The forex markets are generally stuck in very tight range today, as markets await Fed’s rate cut. Dollar is the stronger one as followed by Canadian and Yen. Australian Dollar is the weakest one so far. Sterling follows as second weakest after lower than expected consumer inflation reading. New Zealand Dollar is the third weakest.

Technically, there are a couple of levels to watch to gauge if Dollar is staging a broad based rally. Those levels include 0.9975 in USD/CHF, 109.31 in USD/JPY, 1.2283 in GBP/USD and 0.6807 in AUD/USD. On the other hand, in case of risk aversion, 107.49 support in USD/JPY, 1157.55 in EUR/JPY and 132.17 in GBP/JPY will be watch to confirm strength in Yen.

In Europe, currently, FTSE is down -0.04%. DAX is up 0.09%. CAC is up 0.05%. German 10-year yield is down -0.0267 at -0.499, pressing -0.5% handle. Earlier in Asia, Nikkei dropped -0.18%. Hong Kong HSI dropped -0.13%. China Shanghai SSE rose 0.25%. Singapore Strait Times dropped -0.51%. Japan 10-year JGB yield dropped -0.0295 to -0.181.

Fed still expected to cut even markets are paring bets

Traders continued to pare back their bets on another Fed cut, just ahead of the announcement later today. As of now, fed fund futures are only indicating 54.2% chance of a -25bps to 1.75-2.00%. That’s notably lower than 87.7% chance just a week ago. Trade tensions seemed to be easing a with a US-Japan deal in sight. Also, there is prospect of de-escalation in US-China tariff war. Additionally, oil prices surged this week after an historic disruption in production facilities in Saudi Arabia. Inflation might come back earlier than originally expected.

Though, for now, the rate cut is still generally expected. Updated economic projections would be a major focus, include rate path and dot plots. Additionally, Chair Jerome Powell’s press conference will be closely watched too. The question is whether Powell would signal the end of the so-called “mid-cycle” adjustment.

Here are some suggested readings:

- FOMC Preview – Focus on Dot Plot for Potential Third Rate Cut

- Fed Decision: A Rate Cut With A Not-So-Dovish Spin?

- Gold Hovers At $1500, Eyes FOMC

- FOMC Preview: Another Fed Cut Without Pre-Committing To Further Easing

- September Flashlight for the FOMC Blackout Period

Canada CPI slowed to 1.9%, but stays firm with labor market strength

Canada CPI slowed to 1.90% yoy in August, down fro 2.0% yoy and missed expectation of 2.0%. Nevertheless, Statistics Canada noted: The CPI has grown by 1.9% or more on a year-over-year basis for six consecutive months, after reaching a low of 1.4% in January of this year. The broad-based gains in the CPI over the past two quarters have coincided with strength in Canadian labour market conditions.”

CPI Core Common slowed to 1.8% yoy, down from 1.9% yoy and missed expectation of 1.9% yoy. CPI Core Media was unchanged at 2.1% yoy, matched expectations. CPI Core Trim was also unchanged at 2.1% yoy, matched expectations.

UK CPI slowed to 1.7%, core CPI to 1.5%, GBP dips

UK CPI slowed notably to 1.7% yoy in August, down from 2.1% yoy and missed expectation of 1.8% yoy. That’s also the lowest rate since December 2016. Core CPI also dropped to 1.5% yoy, down from 1.8% yoy and missed expectation of 1.9% yoy. RPI dropped to 2.6% yoy, down from 2.8% yoy but beat expectation of 2.4% yoy.

EU warns risk of no-deal Brexit is very real

European Commission President Jean-Claude Juncker warned that there is very little time left and the risk of no-deal Brexit is “very real”. He added he’s “not emotionally attacked to the Irish backstop” and he has asked UK Prime Minister Boris Johnson “to make, in writing, alternatives”.

EU’s chief Brexit negotiator Michel Barnier also urged “everyone not to underestimate the consequences, clearly for the United Kingdom first of all but also for us, of the absence of a deal.” He also emphasized that the issue of Irish border was a precursor to an agreement. And, “if the United Kingdom leaves without a deal, I want to remind you that all these questions will not just disappear… Some three years after the Brexit referendum we should not be pretending to negotiate.”

Eurozone CPI finalized at 1.0%, highest contribution from services

Eurozone CPI was finalized at 1.0% yoy in August, unchanged from July’s reading. Core CPI was finalized at 0.9% yoy. In August, the highest contribution to the annual Eurozone inflation rate came from services (0.60%), followed by food, alcohol & tobacco (0.40%), non-energy industrial goods (0.08%) and energy (-0.06%).

EU 28 CPI was also stable at 1.4% yoy. The lowest annual rates were registered in Portugal (-0.1%), Greece (0.1%) and Spain (0.4%). The highest annual rates were recorded in Romania (4.1%), Hungary (3.2%), the Netherlands and Latvia (both 3.1%). Compared with July, annual inflation fell in nine Member States, remained stable in six and rose in twelve.

GBP/USD Mid-Day Outlook

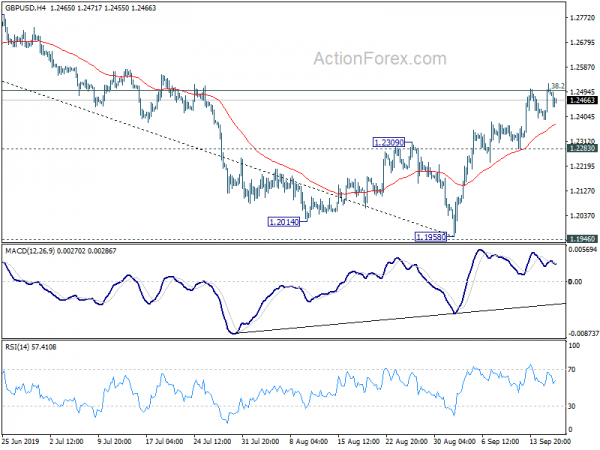

Daily Pivots: (S1) 1.2420; (P) 1.2473; (R1) 1.2554; More….

Intraday bias in GBP/USD remains neutral at this point. On the upside, sustained break of 38.2% retracement of 1.3381 to 1.1958 at 1.2502 will pave the way to 61.8% retracement at 1.2837. On the downside, however, break of 1.2283 minor support will suggest that the rebound is completed. Intraday bias will be turned back to the downside for retesting 1.1958 low.

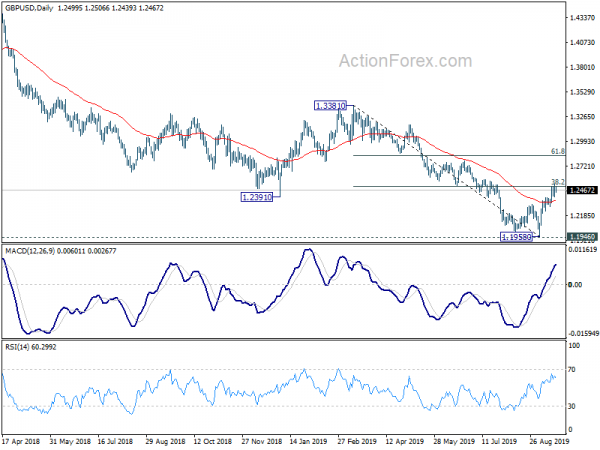

In the bigger picture, we’d remain cautious on medium term bottoming around 1.1946 (2016 low). Sustained trading above 55 week EMA (now at 1.2769) will extend the consolidation pattern from 1.1946 with another rise to 1.4376 resistance. Nevertheless, decisive break of 1.1946 will resume down trend from 2.1161 (2007 high) to 61.8% projection of 1.7190 to 1.1946 from 1.4376 at 1.1135.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Current Account Balance (NZD) Q2 | -1.11B | -1.10B | 0.68B | 0.72B |

| 23:50 | JPY | Trade Balance (JPY) Aug | -0.13T | -0.14T | -0.13T | -0.10T |

| 00:30 | AUD | Westpac Leading Index M/M Aug | -0.30% | 0.14% | 0.20% | |

| 08:30 | GBP | CPI M/M Aug | 0.40% | 0.40% | 0.00% | |

| 08:30 | GBP | CPI Y/Y Aug | 1.70% | 1.80% | 2.10% | |

| 08:30 | GBP | Core CPI Y/Y Aug | 1.50% | 1.80% | 1.90% | |

| 08:30 | GBP | RPI M/M Aug | 0.80% | 0.50% | 0.00% | |

| 08:30 | GBP | RPI Y/Y Aug | 2.60% | 2.40% | 2.80% | |

| 08:30 | GBP | PPI Input M/M Aug | -0.10% | -0.60% | 0.90% | 0.60% |

| 08:30 | GBP | PPI Input Y/Y Aug | -0.80% | -1.00% | 1.30% | 0.90% |

| 08:30 | GBP | PPI Output M/M Aug | -0.10% | 0.10% | 0.30% | |

| 08:30 | GBP | PPI Output Y/Y Aug | 1.60% | 1.70% | 1.80% | 1.90% |

| 08:30 | GBP | PPI Output Core M/M Aug | 0.20% | 0.10% | 0.40% | |

| 08:30 | GBP | PPI Output Core Y/Y Aug | 2.00% | 1.90% | 2.00% | |

| 08:30 | GBP | House Price Index Y/Y Jul | 0.70% | 0.80% | 0.90% | 1.40% |

| 09:00 | EUR | Eurozone CPI M/M Aug | 0.10% | 0.20% | -0.50% | |

| 09:00 | EUR | Eurozone CPI Y/Y Aug F | 1.00% | 1.00% | 1.00% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y Aug F | 0.90% | 0.90% | 0.90% | |

| 12:30 | USD | Building Permits Aug | 1.42M | 1.31M | 1.32M | |

| 12:30 | USD | Housing Starts Aug | 1.42M | 1.36M | 1.19M | 1.22M |

| 12:30 | CAD | CPI M/M Aug | -0.10% | -0.20% | 0.50% | |

| 12:30 | CAD | CPI Y/Y Aug | 1.90% | 2.00% | 2.00% | |

| 12:30 | CAD | CPI Core – Common Y/Y Aug | 1.80% | 1.90% | 1.90% | |

| 12:30 | CAD | CPI Core – Median Y/Y Aug | 2.10% | 2.10% | 2.10% | |

| 12:30 | CAD | CPI Core – Trim Y/YAug | 2.10% | 2.10% | 2.10% | |

| 14:30 | USD | Crude Oil Inventories | -2.1M | -6.9M | ||

| 18:00 | USD | FOMC Rate Decision (Upper Bound) (SEP 18) | 2.00% | 2.25% | ||

| 18:00 | USD | FOMC Rate Decision (Lower Bound) (SEP 18) | 1.75% | 2.00% | ||

| 18:30 | USD | FOMC Press Conference |