Euro surges sharply today on optimistic comments from ECB President Mario Draghi, who also hints at policy tweaks ahead. EUR/USD jumps through 1.28 level and is now having key resistance at 1.1298 in sight. EUR/JPY resumes larger rise from April low at 114.84 and takes out 126.09 key resistance. EUR/GBP is also having focus back on 0.8851/65 key resistance zone and could be resuming larger rise from 0.8312. Meanwhile, Yen remains the weakest one as broad based selloff continues. Strength in Euro is now making dollar vunlerable to downside breakout against Swiss Franc and Canadian Dollar.

Upbeat ECB Draghi hints at policy tweaking

Regarding the economy, Draghi said that "all the signs now point to a strengthening and broadening recovery in the euro area". And, "political winds are becoming tailwinds." He noted there is "newfound confidence in the reform process, and newfound support for European cohesion, which could help unleash pent-up demand and investment." On inflation, Draghi said that drivers of low oil prices at present are mainly supply factors, which a central bank can typically look through. And even if supply factors affect the path of inflation for some time, with inflation expectations secure, they should not ultimately affect the inflation trend." That is, Draghi tried to talk down recent slowing in inflation and believed that’s just temporary.

More improtantly, Draghi said that "as the economy continues to recover, a constant policy stance will become more accommodative, and the central bank can accompany the recovery by adjusting the parameters of its policy instruments – not in order to tighten the policy stance, but to keep it broadly unchanged." That is, Draghi is hinting that monetary policy in 2018 will be less accomoodative. And he’s paving the way to tweaking policies ahead. It’s affirming the view that ECB will annouce scaling back of asset purchase, at least, in September.

BoE requires banks to raise capital requrements on Brexit risks

In UK, BoE told banks to raise capital requirment by GBP 11.4b to protect them from Brexit related economic risks and external shocks. In the Financial Stability Report published today, the central bank said that "the Financial Policy Committee (FPC) is increasing the U.K. countercyclical capital buffer (CCB) rate to 0.5 percent, from 0 percent." And, "absent a material change in the outlook, and consistent with its stated policy for a standard risk environment and of moving gradually, the FPC expects to increase the rate to 1 percent at its November meeting." Re;eased from UK, CBI realized sales rose to 12 in June.

Fed speakers to feature

San Francisco Fed President John Williams spoke again today and urged fiscal policymakers to invest in education, job training, infrastructure and research and development to boost output. He noted that "monetary policy will be severely challenged to achieve stable prices, well-anchored inflation expectations, and strong macroeconomic performance." Meanwhile, he saw tht advanced economist will be stuck in slwo growth over the long term without help from fiscal policies.

More Fed officials will speak today including Fed Chair Janet Yellen, Philadelphia Fed President Patrick Harker, and Minneapolis Fed President Neel Kashkari.

New Zealand trade data positive despite narrowing surplus

New Zealand trade surplus narrowed to NZD 103m in May, down from NZD 536m and missed expectation of NZD 420m. Exports rose 8.7% yoy to NZD 4.95b and hit the highest level since March 2014. Dairy exports continued its strong run and rose for an eighth straight month and led exports overall. Imports jumped 15% yoy to NZD 4.85b, left by 65% increase in crud oil shipments. Economists believed that the robust imports and continued export growth showed underlying strength in the New Zealand economy.

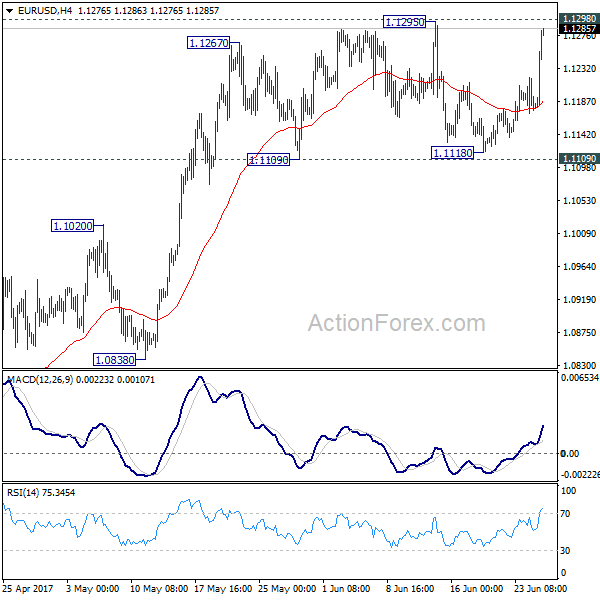

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1162; (P) 1.1190 (R1) 1.1210; More….

EUR/USD rises sharply today with focus on 1.1298 key resistance. Decisive break there will carry larger bullish implication and extend the up trend from 1.0339 to 1.1615 resistance next. On the downside, break of 1.1109 support will indicate short term topping and rejection from 1.1298. In such case, intraday bias will be turned to the downside for 1.0838 support.

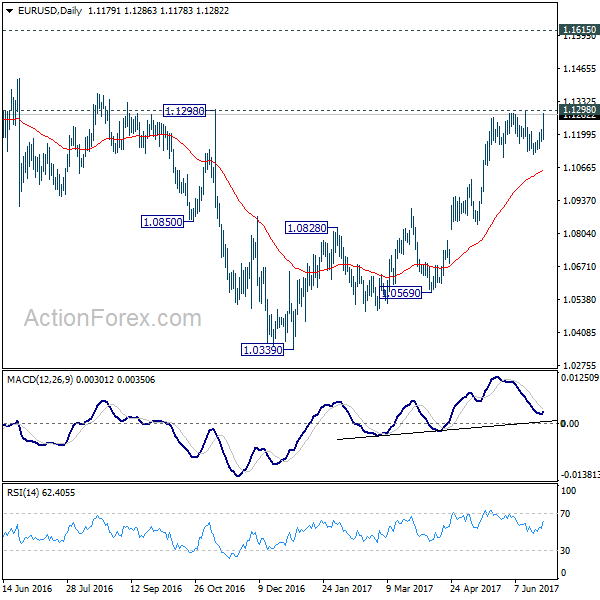

In the bigger picture, the case for medium term reversal continues to build up with EUR/USD staying far above 55 week EMA (now at 1.0941). Also, bullish convergence condition is seen in weekly MACD. Focus will now be on 1.1298 key resistance. Rejection from there will maintain medium term bearishness and would extend the whole down trend from 1.6039 (2008 high). However, firm break of 1.1298 will indicate reversal. In such case, further rally would be seen back to 1.2042 support turned resistance next.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Trade Balance (NZD) May | 103M | 420M | 578M | 536M |

| 09:30 | GBP | BoE Financial Stability Report | ||||

| 10:00 | GBP | CBI Realized Sales Jun | 12 | 2 | 2 | |

| 13:00 | USD | S&P/Case-Shiller Composite-20 Y/Y Apr | 5.70% | 5.90% | 5.90% | |

| 14:00 | USD | Consumer Confidence Jun | 116 | 117.9 |