The forex markets are generally quiet today, staying in tight ranges. Trading is subdued with China and Hong Kong on holiday. Yen, Euro and Dollar are the mildly firmer ones. Australian Dollar, Sterling and Swiss Franc are the relatively weaker ones. US-China trade talks and Brexit will be the focuses this week. And we’d see more volatility in related currencies as news come in.

Technically, Australian Dollar appears to be weakening broadly. EUR/AUD’s retreat and AUD/USD’s recover clearly lost momentum as see in 4 hour charts. We might see retest of 1.6368 temporary top in EUR/AUD and 0.6670 temporary low in AUD/USD ahead is selloff in Aussie worsens. USD/JPY will be a pair to watch in relation to overall sentiments. As long as 107.29 minor resistance holds, further decline is in favor to retest 104.45 low.

In Asia, Nikkei is down -0.20%. Singapore Strait Times is up 0.69%. Japan 10-year JGB yield is down -0.0092 at -0.222.

China said to have narrowed scope of discussions ahead of high level trade talks

Chinese Vice Premier Liu He is expected lead his delegation to Washington for next round of high-level trade talks with US starting this Thursday. But it’s reported that the scope of discussions have narrowed considerably recently. And China is increasingly reluctant to agree to a full trade deal as US President Donald Trump insists on.

Liu indicated that the offer to the US would not include measures that address the core issues, including intellectual property theft, forced technology transfer and subsidies on state-owned enterprises. That could be a result of interpretation of Trump’s impeachment inquiries as a sign of weakening in negotiation position.

Trump said on Friday that “We’ve had good moments with China. We’ve had bad moments with China. Right now, we’re in a very important stage in terms of possibly making a deal. But what we’re doing is we’re negotiating a very tough deal. If the deal is not going to be 100% for us, then we’re not going to make it.”

Fed George: Concern about low inflation seems unnecessary

Kansas City Fed President Esther George said over the week end that “the U.S. economy is currently in a good place, with low inflation, low unemployment and an outlook for continued moderate growth.” And, “in current circumstances, concern about low inflation seems unnecessary.”

She added, it’s more “realistic to accept that there will be both temporary and persistent fluctuations around” Fed’s 2% inflation target. And, “as long as they don’t exceed a reasonable threshold — perhaps as big as 50 or even 100 basis points — they should be tolerated, depending on broader economic conditions”.

“Should incoming data point to a broadly weaker economy, adjusting policy may be appropriate to achieve the Federal Reserve’s mandates for maximum sustainable employment and stable prices,” George said. But “trying to quickly return inflation to 2 percent by adjusting interest rates could require aggressive actions that would misallocate resources and create financial imbalances.”

Australia AiG construction dropped to 42.6, 13th months of contraction

Australia AiG Performance of Construction Index dropped to 42.6 in September, down from 44.6. The construction industry was on aggregate declined more sharply. Contraction continued for 13th consecutive months with industry activity and new orders falling further into negative territory.

Looking ahead: Fed and ECB to release meeting minutes

Looking ahead, US-China trade negotiations and Brexit developments would be most market moving. Additionally, both minutes of Fed and ECB would be scrutinized for hints on further policy easing. Data to be watched include US CPI, Canada employment, UK GDP and productions.

Here are some highlights for the week:

- Monday: Japan leading indicator; Germany factory orders; Swiss Foreign currency reserves; Eurozone Sentix investor confidence.

- Tuesday: Japan average cash earnings, household spending, current account; Australia NAB business confidence; China Caixin PMI services; Swiss unemployment rate; German industrial production; Canada housing starts and building permits; US PPI.

- Wednesday: Australia Westpac consumer sentiment; Japan machine tool orders; FOMC minutes.

- Thursday: Japan bank lending, core machine orders, PPI; Australia home loans, MI inflation expectations; German trade balance; UK GDP, productions, trade balance; ECB monetary policy meeting accounts. Canada new housing price index; US CPI, jobless claims.

- Friday: New Zealand BusinessNZ manufacturing index; German CPI final; Canada employment; US import prices, U of Michigan sentiments.

USD/JPY Daily Outlook

Daily Pivots: (S1) 106.62; (P) 106.87; (R1) 107.17; More…

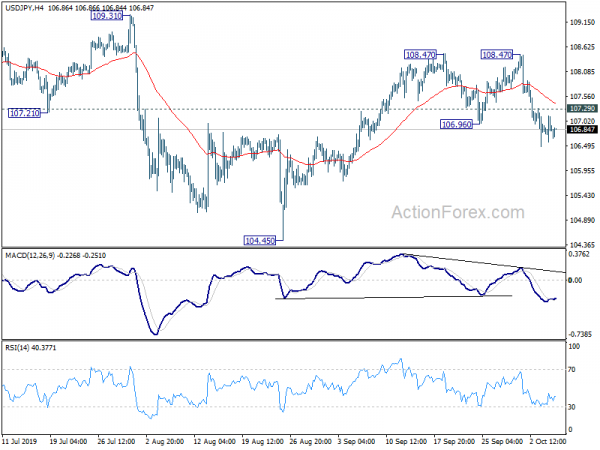

USD/JPY is losing some downside momentum as seen in 4 hour MACD. But intraday bias stays on the downside with 107.29 minor resistance intact. Corrective recovery from 104.45 has completed at 108.47, ahead of 109.31 key resistance. Further fall should be seen for retesting 104.45 low first. On the upside, above 107.29 minor resistance will turn intraday bias neutral first. But risk will remain on the downside as long as 108.47 resistance holds.

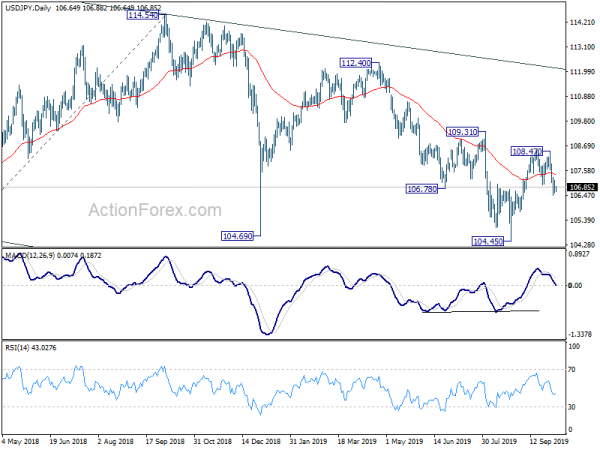

In the bigger picture, decline from 118.65 (Dec 2016) is still in progress and the pair is staying well inside long term falling channel. Firm break of 104.69 will target 100% projection of 118.65 to 104.62 from 114.54 at 100.51. For now, we’d expect strong support above 98.97 (2016 low) to contain downside to bring rebound. However, firm break of 109.31 will be the first sign of medium term reversal and bring stronger rise to 112.40 resistance for confirmation.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Construction Index Sep | 42.6 | 44.6 | ||

| 23:50 | JPY | JP Foreign Reserves Sep | $1322.6B | $1311.6B | ||

| 5:00 | JPY | Leading Economic Index Aug P | 91.7 | 91.8 | 93.7 | |

| 6:00 | EUR | Germany Factory Orders M/M Aug | -0.40% | -2.70% | ||

| 7:00 | CHF | Foreign Currency Reserves (CHF) Sep | 767B | |||

| 7:30 | GBP | Halifax House Prices M/M Sep | 0.10% | 0.30% | ||

| 8:30 | EUR | Sentix Investor Confidence Oct | -13 | -11.1 |