Yen weakens generally today in response to rebounds in Asian markets, as China and Hong Kong are back from holidays. Additionally, US 10-year yield closed mildly higher at 2.045 overnight, seemed to be drawing some support from 2% handle. But sentiments are still capped by uncertainties over US-China trade negotiations. For now, Dollar is the second weakest for today, followed by Swiss Franc. Commodity currencies are generally higher led by New Zealand Dollar.

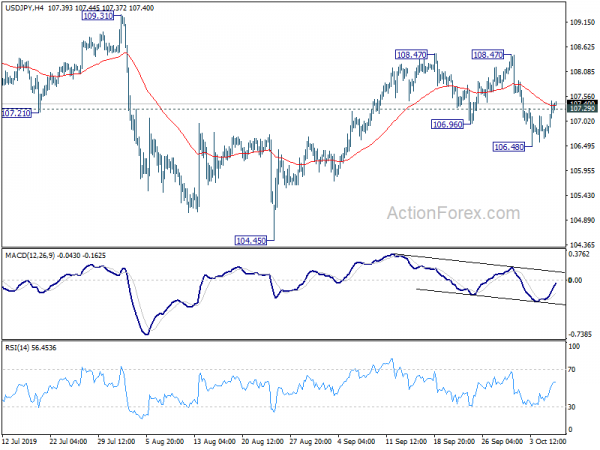

Technically, USD/JPY’s break of 107.29 minor resistance dampens the original view of near term bearish reversal Yet, risk will stay on the downside as long as 108.47 resistance holds. Further declines are also in favor in EUR/JPY and GBP/JPY with 118.47 and 113.35 intact. Dollar pairs are generally in consolidative trading in tight range and we’re not expecting any committed move for now.

In Asia, Nikkei rose 0.99%. Hong Kong HSI is up 0.65%. China Shanghai SSE is up 0.47%. Singapore Strait Times is up 0.56%. Japan 10-year JGB yield is up 0.0241 at -0.201. Overnight, DOW dropped -0.36%. S&P 500 dropped -0.45%. NASDAQ dropped -0.33%. But 10-year yield rose 0.030 to 2.045.

Trump: Probably unlikely for something to happen at US-China trade talks

US President Donald Trump sounded rather cautious ahead the closely watched top-level trade negotiations with China this week. He reiterated he’s shooting for a “big deal”. However, when pressed to elaborate the chances of progress, he said “”Can something happen? I guess, maybe. Who knows. But I think it’s probably unlikely.”

Additionally, he urged China to find a humane a peaceful resolution to the unrest in Hong Kong. And, “If anything happened bad, I think that would be a very bad thing for the negotiation. I think politically it would be very tough.”

China’s Ministry of Commerce confirmed that Vice Premier Liu He would travel to Washington for trade talks on Thursday and Friday. Along with Liu include Commerce Minister Zhong Shan, central bank Governor Yi Gang, and the National Development and Reform Commission’s deputy head Ning Jizhe.

Japan PM Abe expects BoJ Kuroda to make appropriate decisions

Japanese Prime Minister Shinzo Abe told the parliament that he expected BoJ Governor Haruhiko Kuroda to make appropriate monetary policy decisions. And Kuroda would weigh the costs and benefits of each step. According to recent comments from BoJ officials, the country is facing risk that momentum towards price stability is undermined. And there will be re-examination of the economic and price trends at the upcoming meeting.

Released from Japan, labor cash earnings dropped -0.2% yoy in August, below expectation of -0.1% yoy. Household spending rose 1.0% yoy, above expectation of 0.9% yoy. Current account surplus widened to JPY 1.72T in August.

Australia NAB Business confidence dropped to 0, conditions improved slightly

Australia NAB Business Confidence dropped to 0 in September, down from 1. On the other hand, Business Conditions improved to 2, up from 1. Looking at some details, Trading Condition rose from 3 to 4. Profitability Condition rose from -3 to -2. Employment Condition rose from 2 to 3.

Alan Oster, NAB Group Chief Economist “The results of the September survey suggest more of the same for the business sector. Conditions edged up, and confidence was marginally lower, but both remain below their long run average – well below the levels seen just over a year ago. This suggests that activity in the business sector has slowed and we fear the risk that this spreads to both investment and employment intentions”.

And: “We continue to watch the business sector closely – the housing downturn and the weakness in the retail sector are likely to continue to play out further, adding to private sector weakness in the economy. Rate cuts will help but will lag and with a weak consumer and higher global uncertainty, we are unlikely to see a material improvement in the short-term”.

China Caixin PMI composite rose to 51.9, began to show signs of stability

China Caixin Services PMI dropped to 51.3 in September, down from 52.1 and missed expectation of 52.9. PMI Composite Output Index rose from 51.6 to 51.9. Slower growth in services activity was offset by stronger expansion of manufacturing output. Total new work rises at fastest pace since February 2018. Job creation in service sector leads to strongest increase in composite employment since January 2013.

Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group said: “China’s economy showed signs of marginal recovery in September, as the labor market improved and domestic demand increased at a faster pace. However, fluctuations in exchange rates, and rising costs of labor and raw materials increased pressure on companies, which restrained business confidence. Due to previous destocking and capacity-reduction activities, constraints on companies’ production capacity became more severe and backlogs of work increased noticeably, which will help companies restore their investment. After a fast slowdown in previous quarters, China’s economic growth began to show signs of stability.”

Looking ahead

Swiss will release unemployment rate, German will release industrial produciton. France will release trade balance and Italy will release retail sales. Later in the day, US PPI will be featured, along with Canada housing starts and building permits.

USD/JPY Daily Outlook

Daily Pivots: (S1) 106.79; (P) 107.12; (R1) 107.59; More…

USD/JPY’s break of 107.29 minor resistance suggests temporary bottoming at 106.48. Intraday bias is turned neutral first. At this point, we’re still favoring the case that corrective recovery from 104.45 has completed at 108.47. Thus, risk will remain on the downside as long as 108.47 resistance holds. On the downside, break of 106.48 will turn bias back to the downside for retesting 104.45 low. On the upside, break of 108.47 will dampen this view and resume the rebound from 104.45 to 109.31 key resistance.

In the bigger picture, decline from 118.65 (Dec 2016) is still in progress and the pair is staying well inside long term falling channel. Firm break of 104.69 will target 100% projection of 118.65 to 104.62 from 114.54 at 100.51. For now, we’d expect strong support above 98.97 (2016 low) to contain downside to bring rebound. However, firm break of 109.31 will be the first sign of medium term reversal and bring stronger rise to 112.40 resistance for confirmation.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Labor Cash Earnings Y/Y Aug | -0.20% | -0.10% | -1.00% | |

| 23:30 | JPY | Overall Household Spending Y/Y Aug | 1.00% | 0.90% | 0.80% | |

| 23:50 | JPY | Current Account (JPY) Aug | 1.72T | 1.68T | 1.65T | |

| 0:30 | AUD | NAB Business Conditions Sep | 0 | 1 | ||

| 0:30 | AUD | NAB Business Confidence Sep | 2 | 1 | ||

| 1:45 | CNY | Caixin Services PMI Sep | 51.3 | 52.9 | 52.1 | |

| 5:00 | JPY | Eco Watchers Survey: Current Sep | 43.4 | 42.8 | ||

| 5:45 | CHF | Unemployment Rate M/M Sep | 2.30% | 2.30% | ||

| 6:00 | EUR | Germany Industrial Production M/M Aug | -0.20% | -0.60% | ||

| 6:45 | EUR | France Trade Balance (EUR) Aug | -4.23B | -4.61B | ||

| 8:00 | EUR | Italy Retail Sales M/M Aug | 0.00% | -0.50% | ||

| 10:00 | USD | NFIB Business Optimism Index Sep | 104.1 | 103.1 | ||

| 12:15 | CAD | Housing Starts Y/Y Sep | 217K | 227K | ||

| 12:30 | USD | PPI M/M Sep | 0.10% | 0.10% | ||

| 12:30 | USD | PPI Y/Y Sep | 1.70% | 1.80% | ||

| 12:30 | USD | PPI Core M/M Sep | 0.20% | 0.30% | ||

| 12:30 | USD | PPI Core Y/Y Sep | 2.20% | 2.30% | ||

| 12:30 | CAD | Building Permits M/M Aug | 2.30% | 3.00% |