The financial markets remain in risk on mode today. Yen, Swiss Franc and Dollar continue to feel tremendous selling pressure. Meanwhile, commodity currencies are generally the strongest. Euro and Sterling are mixed for now as it’s still unsure where Brexit uncertainty is heading to. The common currency’s rally attempt is also capped by poor economic data from Germany. Trade optimism underpin investor confidence and focus will turn to job report from the US today.

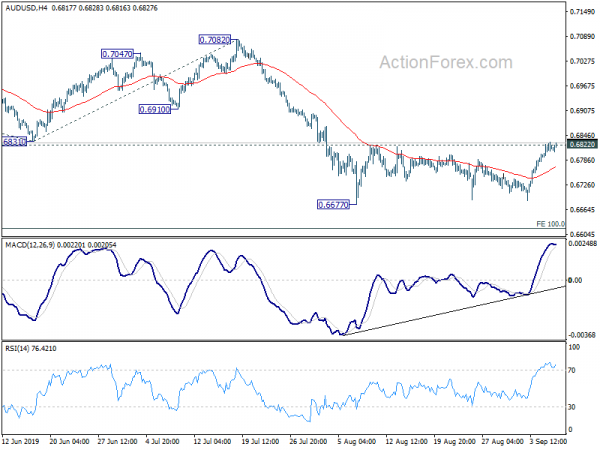

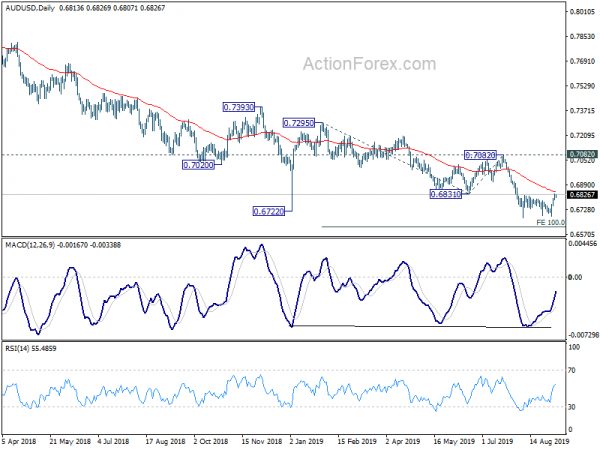

Technically, EUR/GBP is now sitting in an important zone of 0.8891/9051 and we’d still expect this zone to hold and bring rebound. However, sustained break of 0.8891 will suggest reversal for deeper fall to 0.8797 fibonacci level and below. AUD/USD is still struggling around 0.6822 resistance for now. Firm break will extend the rebound from 0.6677 towards 0.6910 support turned resistance. However, rejection by 0.6677 will retain near term bearishness for another low below 0.6677.

In Asia, Nikkei closed up 0.54%. Hong Kong HSI is up 0.29%. China Shanghai SSE is up 0.13%. Singapore Strait Times is up 0.12%. Japan 10-year JGB yield is up 0.02389 at -0.242. Overnight, DOW rose 1.41%. S&P 500 rose 1.30%. NASDAQ rose 1.75%. 10-year yield rose 0.106 to 1.565.

Solid NFP expected as markets weigh chance of another Fed cut

US non-farm payroll report will be a major focus today and could seal the case for another FOMC rate cut later in the month. Fed fund futures are pricing in “only” 93.5% chance of another -25bps cut to 1.75 to 2.00%. Markets are expecting 162k job growth in August. Unemployment rate is expected to be unchanged at 3.7%. Average hourly earnings are expected to rise 0.3% mom.

Looking at other related data, ADP reported 195k growth in private sector jobs, which is positive. Four-week moving average of initial jobless claims was largely unchanged, edged up slightly from 211.5k to 216.3k. However, ISM manufacturing employment dropped sharply from 51.7 to 47.4, signaling contraction. ISM non-manufacturing employment dropped -3 pts to 56.2. Conference Board consumer confidence dropped slightly from 135.8 to 135.1. The over all set of data suggested some solid NFP readings today.

There is hope for some sort of progress in US-China trade negotiations in October. More importantly, as China stop short of retaliating against the latest round of 5% tariffs by the US, chance of further escalation has somewhat receded. Strong job numbers will give Fed policy makers more reasons to keep bullets at bay first.

German industrial production dropped -0.6% mom, below expectation of 0.3% mom

German industrial production dropped -0.6% mom in July, well below expectation of 0.3% mom. Over the year, production dropped -4.2% yoy. Looking at some details, production in industry excluding energy and construction was down by -0.8%. Within industry, the production of intermediate goods decreased by -0.7% and the production of capital goods by -1.2%. The production of consumer goods showed an increase by 0.6%. Outside industry, energy production was down by -1.3% and the production in construction increased by 0.2%.

Merkel: Germany welcomes Chinese investment but there are checks in some strategic sectors

German Chancellor Angela Merkel appeared at a business forum with Chinese Premier Li Keqiang in Beijing today, after part of her trip to China. Merkel said that her country welcomes all Chinese companies for investment. But the government checks investments in certain strategic sectors and critical infrastructure. Merkel also urged “there will be a solution in the trade dispute with the United States since it affects everybody” in the world”

On the other hand, Li hoped that Germany will accept more Chinese companies and loosen up export rule for certain goods. Li also pledged that China is opening up its economy.

BoJ Kuroda doesn’t rule out deeper negative interest rate

In a Nikkei interview, BoJ Governor Harukiho Kuroda maintained his optimistic view on the economy. He noted that “we’re maintaining momentum toward the price stability target” of 2% inflation”. Also, “domestic demand — consumer spending and capital investment — are relatively firm.” However, “caution is needed” due to overseas uncertainties, in particular with trade war. Cutting interest rates “further into the negative zone is always an option” if more monetary stimulus is needed.

BoJ has laid out the four policy options in case of a downturn. Those include cutting the short-term policy rate, lowering its target for long-term rates, stepping up asset purchases and accelerating expansion of the monetary base. Kuroda said “we’re considering a variety of possibilities, including combinations of these and improved versions.”

Released from Japan, overall household spending rose 0.8% yoy in July, below expectation of 0.9% yoy. Labor cash earnings dropped -0.3% yoy, below expectation of 0.1% yoy. Leading indicator rose 0.3 to 93.6, above expectation of 93.2.

Australia AiG construction index recovered to 44.6, slower contraction

Australia AiG Performance of Construction Index recovered to 44.6 in August, up from 39.1. The reading indicated an easing in the construction industry’s overall rate of decline. Looking at some details, rates of decline in new orders, supplier deliveries and employment were all slower in the month. But overall, key activity sub-index fell for an 11th consecutive month.

Looking ahead

Eurozone will release Q2 GDP final and employment in European session. US non-farm payrolls will be a major focus in European session. Canada employment will be equally important while Ivey PMI will be featured too.

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.6795; (P) 0.6813; (R1) 0.6831; More…

Focus remains on 0.6822 resistance in AUD/USD. Decisive break will resume rebound from 0.6677. Intraday bias will be turned back to the upside for 0.6910 support turned resistance. Though, rejection by 0.6822 resistance will maintain near term bearishness. Break of 0.6677 will extend larger down trend to 100% projections of 0.7295 to 0.6831 from 0.7082 at 0.6618.

In the bigger picture, decline from 0.8135 (2018 high) is seen as resuming the long term down trend from 1.1079 (2011 high). Firm break of 0.6826 (2016 low) should confirm this bearish view. Further fall should be seen to 0.6008 (2008 low) next. On the upside, break of 0.7082 resistance is needed to be the first sign of medium term bottoming. Otherwise, outlook will remain bearish even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Construction Index Aug | 44.6 | 39.1 | ||

| 23:30 | JPY | Overall Household Spending Y/Y Jul | 0.80% | 0.90% | 2.70% | |

| 23:30 | JPY | Labor Cash Earnings Y/Y Jul | -0.30% | 0.10% | 0.40% | |

| 5:00 | JPY | Leading Index Jul P | 93.6 | 93.2 | 93.3 | |

| 6:00 | EUR | German Industrial Production M/M Jul | -0.60% | 0.30% | -1.50% | -1.10% |

| 7:00 | CHF | Foreign Currency Reserves (CHF) Aug | 768B | |||

| 9:00 | EUR | Eurozone Employment Q/Q Q2 F | 0.20% | 0.20% | ||

| 9:00 | EUR | Eurozone GDP Q/Q Q2 F | 0.20% | 0.20% | ||

| 12:30 | CAD | Net Change in Employment Aug | 12.5K | -24.2K | ||

| 12:30 | CAD | Unemployment Rate Aug | 5.70% | |||

| 12:30 | USD | Change in Non-farm Payrolls Aug | 162K | 164K | ||

| 12:30 | USD | Unemployment Rate Aug | 3.70% | 3.70% | ||

| 12:30 | USD | Average Hourly Earnings M/M Aug | 0.30% | 0.30% | ||

| 14:00 | CAD | Ivey PMI Aug | 55.2 | 54.2 |