m certainly open minded to those arguments,” he added. Minneapolis Fed President Neel Kashkari said he was “generally in favor” of lower interest rates, but, “I don’t know how much lower they should go.”

UK Johnson facing resignation warnings from ministers over no-deal Brexit

In UK, the Times newspaper reported that a “very large number” of ministers threatened to quit if Prime Minister Boris Johnson is leading the country to a no-deal Brexit. The resignation watch list include Culture Secretary Nicky Morgan, British Minister for Northern Ireland Julian Smith, Justice Secretary Robert Buckland, Health Minister Matt Hancock and Attorney General Geoffrey Cox. Separately, Financial Times said there were at least 50 MPS that will revolve against a general election manifesto pledging to pursue a no-deal Brexit.

Suggested readings on Brexit:

- Brexit Update – Johnson’s Deal Appears Unattractive to EU Members

- Brexit Monitor: Negotiations Have Broken Down, Blame Game Has Started

On the data front

Australia Westpac consumer confidence dropped -5.5% to 92.8 in October, hitting the lowest level since July 2015. Japan machine tools orders dropped -35.5% yoy in September. US will release wholesale inventories final today. But main focus will be on FOMC minutes.

GBP/JPY Daily Outlook

Daily Pivots: (S1) 130.15; (P) 131.14; (R1) 131.83; More…

Intraday bias in GBP/JPY remains on the downside at this point. Corrective rebound from 126.54 should have completed. Deeper fall should be seen to retest this low. On the upside, break of 132.24 minor resistance will turn intraday bias back to the upside for 135.74 resistance instead.

In the bigger picture, consolidation pattern from 122.75 (2016 low) is possibly still in progress. Strong rebound from 126.54 argues that it may be the third leg of the pattern. Further rise could be seen to 148.87/156.59 resistance zone before completion. On the downside, though, sustained break of 122.75 low will target 116.83 (2011 low).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:30 | AUD | Westpac Consumer Confidence Oct | -5.50% | -1.70% | ||

| 6:00 | JPY | Machine Tool Orders Y/Y Sep P | -35.5% | -37.10% | -37.0% | |

| 14:00 | USD | JOLTS Job Openings Aug | 7.35M | 7.22M | ||

| 14:00 | USD | Wholesale Inventories Aug F | 0.40% | 0.40% | ||

| 14:30 | USD | Crude Oil Inventories | 3.1M | |||

| 18:00 | USD | FOMC Minutes |