Canadian Dollar regains some strengthen in early US session after solid economic data. Headline retail sales rose 0.8% mom in April. well above expectation of 0.3% mom. Ex-auto sales rose even more by 1.5% mom, beating expectation of 0.7% mom. Loonie has retreated much this week after oil rout continued with WTI hitting the lowest level this year at 42.05. Nonetheless, USD/CAD is held well below 1.3387 near term resistance and maintains bearish outlook. Deeper decline could now be seen back to 1.3164 support.

Released from US, initial jobless claims rose 3k to 241k in the week ended June 17. That’s slightly above expectation of 240k but stayed at a very low level historically. And it’s now below 300k handle for the 120th straight weeks. The four week moving average rose 1.5k to 244.75k. Continuing claims rose 8k to 1.94m in the week ended June 10. It stayed below 2m level for the 10th straight week, last seen back in 1973. Dollar continues to trade mixed against others. Also released today, UK CBI trends total orders rose to 16 in June. Swiss trade surplus widened to CHF 3.40b in May.

ECB expects solid growth in Q2

ECB sounded optimistic in the latest economic bulletin and noted that "overall, incoming data point to solid growth in the second quarter of 2017." It mentioned that "the euro area economy has now expanded for four consecutive years and growth has become increasingly resilient as it has broadened across sectors and countries." Meanwhile, "growth is supported primarily by domestic demand, although tailwinds from the external environment have increasingly lent support to the outlook." However, "on the basis of current oil futures prices, headline inflation is likely to fluctuate around current levels in the coming months." And, "underlying inflation has yet to show convincing signs of a pick-up and is expected to rise only gradually over the medium term."

BoJ Kikuo: Absolutely no need to raise interest rate now

BoJ deputy governor Kikuo Iwata said today that there is "absolutely no need" to raise interest rate right now since the economy still needs support from "powerful" monetary easing. Echoing governor Haruhiko Kuroda, Iwata also said that Japan is "still distant" from achieving the 2% inflation target. Also, he urged the central bank to maintain the pledge to raise monetary base by JPY 80T a year as "removing the pledge could cause unnecessary market turmoil.

Mild RBNZ hawkish turn

New Zealand Dollar strengthens broadly after RBNZ left the OCR unchanged at record low of 1.75% as widely expected. There are two main factors that are driving up the Kiwi. Firstly, RBNZ removed "developments since the February Monetary Policy Statement on balance are considered to be neutral for the stance of monetary policy." While the the central bank is still in general in a neutral stance, some traders perceive the removal of the sentence as a mild hawkish turn. Secondly, RBNZ noted the around 3% rise in trade-weighted exchange rate since May. And it attributed that increase as "partly in response to higher export prices". While it still noted that a lower NZD will "help rebalance the growth outlook towards the tradables sector", it’s not too concerned with the rise in exchange rates.

USD/CAD Mid-Day Outlook

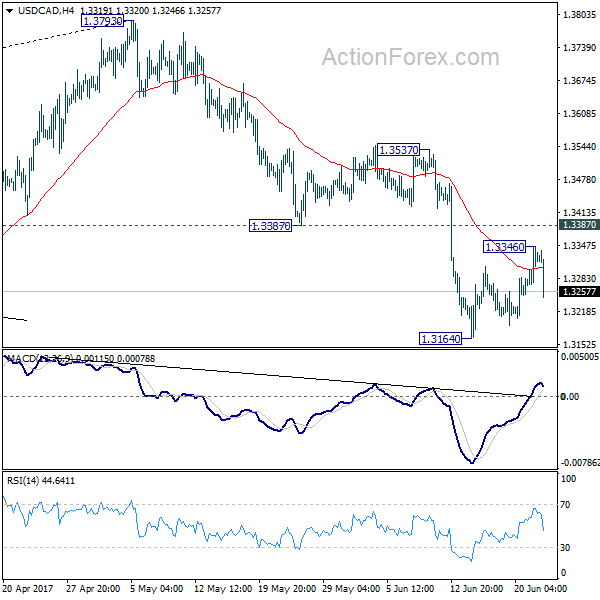

Daily Pivots: (S1) 1.3278; (P) 1.3312; (R1) 1.3364; More….

USD/CAD drops sharply in early US session but it’s staying above 1.3164. Intraday bias remains neutral first. Consolidation from 1.3164 might extend but upside should be limited by 1.3387 support turned resistance and bring fall resumption. We’re holding on to the view that corrective rise from 1.2460 has completed at 1.3793 already. Below 1.3164 will target 1.2968 cluster support, 61.8% retracement of 1.2460 to 1.3793 at 1.2969. However, firm break of 1.3387 will dampen our view and turn focus back to 1.3537 resistance next.

In the bigger picture, price actions from 1.4689 medium term top are seen as a correction pattern. The first leg has completed at 1.2460. Rise from 1.2460 is seen as the second leg and has completed at 1.3793, ahead of 61.8% retracement of 1.4689 to 1.2460 at 1.3838. Break of 1.3222 should now indicate the start of the third leg while further break of 1.2968 should confirm. In that case, USD/CAD should decline through 1.2460 support to 50% retracement of 0.9406 to 1.4869 at 1.2048.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:00 | NZD | RBNZ Rate Decision | 1.75% | 1.75% | 1.75% | |

| 06:00 | CHF | Trade Balance (CHF) May | 3.40B | 2.44B | 1.97B | 1.96B |

| 08:00 | EUR | ECB Economic Bulletin | ||||

| 10:00 | GBP | CBI Trends Total Orders Jun | 16 | 7 | 9 | |

| 12:30 | CAD | Retail Sales M/M Apr | 0.80% | 0.70% | 0.50% | |

| 12:30 | CAD | Retail Sales Less Autos M/M Apr | 1.50% | 0.70% | -0.20% | -0.10% |

| 12:30 | USD | Initial Jobless Claims (17 Jun) | 241K | 240K | 237K | 238K |

| 13:00 | USD | House Price Index M/M Apr | 0.50% | 0.60% | ||

| 14:00 | EUR | Eurozone Consumer Confidence Jun A | -3 | -3.3 | ||

| 14:00 | USD | Leading Indicators May | 0.40% | 0.30% | ||

| 14:30 | USD | Natural Gas Storage | 78B |