Market sentiments are generally lifted in Asia, by China’s announcement to exempt some US imports from tariffs, ahead of next month’s meeting. Also, while symbolic, investors also cheer China’s move to remove quota for foreign institutional investors on the capital market. Yen and Swiss Franc are under selling pressure while Sterling stays weak too. On the other hand, Australian Dollar leads other commodity currencies higher.

Technically, USD/JPY, EUR/JPY and GBP/JPY pick up upside momentum again today. Further rise remains in favor for the near term. AUD/USD is resuming recent rebound to 0.6910 support turned resistance. USD/CAD, with weak momentum, is also resuming fall from 1.3382 to retest 1.3016 low. EUR/GBP will remain a focus today as it’s still struggling to break through 0.8891 key cluster support.

In Asia, Nikkei closed up 0.96%. Hong Kong HSI is up 1.69%. China Shanghai SSE is down -0.34%. Singapore Strait Times is up 1.05%. Japan 10-year JGB yield is up 0.0236 at -0.201. Overnight, DOW rose 0.28%. S&P 500 rose 0.03%. NASDAQ dropped -0.04%> 10-year yield extends recent rebound and closed up 0.080 at 1.702. That’s another factoring pressure the Yen too.

China exempts 15 categories of US imports from tariffs

Today, China announced to exempt a range of US imports from the 25% tariffs imposed last year. The exemptions cover 16 categories of products, ranging from fish food to pesticides, and will be effective from Sept. 17 to Sept. 16 2020. Negotiations between the teams are continuing, in preparation for top level meeting to be held in Washington next month.

Additionally, China also announced yesterday to abolish the investment quota restriction for Qualified Foreign Institutional Investors (QFII) and Renminbi Qualified Foreign Institutional Investors (RQFII) to boost financial reforms and opening-up.

Over half of US companies in China delay or reduce investment due to trade war

The American Chamber of Commerce in Shanghai warned that with no sign of a trade agreement between US and China, “2019 will be a difficult year” and “2020 may be worse”. It said that “revenue growth projections have lowered, optimism about the future has waned, and many companies are redirecting investment originally planned for China”.

In the 2019 China Business Report, AmCham noted that the survey results are “decidedly mixed”. In particular, revenue growth estimates for 2019 are weak. Only 50.5% of companies expect revenues to beat their 2018 numbers. 27.1% of companies anticipate lower revenues, markedly up from the 6.1% that projected lower revenues for 2018. 47.6% of automotive companies anticipate lower revenues.

Five-year optimism dropped by one fifth to 61.4%, against historical rates of 80-90%, while pessimism about the future rose by 14.0 percentage points. The most downbeat industries included non-consumer electronics and chemicals.

35.6% of survey respondents see the U.S.-China trade tensions continuing for 1-3 years, and 12.7% expect them to continue for 3-5 years. 16.9% believe the trade tensions will continue indefinitely. 53.4% of companies say that they are either delaying or reducing investment as a direct result of the U.S.-China trade tensions, with only 4.5% increasing investment in response.

WH Navarro urges patience on trade negotiations with China

White House economic adviser Peter Navarro urged investors to be patient regarding US-China trade negotiations. He emphasized that “if we’re going to get a great result, we really have to let the process take its course.” And, “in the meantime, we need to be patient with the China negotiations.”

Navarro also added that tariffs on China were “working beautifully”. “People need to understand this: the tariffs on China are our best defense against China’s economic aggression and best insurance policy – this is important – the best insurance policy that China will continue to negotiate in good faith,” he said.

BoE Carney: Sterling volatility at emerging market levels

BoE Governor Mark Carney noted yesterday that volatility of Pound’s exchange rate is now at “emerging market levels” and has “decoupled from other advanced economy pairs for obvious reasons”. Also, he warned that “a variety of other indicators show financial markets are going to move substantially in one way or another depending on the outcome of” Brexit.

Carney also said yield curve inversion is not a “vote of confidence in the economic outlook. Both yield curves in US and UK have inverted for a while.

NAB expects RBA to cut to 0.5% by February, more stimulus might be needed afterwards

Australia’s NAB revised their RBA interest expectations today, now factoring in an additional rate cut in February, in addition to one in November, to take cash rate to 0.50%. NAB also said RBA “could cut as soon as October if there was further weakness in the labour market revealed next week.”

NAB noted that ‘the forecast of lower interest rates reflects increased downside risks to the domestic economy and greater uncertainty about the world economy.” Domestically, growth continued to undershoot RBA’s forecast and unemployment is likely to edge higher. Private demand has fallen for the first time since the global financial crisis. business survey also points to continued weakness in private demand. Internationally, global trade and manufacturing fell on US-China trade war escalation. Business confidence has slumped with firms deferring investment.

NAB also urged for additional fiscal stimulus through new infrastructure investment, cash hand-outs and/or the pull-forward of tax cuts. It also warned that more stimulus could be needed by mid-2020 even with interest rate at 0.50%, “unless the Government steps in”.

On the data front

Japan BSI large manufacturing dropped improved to -0.2 in Q2, up from -10.4, above expectation of -7.1. BSI large all industry index improved to 1.1, up from -3.7 and beat expectation of -1.0. Australia Westpac consumer confidence dropped -1.7% in September. US will release PPI today as well as wholesale inventories.

AUD/USD Daily Outlook

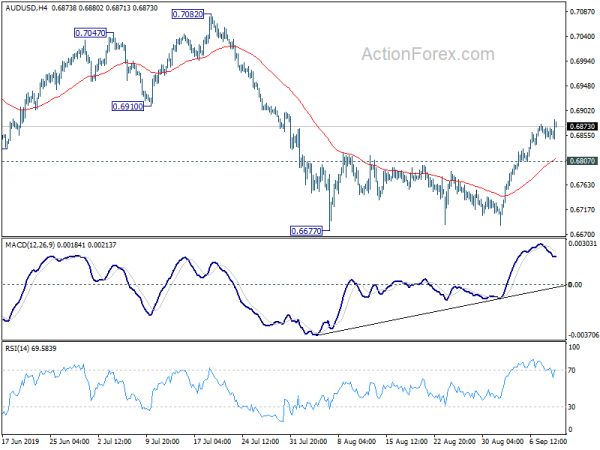

Daily Pivots: (S1) 0.6850; (P) 0.6860; (R1) 0.6871; More…

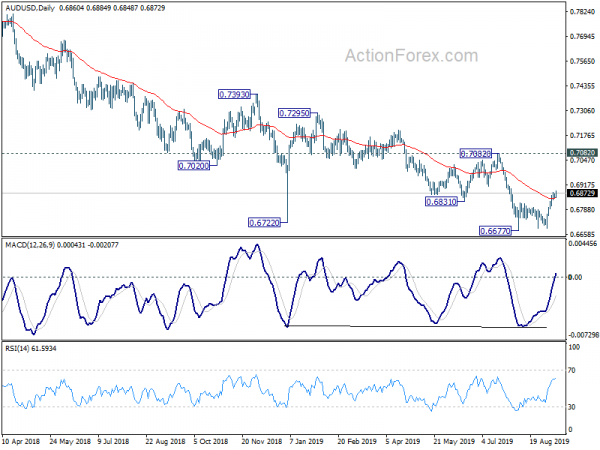

AUD/USD’s rebound resumes after brief consolidation. Intraday bias is back on the upside for 0.6910 support turned resistance, and possibly above. At this point, such rebound is seen as a corrective move, thus, upside should be limited below 0.7082 resistance to bring fall resumption. On the downside, below 0.6807 minor support will turn intraday bias back to the downside for retesting 0.6677 low.

In the bigger picture, decline from 0.8135 (2018 high) is seen as resuming the long term down trend from 1.1079 (2011 high). Next target is 0.6008 (2008 low). On the upside, break of 0.7082 resistance is needed to be the first sign of medium term bottoming. Otherwise, outlook will remain bearish even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BSI Large Manufacturing Q/Q Q3 | -0.2 | -7.1 | -10.4 | |

| 23:50 | JPY | BSI Large All Industry Q/Q Q3 | 1.1 | -1.0 | -3.7 | |

| 0:30 | AUD | Westpac Consumer Confidence Sep | -1.70% | 3.60% | ||

| 12:30 | USD | PPI Final Demand M/M Aug | 0.10% | 0.20% | ||

| 12:30 | USD | PPI Final Demand Y/Y Aug | 1.70% | 1.70% | ||

| 12:30 | USD | PPI Core M/M Aug | 0.20% | -0.10% | ||

| 12:30 | USD | PPI Core Y/Y Aug | 2.20% | 2.10% | ||

| 14:00 | USD | Wholesale Inventories M/M Jul F | 0.20% | 0.20% | ||

| 14:30 | USD | Crude Oil Inventories | -4.8M |