Investors turned generally cautious again after Bloomberg came back with another report that US is on ways to further scrutinize index providers’ decision to add Chinese firms that could be material risks for investors. The administration believed that Americans are harmed by channeling funds into Chinese companies which pose national security threats the US, and are involved in human-right violations. The news came a day after US blacklisted 28 Chinese companies, including surveillance technology company Hikvision, for they involvements in Xijiang. Atmosphere for top level trade negotiations later this week is tensing up.

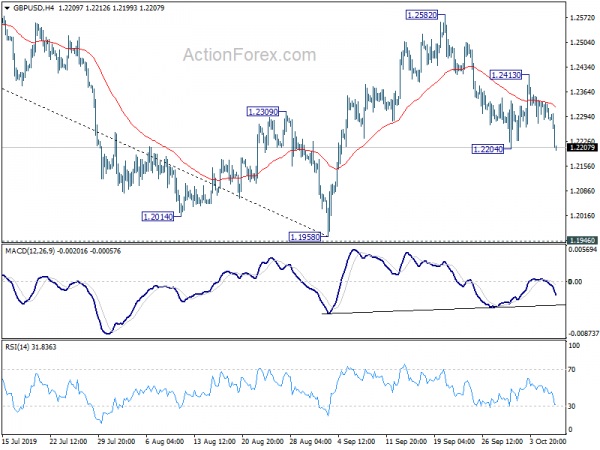

For now, Sterling is the weakest one for today after EU warned UK not to play stupid blame game on Brexit negotiations. Dollar is the second weakest, followed by Canadian. New Zealand Dollar is the strongest, followed by Swiss Franc and Yen. technically, GBP/USD’s break of 1.2204 suggests resumption of fall from 1.2382 towards 1.1958 low. GPB/JPY is on track to 126.54 low too. USD/JPY is back under some selling pressure after rejection by 4 hour 55 EMA. Focus is back on 106.48 temporary low.

In Europe, currently, FTSE is down -0.10%. DAX is down -0.89%. CAC is down -0.76%. Germany 10-year yield is down -0.018 at -0.590. Earlier in Asia, Nikkei rose 0.99%. Hong Kong HSI rose 0.28%. China Shanghai SSE rose 0.29%. Singapore Strait Times rose 0.37%. Japan 10-year JGB yield rose 0.0255 to -0.20.

US PPI and core PPI slowed in September, missed expectations

Both US PPI and core PPI slowed in September and missed expectations. PPI dropped came in at -0.3% mom, 1.4% yoy, versus expectation of 0.1% mom, 1.7% yoy. PPI core was at -0.3% mom, 2.0% yoy, versus expectation of 0.2% mom, 2.2% yoy.

Canada housing starts dropped to 221k in September, versus expectation of 217k. Building permits rose 6.1% mom in August, above expectation of 2.3% mom.

EU Tusk to Johnson: Don’t play stupid blame game

European Council Donald Tusk warned Johnson that “what’s at stake is not winning some stupid blame game”. And, “at stake is the future of Europe and the UK as well as the security and interests of our people”. “You don’t want a deal, you don’t want an extension, you don’t want to revoke, quo vadis?”

European Commission spokesperson Mina Andreeva reiterated that “The EU position has not changed, we want a deal, we are working for a deal with the United Kingdom and under no circumstances will we accept that the EU wants to do harm the Good Friday Agreement. The purpose of our work is to protect it.”

UK updates temporary tariff regime for no-deal Brexit

UK Department for International Trade announce an update to the “temporary tariff regime” today, in response to feedback from industry and consumer groups. Under the regime, 88% of total imports to the UK by value would be eligible for tariff free access, in case of no-deal Brexit. The revised plan applies tariffs to additional clothing products and adjusts levies on bioethanol to retain support for UK producers of the fuel.

Trade Policy Minister Conor Burns said,”the UK is a free trading nation and British business is in a strong position to compete in an open, free-trading environment,” Trade Policy Minister Conor Burns said.

German industrial production rose 0.3% mom, above expectations

German industrial production rose 0.3% mom in August, much better than expectation of -0.2% mom decline. Over the year, industrial production dropped -4.0% yoy. Production in industry excluding energy and construction was up by 0.7% mom. Within industry, the production of intermediate goods increased by 1.0% mom and the production of capital goods by 1.1% mom. The production of consumer goods showed a decrease by -1.0% mom. Outside industry, energy production was down by -1.7% mom and the production in construction decreased by -1.5% mom.

Also released, Italy retail sales dropped -0.6% mom in August, missed expectation of 0.0% mom. France trade deficit widened to EUR -5.02B in August, versus expectation of EUR -4.23B. Swiss unemployment rate was unchanged at 2.3% in September, matched expectations.

Japan PM Abe expects BoJ Kuroda to make appropriate decisions

Japanese Prime Minister Shinzo Abe told the parliament that he expected BoJ Governor Haruhiko Kuroda to make appropriate monetary policy decisions. And Kuroda would weigh the costs and benefits of each step. According to recent comments from BoJ officials, the country is facing risk that momentum towards price stability is undermined. And there will be re-examination of the economic and price trends at the upcoming meeting.

Released from Japan, labor cash earnings dropped -0.2% yoy in August, below expectation of -0.1% yoy. Household spending rose 1.0% yoy, above expectation of 0.9% yoy. Current account surplus widened to JPY 1.72T in August.

China Caixin PMI composite rose to 51.9, began to show signs of stability

China Caixin Services PMI dropped to 51.3 in September, down from 52.1 and missed expectation of 52.9. PMI Composite Output Index rose from 51.6 to 51.9. Slower growth in services activity was offset by stronger expansion of manufacturing output. Total new work rises at fastest pace since February 2018. Job creation in service sector leads to strongest increase in composite employment since January 2013.

Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group said: “China’s economy showed signs of marginal recovery in September, as the labor market improved and domestic demand increased at a faster pace. However, fluctuations in exchange rates, and rising costs of labor and raw materials increased pressure on companies, which restrained business confidence. Due to previous destocking and capacity-reduction activities, constraints on companies’ production capacity became more severe and backlogs of work increased noticeably, which will help companies restore their investment. After a fast slowdown in previous quarters, China’s economic growth began to show signs of stability.”

Australia NAB Business confidence dropped to 0, conditions improved slightly

Australia NAB Business Confidence dropped to 0 in September, down from 1. On the other hand, Business Conditions improved to 2, up from 1. Looking at some details, Trading Condition rose from 3 to 4. Profitability Condition rose from -3 to -2. Employment Condition rose from 2 to 3.

Alan Oster, NAB Group Chief Economist “The results of the September survey suggest more of the same for the business sector. Conditions edged up, and confidence was marginally lower, but both remain below their long run average – well below the levels seen just over a year ago. This suggests that activity in the business sector has slowed and we fear the risk that this spreads to both investment and employment intentions”.

And: “We continue to watch the business sector closely – the housing downturn and the weakness in the retail sector are likely to continue to play out further, adding to private sector weakness in the economy. Rate cuts will help but will lag and with a weak consumer and higher global uncertainty, we are unlikely to see a material improvement in the short-term”.

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2272; (P) 1.2304; (R1) 1.2322; More….

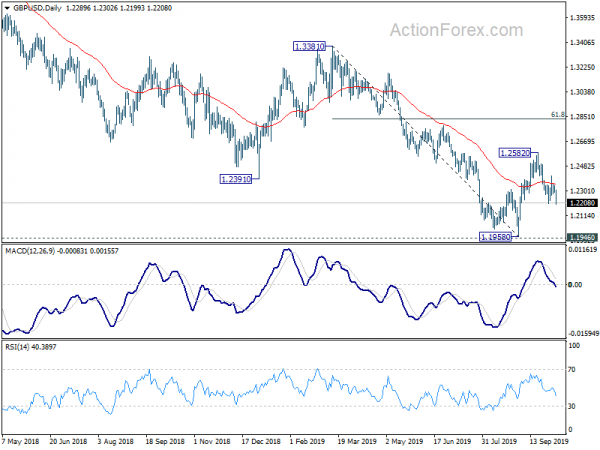

Break of 1.2204 minor temporary low suggests resumption of fall from 1.2582. Corrective rebound from 1.1958 should have completed at 1.2582. Intraday bias is back on the downside for retesting 1.1946/58 key support zone. on the upside, though, above 1.2413 will bring another rebound to 1.2582 resistance instead.

In the bigger picture, we’d remain cautious on medium term bottoming around 1.1946 (2016 low). Sustained trading above 55 week EMA (now at 1.2727) will extend the consolidation pattern from 1.1946 with another rise to 1.4376 resistance. Nevertheless, decisive break of 1.1946 will resume down trend from 2.1161 (2007 high) to 61.8% projection of 1.7190 to 1.1946 from 1.4376 at 1.1135.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Labor Cash Earnings Y/Y Aug | -0.20% | -0.10% | -1.00% | |

| 23:30 | JPY | Overall Household Spending Y/Y Aug | 1.00% | 0.90% | 0.80% | |

| 23:50 | JPY | Current Account (JPY) Aug | 1.72T | 1.68T | 1.65T | |

| 00:30 | AUD | NAB Business Conditions Sep | 0 | 1 | ||

| 00:30 | AUD | NAB Business Confidence Sep | 2 | 1 | ||

| 01:45 | CNY | Caixin Services PMI Sep | 51.3 | 52.9 | 52.1 | |

| 05:00 | JPY | Eco Watchers Survey: Current Sep | 46.7 | 43.4 | 42.8 | |

| 05:45 | CHF | Unemployment Rate Sep | 2.30% | 2.30% | 2.30% | |

| 06:00 | EUR | Germany Industrial Production M/M Aug | 0.30% | -0.20% | -0.60% | -0.40% |

| 06:45 | EUR | France Trade Balance (EUR) Aug | -5.02B | -4.23B | -4.61B | -4.54B |

| 08:00 | EUR | Italy Retail Sales M/M Aug | -0.60% | 0.00% | -0.50% | |

| 10:00 | USD | NFIB Business Optimism Index Sep | 101.8 | 104.1 | 103.1 | |

| 12:15 | CAD | Housing Starts Y/Y Sep | 221K | 217K | 227K | |

| 12:30 | CAD | Building Permits M/M Aug | 6.10% | 2.30% | 3.00% | 3.20% |

| 12:30 | USD | PPI M/M Sep | -0.30% | 0.10% | 0.10% | |

| 12:30 | USD | PPI Y/Y Sep | 1.40% | 1.70% | 1.80% | |

| 12:30 | USD | PPI Core M/M Sep | -0.30% | 0.20% | 0.30% | |

| 12:30 | USD | PPI Core Y/Y Sep | 2.00% | 2.20% | 2.30% |