Australian Dollar weakens broadly in Asian session after RBA minutes suggested more rate cuts ahead. Commodity currencies are also generally lower on mild risk aversion. There is little support from news of US-Japan trade agreement. on the other hand, Swiss Franc and Euro are trading generally stronger, followed by Dollar. The greenback is supported by receding bets on Fed cut this week. Fed fund futures are only pricing in 65.8% chance of a -25bps cut to 1.75-2.00%.

Technically, with today’s fall, focus is turning to 0.6807 minor support in AUD/USD. Break will indicate completion of recent corrective rise from 0.6677 and bring retest of this low. EUR/AUD should have bottomed at 1.5905, ahead of 1.5894 key support. Further rise is in favor for 1.6308 support turned resistance next. Considering weakness in Yen crosses in general, USD/JPY’s rebound from 104.45 is probably having just one leg up leg and upside should be limited by 109.31 resistance.

In Asia, Nikkei is currently flat. Hong Kong HSI is down -1.39%. China Shanghai SSE is down -1.55%. Singapore Strait Times is down -0.55%. Japan 10-year JGB yield is up 0.0036 at -0.152. Overnight, DOW dropped -0.52%. S&P 500 dropped -0.31%. NASDAQ dropped -0.28%. 10-year yield dropped -0.062 to 1.841.

RBA minutes suggest easing bias, affirm more rate cut

In the minutes of September meeting, RBA maintained easing bias with some dovishness between paragraphs. The minutes overall are inline with market expectations of further rate cut ahead, probably in October. It’s noted that “members would assess developments in both the international and domestic economies, including labour market conditions, and would ease monetary policy further if needed to support sustainable growth in the economy and the achievement of the inflation target over time.”

On international developments, RBA said “risks to the global growth outlook were to the downside”. US-China trade disputes had “escalated” while China’s growth “had continued to slow”. These developments were “affecting trade and investment decisions in overseas economies”. And, “against this backdrop and with ongoing low inflation, a number of central banks had reduced interest rates over recent months and further monetary easing was widely expected.”

Domestically, employment growth continued to be strong but “unemployment rate had remained steady at around 5.2 per cent”. Wages growth had “remained slow” with few indications of building pressures. Also, RBA repeated that the economy “could sustain lower rates of unemployment and underemployment.” Q2 Growth was expected to have been around 0.5%. “Private final demand, which includes consumption, business investment and dwelling investment, was expected to have been weak.”

US & Japan reach trade deal, but auto tariffs to be reconfirmed

US President Donald Trump indicated in a letter to Congress that he’s entering in to a trade deal with Japan in the “coming weeks”. There will be agreements on trade tariffs and digital trade that could allow him to make reciprocal tariff reductions by proclamation. No Congress approval would be needed.

For now, it’s unclear whether there is agreement for avoiding so-called Section 232 national security tariffs on Japanese autos. Japan’s Foreign Minister Toshimitsu Motegi said a a regular news conference that “at the finishing stage, we plan to reconfirm that 232 won’t be imposed.” Finance Minister Taro Aso also indicated the deal won’t contain any provision on currencies.

US-China to start deputy level trade talks this Thursday

US Trade Representative office said yesterday that deputy level US-China trade talks will start in Washington this Thursday. That would pave the way for high-level talks in October. There is no details regarding the upcoming deputy-level talks for now.

Separately, US Chamber of Commerce Chief Executive Tom Donohue said USTR Robert Lighthizer indicated he was seeking a “real agreement” on intellectual property theft and forced technology transfer issues. Also, Donohue also said Lighthizer “did indicate that there was some movement in the direction of purchasing of agricultural products and other issues”.

Donohue also said, “I don’t think you’re going to see the tariffs going away and people feeling we’ve made a great accomplishment until we have a real agreement. “A real agreement, in my opinion, will not be buying more crops and doing the small things that would be good to set the stage for us to have more substantive conversations.”

On the data front

New Zealand Westpac consumer confidence dropped from 103.5 to 103.1 in Q3. Australia house price index dropped -0.7% qoq in Q2, better than expectation of -1.1% qoq. Germany ZEW will be major focus in European session. US will release industrial production and NAHB housing index. Canada will release manufacturing sales.

AUD/USD Daily Outlook

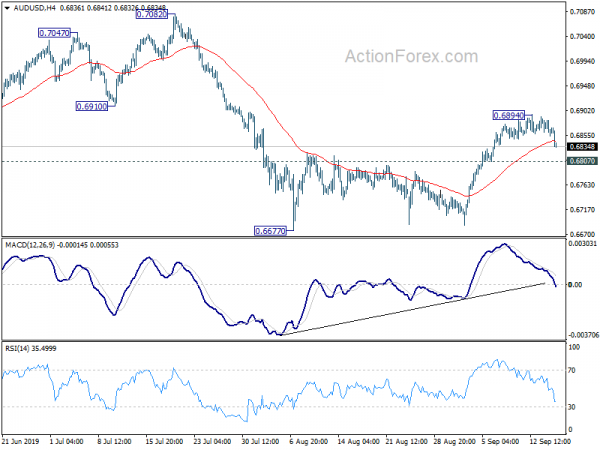

Daily Pivots: (S1) 0.6852; (P) 0.6868; (R1) 0.6882; More…

Intraday bias in AUD/USD remains neutral with focus on 0.6807 minor support. Break will suggests that corrective recovery from 0.6677 has completed. Intraday bias will be turned to the downside for retesting 0.6677. Break will resume larger down trend. On the upside, above 0.6894 will resume the rebound. But upside should be limited below 0.7082 key resistance to bring down trend resumption.

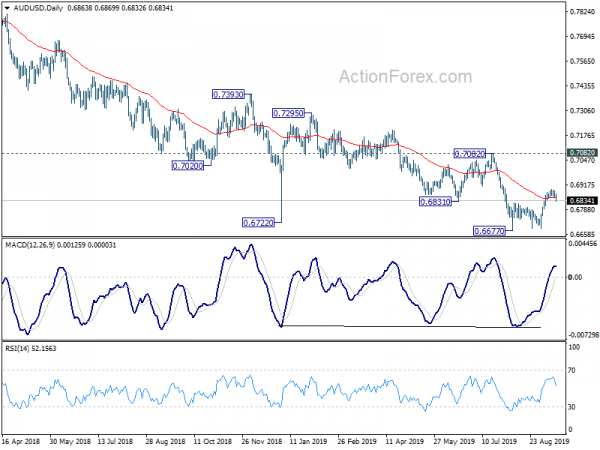

In the bigger picture, decline from 0.8135 (2018 high) is seen as resuming the long term down trend from 1.1079 (2011 high). Next target is 0.6008 (2008 low). On the upside, break of 0.7082 resistance is needed to be the first sign of medium term bottoming. Otherwise, outlook will remain bearish even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:00 | NZD | Westpac Consumer Confidence Q3 | 103.1 | 103.5 | ||

| 1:30 | AUD | House Price Index Q/Q Q2 | -0.70% | -1.10% | -3.00% | |

| 1:30 | AUD | RBA Minutes Sep | ||||

| 9:00 | EUR | German ZEW Economic Sentiment Sep | -38 | -44.1 | ||

| 9:00 | EUR | German ZEW Current Situation Sep | -15 | -13.5 | ||

| 9:00 | EUR | Eurozone ZEW Economic Sentiment Sep | -37.4 | -43.6 | ||

| 12:30 | CAD | Manufacturing Sales M/M Jul | -1.20% | |||

| 13:15 | USD | Industrial Production M/M Aug | 0.20% | -0.20% | ||

| 13:15 | USD | Capacity Utilization Aug | 77.60% | 77.50% | ||

| 14:00 | USD | NAHB Housing Market Index Sep | 66 | 66 |