The developments in the forex markets look as if traders are in risk seeking mode. Commodity currencies including Canadian Dollar, Australian Dollar and New Zealand Dollar trade broadly higher since the start of the week. Meanwhile, Japanese Yen and Swiss Franc are the weakest ones. However, this picture is not reflected in other markets. DOW jumped to to 21506.21 overnight but failed to break recent historical high at 21503.03. The index closed up just 0.07% at 21409.55 after paring initial gains. S&P 500 also rose a mere 0.03% to close at 2439.07. But NASDAQ lost -0.29% to close at 6247.15.

Weakness is seen in long term US treasury yield as 30 year yield dropped -0.018 to close at 2.696, extending recent down trend. 10 year yield stayed in recent range and lost -0.007 to close at 2.137. On the other hand, Asian equities are mixed with Nikkei trading up 0.3% at the time of writing. Hong Kong HSI is up 0.1% but China SSE composite is down -0.15%. Australia all ordinaries is down -0.3%. Gold tumbled to as low as 1236.5 yesterday and is still struggling to regain 1250 handle. WTI crude oil continues with its consolidation and is trading in range at around 43.50.

Central bankers to highlight a light day

Half-year end subdued trading will probably keep volatility low. With a relatively light economic calendar today, traders will look into speeches of central bankers for inspirations. The list include RBA Deputy Governor Guy Debelle, ECB President Mario Draghi, BoE Governor Mark Carney, Fed Chair Janet Yellen, Philadelphia Fed President Patrick Harker, and Minneapolis Fed President Neel Kashkari. Meanwhile, on the data front, BoE will release financial stability report, US will release S&P Case Shiller house price and Conference Board consumer confidence.

New Zealand trade data positive despite narrowing surplus

New Zealand trade surplus narrowed to NZD 103m in May, down from NZD 536m and missed expectation of NZD 420m. Exports rose 8.7% yoy to NZD 4.95b and hit the highest level since March 2014. Dairy exports continued its strong run and rose for an eighth straight month and led exports overall. Imports jumped 15% yoy to NZD 4.85b, left by 65% increase in crud oil shipments. Economists believed that the robust imports and continued export growth showed underlying strength in the New Zealand economy.

NZD/JPY is one of the strongest pairs for the month. The rise from April low at 75.65 extends to as high as 81.68 so far. Near term outlook will remain bullish as long as 80.11 support holds. And such rally is expected to head for a test on 83.76 high next. At this point, it’s uncertain whether the whole rise from 2016 low at 68.88 is developing into an medium term impulsive or correct move. Key focus will be on the reaction to 61.8% projection of 68.88 to 83.76 from 75.65 at 84.84.

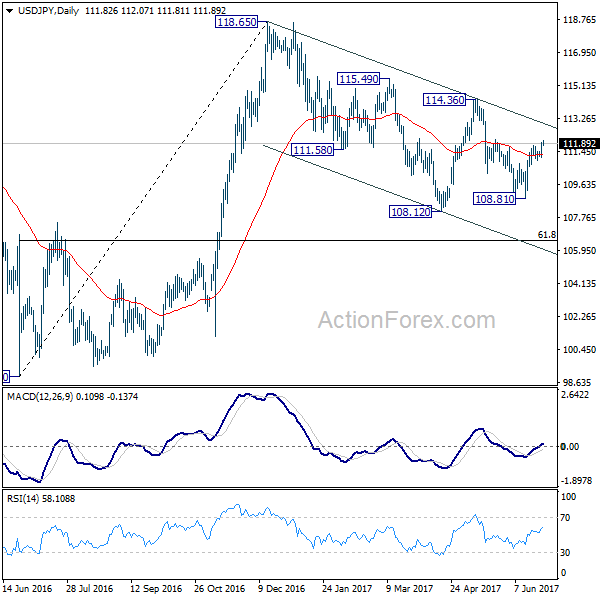

USD/JPY Daily Outlook

Daily Pivots: (S1) 111.34; (P) 111.64; (R1) 112.16; More…

USD/JPY’s rally from 108.81 resumed by taking out 111.78 temporary top and reaches as high as 112.07 so far. Intraday bias is back on the upside for channel resistance (now at 112.99). Sustained break there will suggest that whole pull back from 118.65 has completed at 108.12 already. In such case, further rise should be seen to 114.36 resistance for confirmation. On the downside, however, break of 110.94 support will argue that rebound from 108.81 has completed and turn bias back to the downside.

In the bigger picture, price actions from 125.85 high are seen as a corrective pattern. It’s uncertain whether it’s completed yet. But in case of another fall, downside should be contained by 61.8% retracement of 75.56 to 125.85 at 94.77 to bring rebound. Overall, rise from 75.56 is still expected to resume later after the correction from 125.85 completes.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Trade Balance (NZD) May | 103M | 420M | 578M | 536M |

| 9:30 | GBP | BoE Financial Stability Report | ||||

| 10:00 | GBP | CBI Realized Sales Jun | 2 | 2 | ||

| 13:00 | USD | S&P/Case-Shiller Composite-20 Y/Y Apr | 5.90% | 5.90% | ||

| 14:00 | USD | Consumer Confidence Jun | 116 | 117.9 |